Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Apr 28, 2015

Australian credit lifted by iron ore rebound

The rising price of iron ore has seen debt markets treat the three main Australian iron ore producers with increased bullishness.

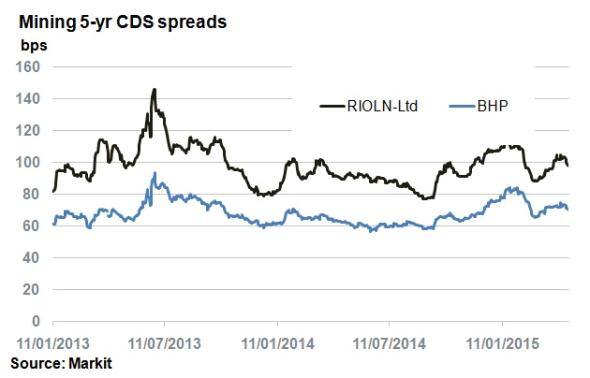

- BHP Billiton's CDS spread has tightened below 70bps

- Fortescue's record breaking junk issue is trading above par since listing last week

- The Markit iBoxx $ Eurodollar Mining index is now trading at its lowest yield in a year

The price of iron ore has dropped 70% since its peak in 2011 as the global market contends with lower Chinese demand and an oversupply, stemming from a string of new projects coming online.

Companies have had to work to adjust to the new market dynamics. BHP Billiton, the third largest producer, recently promised to scale back expansion to slash costs. In a market dominated by a select group of corporations, influence is highly sensitive to price volatility. This has had a positive impact on the prices as the price of one tonne of iron ore has rallied 23% to $57 over April after hitting a low of $47 earlier this month.

Credit markets react positively

The recent lift of the commodity from its recent lows has had a positive impact on the credit markets. BHP Billiton's 5-yr CDS spread, which measures the market's view on a corporation defaulting on its debt, has dipped below 70bps after being hitting 84bps in January this year.

Rio Tinto, the second largest global iron ore miner has also seen its CDS spread tighten in April.

Fortescue

The bounce in the iron ore price has also boded well for Fortescue, the fourth largest iron ore producer in the world.

With a breakeven price of around $50 to cover production, maintain spending and pay down debt, operations have suffered in parallel with the declining price. Fortescue's stock price has tumbled over the last year and investors were quick to jump on the negative sentiment, making it one of the most shorted stocks. Earlier this year, the company had trouble raising new funds via the debt capital markets, coming to a head in March when the company withdrew a proposed bond issuance as investors balked at the offered yield.

Rating agencies haven't spared the company, with both S&P and Moody's recently downgrading Fortescue's credit.

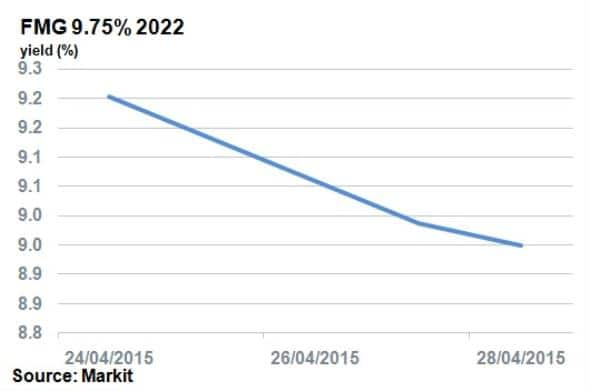

Fortescue was quick to respond with improved terms, and found willing buyers among investors last week. The 9.75% 2022 secured bond was priced to yield a couple of percentage points higher than what was initially intended in the unsuccessful attempt earlier this year. This pricing may have been overly conservative for the company, as the bond issue has seen its price surge in the secondary market. The last few days have seen the bond trade significantly higher than its offered price, now yielding around 9% according to Markit Bond Pricing; 125bps tighter than its initial yield.

This bullish mood is also reflected in the wider mining bond market, as the iBoxx $ Eurodollar Mining index has seen its yield fall to its lowest level of the year so far in the wake of the iron ore rally.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28042015-Credit-Australian-credit-lifted-by-iron-ore-rebound.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28042015-Credit-Australian-credit-lifted-by-iron-ore-rebound.html&text=Australian+credit+lifted+by+iron+ore+rebound","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28042015-Credit-Australian-credit-lifted-by-iron-ore-rebound.html","enabled":true},{"name":"email","url":"?subject=Australian credit lifted by iron ore rebound&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28042015-Credit-Australian-credit-lifted-by-iron-ore-rebound.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Australian+credit+lifted+by+iron+ore+rebound http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28042015-Credit-Australian-credit-lifted-by-iron-ore-rebound.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}