Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 25, 2017

Flash Japan Manufacturing PMI slips to eight-month low at start of Q3

Japan's manufacturing economy signalled a further loss of momentum at the start of the third quarter, with the Flash PMI edging down to an eight-month low. Exports - a key source of growth- stagnated in July.

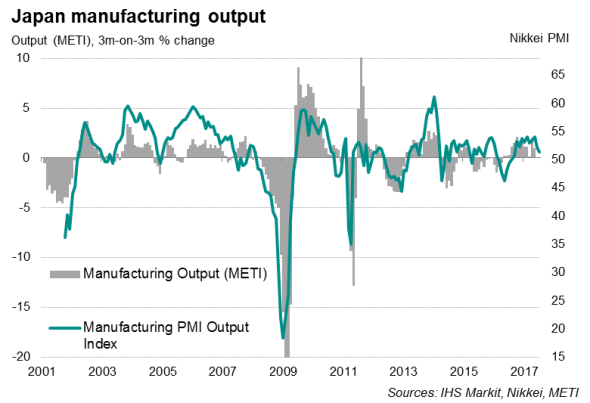

At 52.2 in July, the flash reading of the Nikkei Japan Manufacturing PMI was broadly similar to 52.4 in June, though it signalled the weakest improvement in the health of the sector since last November. Nevertheless, the index remains in expansion territory and comparisons with official series suggest the latest reading is consistent with modest manufacturing output growth.

New business continued to rise despite stagnant export sales, suggesting the domestic market served as the main driver of growth. However, the overall increase in new orders was the smallest for eight months.

Stronger inflation likely

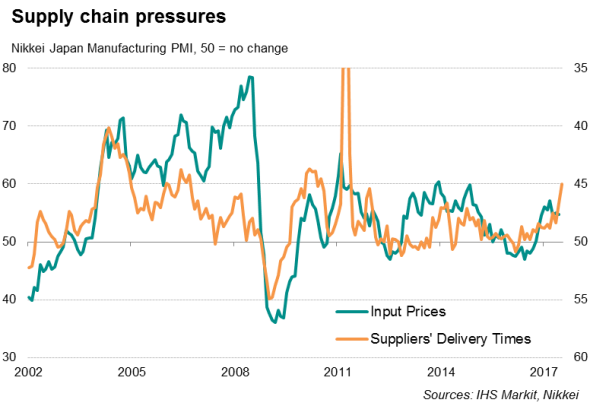

Manufacturers meanwhile continued to see strong input cost inflation in July. This led firms to raise average prices charged for manufactured goods at a pace that, though modest, was one of the fastest seen in the survey history.

Persistently strong increases in input prices reflected supply chain constraints: delivery times lengthened at a rate not seen for over six years in July (since the immediate aftermath of the 2011 earthquakes). The delays reflected greater demand for inputs (notably electronic components), supply shortages and insufficient supplier capacity. A lack of supply contributed to firms having to draw down existing stocks to meet demand. If demand continues to exceed supply, suppliers not only tend to boost capacity, but also raise prices.

As industrial prices put upward pressure on consumer prices, the Bank of Japan will be heartened to see any signs of gathering price pressures, especially when the central bank again pushed back the timing to meet its 2% inflation target - for a sixth time.

Buoyant expectations

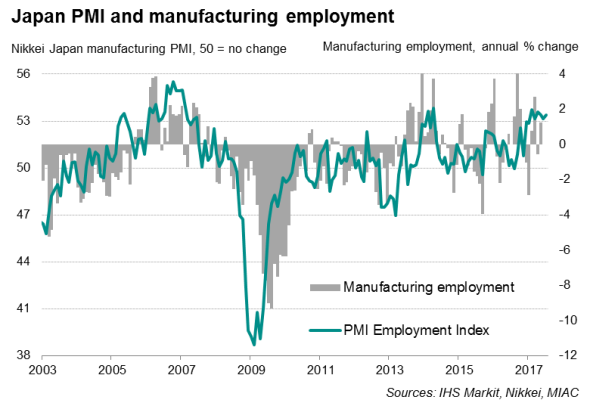

Despite the slowdown in order book growth, Japanese manufacturers remained buoyant about growth prospects and maintained a robust pace of hiring. July data showed that expectations about future output were at a record high (the future optimism series began in 2012), suggesting that the recent slowdown is widely expected to be temporary.

Producers also anticipate of the need for increased capacity in the year ahead. Employment continued to grow at one of the fastest rates for a decade.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25072017-Economics-Flash-Japan-Manufacturing-PMI-slips-to-eight-month-low-at-start-of-Q3.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25072017-Economics-Flash-Japan-Manufacturing-PMI-slips-to-eight-month-low-at-start-of-Q3.html&text=Flash+Japan+Manufacturing+PMI+slips+to+eight-month+low+at+start+of+Q3","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25072017-Economics-Flash-Japan-Manufacturing-PMI-slips-to-eight-month-low-at-start-of-Q3.html","enabled":true},{"name":"email","url":"?subject=Flash Japan Manufacturing PMI slips to eight-month low at start of Q3&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25072017-Economics-Flash-Japan-Manufacturing-PMI-slips-to-eight-month-low-at-start-of-Q3.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+Japan+Manufacturing+PMI+slips+to+eight-month+low+at+start+of+Q3 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25072017-Economics-Flash-Japan-Manufacturing-PMI-slips-to-eight-month-low-at-start-of-Q3.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}