Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 25, 2017

UK GDP indicates worse than previously thought start to the year

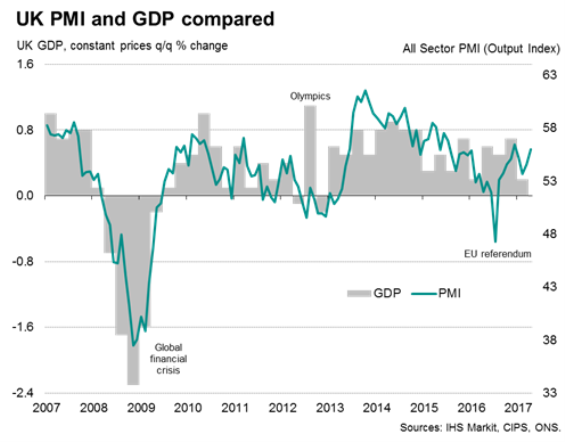

The economy got off to an even worse start to the year than previously thought, according to fresh official data. There's a strong likelihood that growth will pick up in the second quarter, but whether robust growth can be sustained further ahead remains highly uncertain.

Disappointing start to 2017

The second estimate of gross domestic product from the Office for National Statistics showed the economy growing 0.2% in the first three months of the year, down from an original estimate of 0.3% and declining from 0.7% at the end of last year

By sector, it's hard to see any bright spots in the breakdown of the data with the sole exception of business services & finance, which grew 0.6%. The broader service sector, which has been the mainstay of growth in recent years, saw the pace of expansion slump to just 0.2%. That compares to an average of 0.7% during 2016.

Manufacturing growth was revised down from 0.5% to 0.3%, contributing to a weaker than previously thought expansion of industrial production (up 0.1% instead of 0.3%). Construction output meanwhile rose just 0.2%.

Key drags on the economy were a sluggish 0.3% rise in household spending and a 1.6% drop in exports, the latter raising further questions about whether sterling's depreciation is going to help boost trade.

Brighter future?

PMI survey data indicate that the pace of economic growth lifted higher at the start of the second quarter, but also revealed that the economy continued to be held back as consumer spending remained under pressures from higher prices and low pay growth.

If anything, the squeeze on household finances worsened further in May. IHS Markit's Household Finance Index, the first consumer survey available each month, showed current finances worsening to one of the greatest extents in the past three years.

While the survey data for April therefore offer a tentative suggestion that second quarter economic growth may be slightly stronger than the 0.2% expansion seen in the first quarter, there's every possibility that growth could wane again later in the year unless inflationary pressures ease and wages start to show stronger growth.

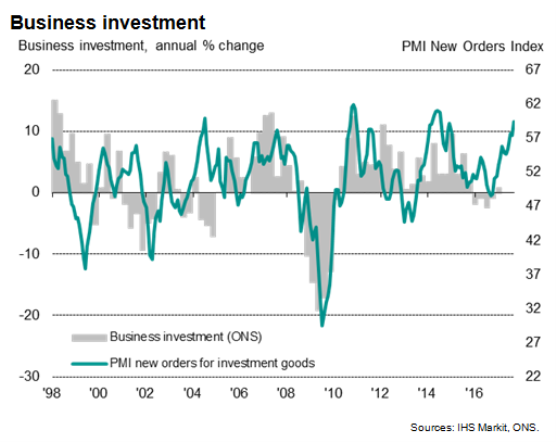

Business investment

One area that did show encouraging signs in the official data was a return to growth of business investment. Up 0.6%, after a 0.9% decline in the final quarter of last year, investment was 0.8% higher than a year ago, which represents the first annual increase since 2015.

The upswing in investment follows a similar upturn in the PMI survey's index of new orders for capital goods, such as plant and machinery. With the latter continuing to rise into April, when it registered the steepest rise since January 2011, it's possible that business investment could also strengthen in the second quarter.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25052017-Economics-UK-GDP-indicates-worse-than-previously-thought-start-to-the-year.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25052017-Economics-UK-GDP-indicates-worse-than-previously-thought-start-to-the-year.html&text=UK+GDP+indicates+worse+than+previously+thought+start+to+the+year","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25052017-Economics-UK-GDP-indicates-worse-than-previously-thought-start-to-the-year.html","enabled":true},{"name":"email","url":"?subject=UK GDP indicates worse than previously thought start to the year&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25052017-Economics-UK-GDP-indicates-worse-than-previously-thought-start-to-the-year.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+GDP+indicates+worse+than+previously+thought+start+to+the+year http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25052017-Economics-UK-GDP-indicates-worse-than-previously-thought-start-to-the-year.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}