Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

INDICES COMMENTARY

Apr 27, 2015

QE lifts Central & Eastern European sovereigns

European countries have benefitted from the recent ECB QE action, with yields falling and new issuance volume increasing.

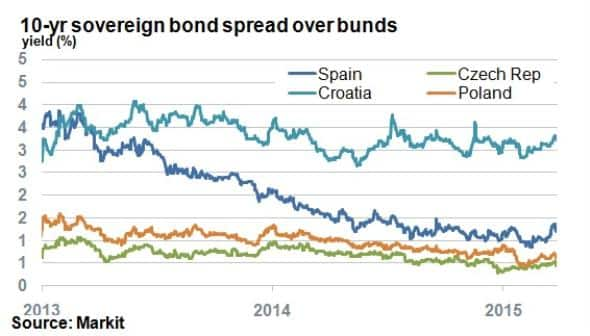

- Poland and the Czech Republic have seen euro 10-yr bonds’ spreads over bunds fall 25bps and 37bps respectively over the last 12 months

- Croatia has seen its spreads over bunds remain flat, but has benefitted from falling yields

- Poland recently issued 12-yr bond with a sub 1% coupon; capitalising on low yields

Nearly two months into the ECB’s €1.1tn QE program, the demand for bonds issued in euros sees no sign of letting up. With the possibility of supply shortages, investors have turned to emerging market issuers to earn extra yield and issuers are more than happy to take advantage of record low borrowing costs.

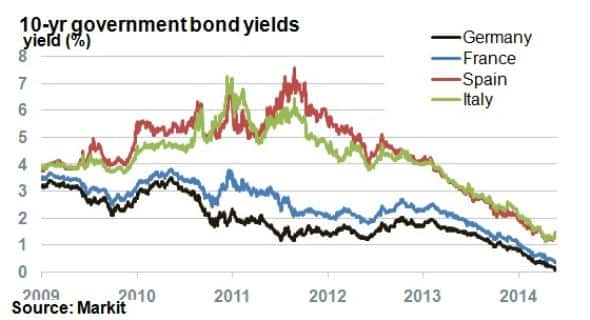

Yields in the eurozone have fallen to unprecedented levels. The German 10-yr bund is tentatively hovering above zero. France has seen its 10-yr bond yield halve this year and even peripheral eurozone nations such as Spain and Italy have seen their yields converge towards core Europe. This trend has swayed investors to the riskier end of the credit scale.

Since reports of potential QE plans surfaced last November, eurozone nations have seen their borrowing costs and credit spreads tumble, as represented by the spread over German bunds.

With diminishing nominal returns in core Europe and plenty of investor demand, a number of countries in Central and Eastern Europe have benefitted.

Three EU members that are not part of the eurozone; Croatia, Poland and the Czech Republic, have seen mixed impact from QE. Croatia, the weakest of the three in terms of credit rating (BB) has seen its bond yields come down in recent months as the bund yield reached all-time lows. The country’s spread over bunds however has continued to hover above 3%. This spread was similar to that of Italy and Spain in 2013, both of which have seen their spreads more than halve.

Conversely, Poland and the Czech Republic have seen their 10-yr spreads over bunds decrease 25bps and 37bps respectively over a one year period. For these two stronger Central and Eastern European names, the positive spill over effects of QE are clear as investors head towards strong eurozone-linked countries in search of value.

Emerging market sovereigns

have been more than eager to take advantage of the recent falling yields. A rated Poland, for example, has recently issued a 12 year bond with a sub 1% coupon.

Central and Eastern European countries provide one of the few bright spots in emerging market Eurobond sovereign issuance space as Russia and Brazil, prominent issuers in the past, have been absent from capital markets due to declining commodity prices and political turmoil.

Neil Mehta, Analyst, Fixed Income at Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27042015-Credit-QE-lifts-Central-Eastern-European-sovereigns.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27042015-Credit-QE-lifts-Central-Eastern-European-sovereigns.html&text=QE+lifts+Central+%26+Eastern+European+sovereigns","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27042015-Credit-QE-lifts-Central-Eastern-European-sovereigns.html","enabled":true},{"name":"email","url":"?subject=QE lifts Central & Eastern European sovereigns&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27042015-Credit-QE-lifts-Central-Eastern-European-sovereigns.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=QE+lifts+Central+%26+Eastern+European+sovereigns http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27042015-Credit-QE-lifts-Central-Eastern-European-sovereigns.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}