Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 26, 2015

UK economy slows as business investment shows biggest slump since 2009

The pace of UK economic growth slowed at the end of last year, but already looks to be reviving in early-2015. The longer-term outlook is mixed, however, as digging deeper into the numbers reveals a worrying dependence on the consumer, with business investment falling at its steepest rate since 2009.

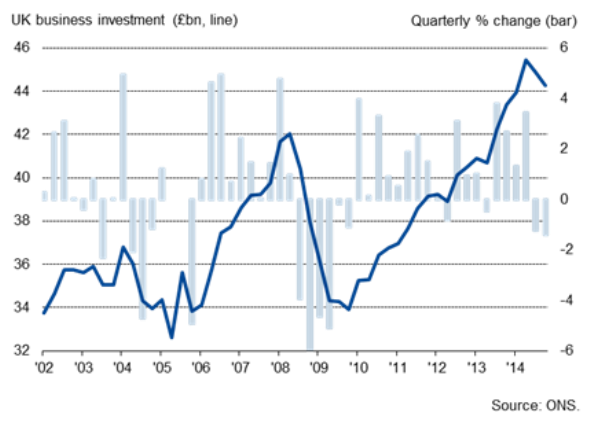

Lower levels of business investment are a sign that companies have become increasingly worried about long-term prospects, putting a question mark over the economy's ability to continue growing at a solid pace in coming years. Business investment needs to revive for the upturn to be truly sustainable. At the moment, the growth outlook appears to be largely reliant on households benefitting from low inflation and higher wages, with the latter being far from guaranteed.

Consumer-led growth

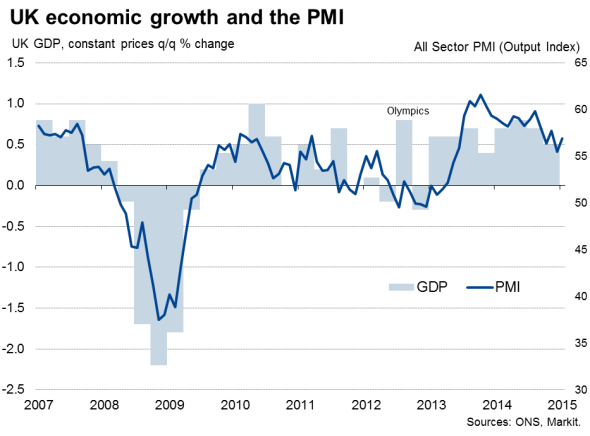

Updated numbers from the Office for National Statistics confirmed the initial estimates showing gross domestic product rose 0.5% in the final three months of last year. That was the weakest pace of expansion seen for a year, down from 0.7% in the third quarter, due mainly to falling business investment.

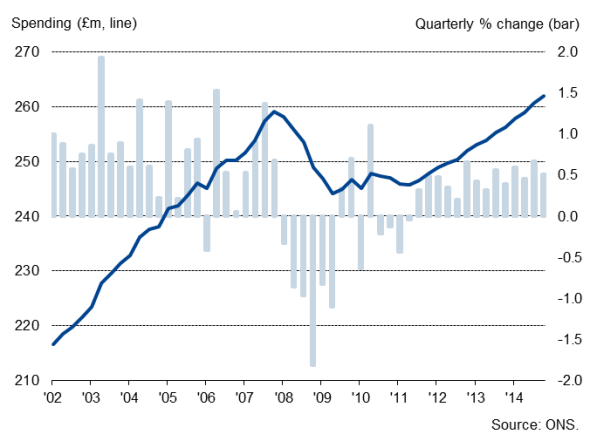

Household spending rose 0.5% in the three months to December but business investment slumped by 1.4%, its largest decline since the second quarter of 2009 and coming on the heels of a 1.2% fall in the third quarter.

Growth was also largely driven by the domestic-focused service sector while manufacturing lagged behind. Services companies enjoyed the strongest year-on-year growth since 2007, with output up 0.8% on the quarter, while the manufacturing sector eked out a mere 0.2% expansion. This is clearly not an economy that is rebalancing away from domestic consumption towards export-led manufacturing.

UK business investment

Energy producers saw output fall and output of the construction sector reportedly slumped by 2.1%, though the latter looks an unusually weak number and possibly understates the true health of the building sector, especially when compared to robust survey evidence in recent months.

UK consumer spending

Weaker dividend trend amid business caution

The slowdown in the economy is reflected in corporate performance, and in particular signs of slower growth of dividend pay-outs. Markit's dividend forecasting team is expecting FTSE 350 companies to pay out "85.3bn this fiscal year (an annual increase of 11% on 2013-14), but this includes a mere 4.4% increase in ordinary dividends (the difference is special payments). While still decent by historical standards, the 4.4% increase in the current fiscal year compares to growth approaching 6% in 2013-14.

While the pace of economic growth already appears to be reviving so far this year, the expansion still appears to be being driven by consumers while businesses remain cautious. PMI business surveys showed growth picking up momentum again in January after slipping to a 19-month low in December, and surveys of consumers show households feeling less worried about their finances so far this year than at any time since the recession.

Domestic-focused service providers and retailers are expected to be buoyed this year by rising employment, higher wages and consumers benefitting from low fuel bills, as well as record low interest rates. While manufacturers should also benefit from rising domestic demand, the sector is likely to struggle in the face of stiff competition from abroad, exacerbated by sterling's recent strength, notably against the euro. The pound has appreciated almost 6% against the euro so far this year.

The energy sector is likely to remain a drag on the economy, as low oil prices discourage investment in the sector. Construction looks set to fare reasonably well, feeding off strong house building, and should rebound from the weakness seen late last year, but the health of this sector remains a big unknown.

Optimism among forecasters

The economy is expected to grow by 2.6% in 2015 according to consensus forecasts of independent economists, with the Bank of England expecting a 2.9% rise. In our view this pace of expansion will be a challenge to achieve unless business investment shows signs of picking up soon. We also note that the rosy outlook assumes a lack of disruption to the economy from the General Election, which remains a key uncertainty for the economy and business investment in particular.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26022015-economics-uk-economy-slows-as-business-investment-shows-biggest-slump-since-2009.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26022015-economics-uk-economy-slows-as-business-investment-shows-biggest-slump-since-2009.html&text=UK+economy+slows+as+business+investment+shows+biggest+slump+since+2009","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26022015-economics-uk-economy-slows-as-business-investment-shows-biggest-slump-since-2009.html","enabled":true},{"name":"email","url":"?subject=UK economy slows as business investment shows biggest slump since 2009&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26022015-economics-uk-economy-slows-as-business-investment-shows-biggest-slump-since-2009.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+economy+slows+as+business+investment+shows+biggest+slump+since+2009 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26022015-economics-uk-economy-slows-as-business-investment-shows-biggest-slump-since-2009.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}