Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jul 25, 2016

UK bonds resilient to plunging PMI

The UK Flash PMI numbers sparked a rally across the spectrum of pound denominated bonds as anticipation grew for an August rate cut from the Bank of England.

- The UK sovereign CDS now trading at 35bps, tighter than at any time since the referendum

- Both financial and non-financial GBP denominated IG bond spreads lower than pre-Brexit

- High yield GBP denominated bonds also trading tighter than before referendum

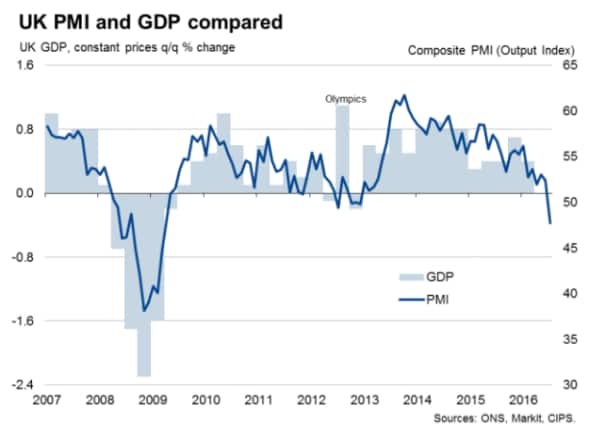

The bond market could have been forgiven for displaying signs of angst in the wake of last Friday's July Markit Flash UK PMI, but UK denominated debt rallied to new recent highs. It appears that the market chose instead to focus on the potential for more monetary loosening as policy makers address the post-Brexit uncertainty.

The Bank of England's monetary policy committee noted that it was waiting for concrete evidence of the referendum's impact on the UK economy when it held interest rates flat in its July meeting. Friday's PMI data likely helped build the case that the rate setting body will cut rates in its August meeting.

Bonds rally across the board

This anticipation driven rally was seen in gilts as the yield of the iBoxx " Gilts index, which tracks the asset class, closed 3bps tighter on the Friday compared to its previous day's close. The index's closing yield on Friday, 1.36%, is roughly 0.5% less than its pre-referendum level which indicates that the market has already priced in a zero rate environment.

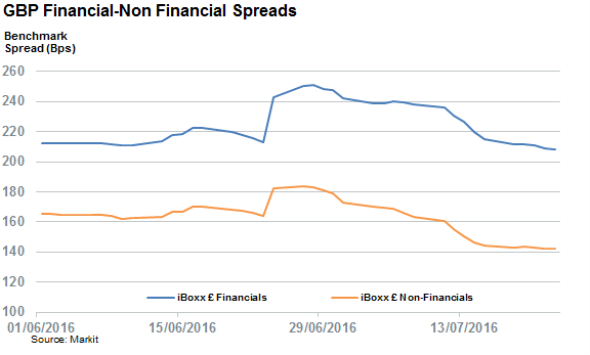

Investment grade corporate bonds have seen their yields fall by an even larger margin than their gilt peers since the vote. The yield of the iBoxx " Corporates index is now 66bps less than on the eve of the referendum as the benchmark spread priced into the index has fallen to a new multi month low.

Investment grade financials bonds had shown more residual risk in the weeks since the vote, but their spreads retreated back below their pre-referendum levels last week, showing that even the most recalcitrant parts of the bond market are being lifted by the post-Brexit stimulus anticipation rally.

High yield bonds catching up

The rally seen in high grade UK assets was also evidenced in lesser graded assets as pound denominated high yield bonds have also seen their yields retreat to below pre-referendum levels as high yield sterling bonds now yields 5.8%, 20bps less than on the eve of the vote.

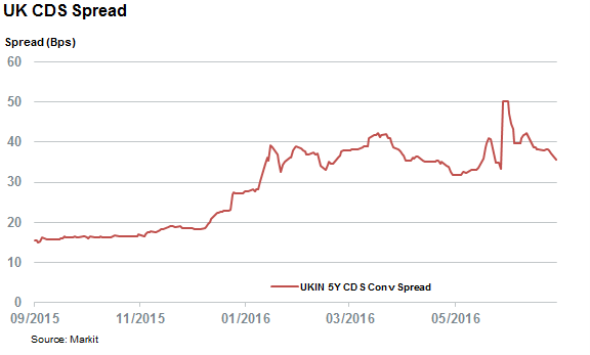

CDS spreads steady

The market's faith in UK bonds has also shown no signs of deterioration in the wake of last Friday's data given that the UK CDS spreads are trading flat from Thursday's close. While the current CDS spread is still roughly twice the levels seen at the start of the year, the latest spread is a third lower than on the day after the referendum.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25072016-Credit-UK-bonds-resilient-to-plunging-PMI.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25072016-Credit-UK-bonds-resilient-to-plunging-PMI.html&text=UK+bonds+resilient+to+plunging+PMI","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25072016-Credit-UK-bonds-resilient-to-plunging-PMI.html","enabled":true},{"name":"email","url":"?subject=UK bonds resilient to plunging PMI&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25072016-Credit-UK-bonds-resilient-to-plunging-PMI.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+bonds+resilient+to+plunging+PMI http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25072016-Credit-UK-bonds-resilient-to-plunging-PMI.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}