Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 24, 2017

Japan Flash Manufacturing PMI signals export-led upturn

PMI data point to Japan's manufacturing economy being on course to finish the year with its strongest quarterly performance for nearly four years. The improved survey data go some way to ease concerns about the slower third quarter growth. Furthermore, there are signs in the survey sub-indices to suggest that the upturn will gather pace in December.

The Nikkei Flash Japan Manufacturing PMI™ rose from 52.8 in October to 53.8 in November, marking its highest level since March 2014. The PMI has now been above the 50.0 no-change level for 15 months, with the fourth quarter average so far the highest since the opening three months of 2014.

The headline PMI is a composite indicator derived from survey questions on output, new orders, employment, inventories of inputs and suppliers' delivery times. As such, the PMI data provide a broad indication of the health of the all-important manufacturing economy each month.

Export-led upturn

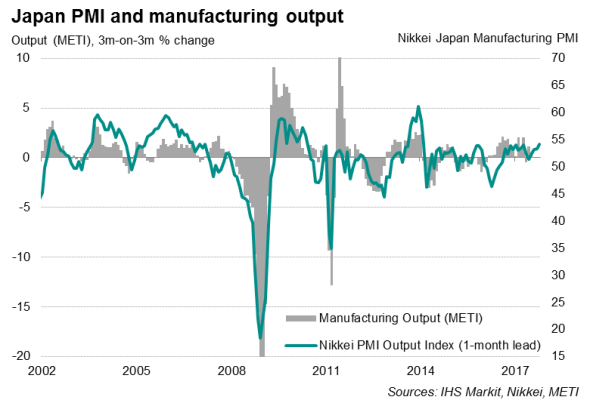

The survey's sub-indices tell a more detailed story. The Output Index, which correlates closely with official manufacturing production data (exhibiting a correlation of 80% with a one-month lead) showed production expanding at the fastest rate since March 2014, buoyed by the largest rise in new orders seen over this period.

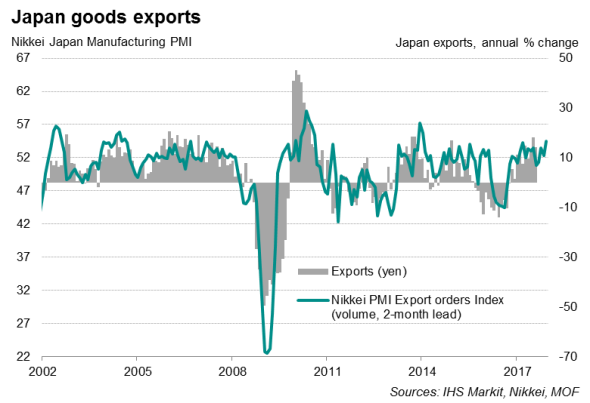

A major driver of higher output has been sustained growth in manufacturing exports. The PMI's gauge of new export order volumes, which exhibits a 72% correlation with official export data with a two-month lead, showed the recent expansion in foreign sales accelerating in November, resulting in the largest monthly increase since December 2013.

The upturn in sales was linked to stronger demand in key overseas markets, including China, while a limited recovery in the yen following its sharp depreciation against the US dollar in late 2016 has helped Japanese exporters maintain competitiveness.

The improvement in order book growth encouraged firms to step up hiring. November saw the largest monthly gain in factory employment since June.

Rising costs

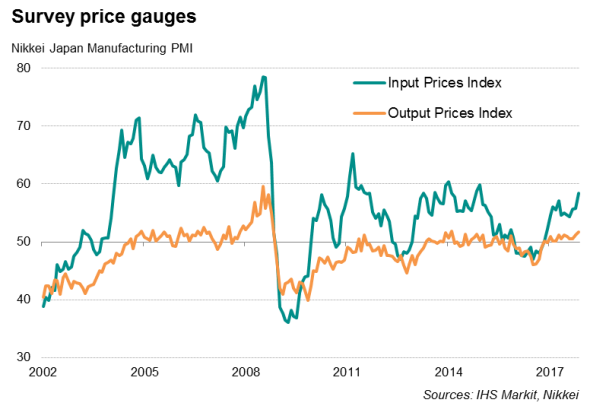

A weaker yen is keeping cost pressures up. Input prices increased at the sharpest rate in nearly three years, commonly reflecting higher prices paid for imported raw materials such as fuel and industrial metals. Despite a tightening of profit margins, firms remained reluctant to raise charges at a pace comparable to the rise in costs. Selling price inflation continued to be modest, due in part to intense competition, highlighting the difficulty faced by the Bank of Japan in spurring consumer price inflation.

Outlook

The one black mark on the copy book for November was a drop in business expectations about future activity, the only subjective measure in the PMI survey, which slipped for a second successive month to its lowest for a year as companies grew more cautious about the outlook.

However, for now, the hard numbers from the latest survey data paint an encouraging picture. Further rises in new orders, backlogs of work and purchases of inputs all point to the current upturn continuing and possibly accelerating in December.

The PMI therefore suggests the slowdown in Japan's economic growth during the third quarter, when GDP rose 0.3%, may have been short-lived. Not only is the stronger manufacturing upturn likely to boost economic activity in the last three months of 2017, October's Nikkei Services PMI data also showed a solid pickup in growth in the tertiary sector, boding well for domestic demand.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24112017-economics-japan-flash-manufacturing-pmi-signals-export-led-upturn.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24112017-economics-japan-flash-manufacturing-pmi-signals-export-led-upturn.html&text=Japan+Flash+Manufacturing+PMI+signals+export-led+upturn","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24112017-economics-japan-flash-manufacturing-pmi-signals-export-led-upturn.html","enabled":true},{"name":"email","url":"?subject=Japan Flash Manufacturing PMI signals export-led upturn&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24112017-economics-japan-flash-manufacturing-pmi-signals-export-led-upturn.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan+Flash+Manufacturing+PMI+signals+export-led+upturn http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24112017-economics-japan-flash-manufacturing-pmi-signals-export-led-upturn.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}