Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 25, 2016

Most shorted ahead of earnings

A review of how short sellers are positioning themselves ahead of earnings announcements in the coming week.

- Iridium heavily shorted as Google and Facebook move into connectivity space

- UK property firms announce earnings after seeing short interest surge post-Brexit

- Shipping firms continue to see heavy short positions in Asia

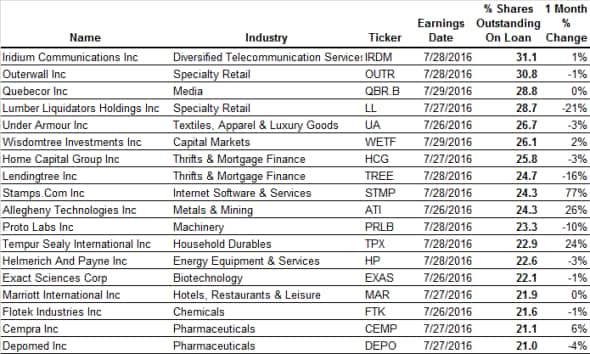

North America

The most shorted company announcing earnings next week is satellite communication company Iridium Communication, which has 31% of shares out on loan. Iridium's colourful corporate history was featured in a recent book detailing its improbable survival since debuting in the late '90s. The company was ahead of the times when it launched and has been able to carve a niche among marine and defence customers but tech giants such as Google and Facebook are now looking at the niche currently filled by Iridium.

Shares have rebounded from their lows in recent months, but short sellers have been eager to stay the course as demand to borrow Iridium shares has hovered around the 30% of shares outstanding mark for the last 12 months.

Of the heavily shorted companies reporting earnings next week, Stamps.com, Allegheny Tech and Tempur Sealy have seen the largest jumps on short interest in the months leading up to earnings.

The former of the three has seen short interest jump by over three quarters in the last month after several analyst reports raised questions around the company's revenue models. Investors on the long side have also been heeding these calls as Stamps' shares are down by over 18% in the last month.

On the other side of the shorting momentum, we've seen short interest in Lumber Liquidators fall by over a fifth in the last month. The retailer was involved in a highly public controversy regarding the level of formaldehyde in its laminates and at one point had over 40% of its shares shorted. Its share price has rebounded somewhat from the lows and the appears to be little appetite to short the rally as demand to borrow lumber liquidator shares to short has fallen below the 30% of shares outstanding mark.

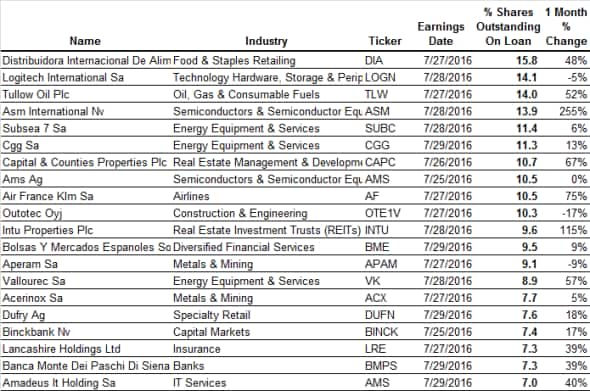

Europe

Most shorted European company announcing earnings this week is Spanish grocer Distribuidora Internacional De Alimentacion (DIA) which has 16% of shares out on loan. DIA has seen its short interest trickle up in the last few months as short sellers look to capitalise of the Europe's weak inflation and sluggish consumer spending.

The other company seeing a rise in short interest in the wake of the European economic slump is Italian bank Banca Monte Dei Paschi Di Siena (BMPS) which has been at the centre of the Italian bank crisis. Its short interest has climbed by 39% in the last month despite the fact that the recent volatility has seen BMPS fall by three quarters.

In the UK, Tullow Oil has seen a significant 52% increase in demand to borrow its shares in the last month which has taken its short interest to a new all-time high. It's worth noting that the most recent increase in demand to borrow Tullow shares coincided with the company's decision to issue a $300m convertible bond which indicates that most of the recent jump in short interest may not be driven by directional short sellers, but bond investors looking to hedge their exposure to the company's equity.

Two other UK companies announcing earnings which have seen significant increases in short interest in the month since the UK Brexit vote are real estate firms Intu Properties and Capital & Counties which have seen a 115% and 67% increase in short interest respectively. Brexit has made the sector popular among short sellers looking to bet on falling UK commercial and residential property values.

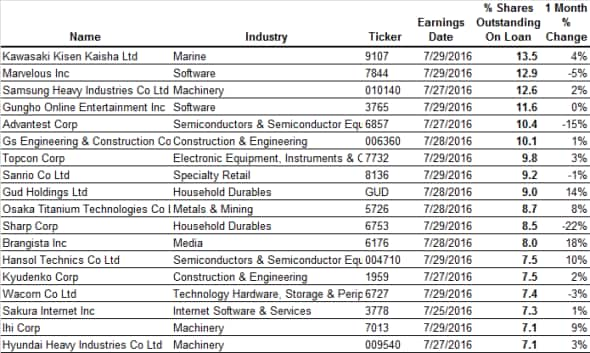

Apac

Shipping firm Kawasaki Kaisen Kaisha is the highest conviction Asian short this week with 13.5% of its shares out on loan to short sellers. Its shares have recovered from recent lows in January but short sellers have stayed the course as over 80% of the Kawasaki Kaisen Kaisha shares that can be lent out to short seller have already been claimed.

Shipping shorts are also evidenced in the perennially shorted shipbuilding firms and this week sees Samsung Heavy Industries and Hyundai Heavy Industries make the list of the most shorted companies ahead of earnings.

Simon Colvin, Research Analyst at IHS Markit

Posted 25 July 2016

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25072016-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25072016-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25072016-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25072016-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25072016-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}