Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 23, 2017

Eurozone PMI output, demand, employment and inflation indicators hit multi-year highs

Eurozone growth kicked higher in November to put the region on course for its best quarter since the start of 2011. Multi-year highs were seen for all main flash PMI indicators of output, demand, employment and inflation in November. Business activity and prices rose at the steepest rates for over six years, while the largest accumulation of uncompleted work for over a decade encouraged firms to take on staff at a rate not seen for 17 years.

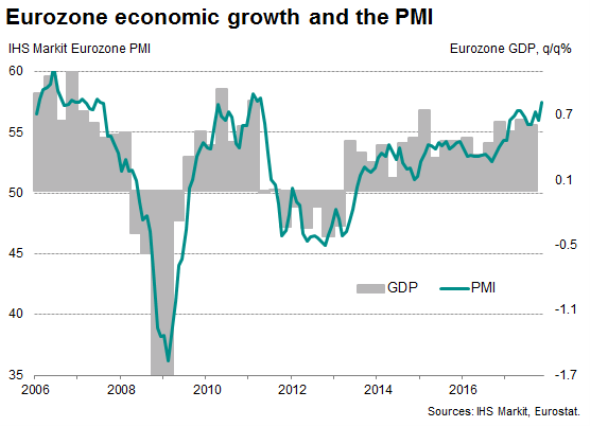

The headline flash IHS Markit Eurozone PMI, based on approximately 85% of final replies, rose to 57.5 in November, up from 56.0 in October and its highest since April 2011.

Statistical comparisons of the PMI data with quarterly changes in official GDP indicate that the PMI is so far running at a level signalling a 0.8% increase in GDP in the final quarter of 2017, which would round-off the best year for a decade.

A manufacturing-led rise in the composite PMI for Germany puts the euro area's largest member state on course for GDP growth of possibly as much as 0.9% in the fourth quarter, up from an already-spritely 0.8% pace in the third quarter.

In France, a marked improvement in the PMI, fuelled by an increasingly buoyant service sector and improved manufacturing growth, is consistent with GDP rising at a strong 0.7% rate in the fourth quarter.

Manufacturing is leading the upturn, with business conditions improving at a rate only beaten once in the survey's two-decade history amid record export and jobs growth. The service sector is reporting comparatively slower but still strong growth, as witnessed by hiring reaching a ten-year high.

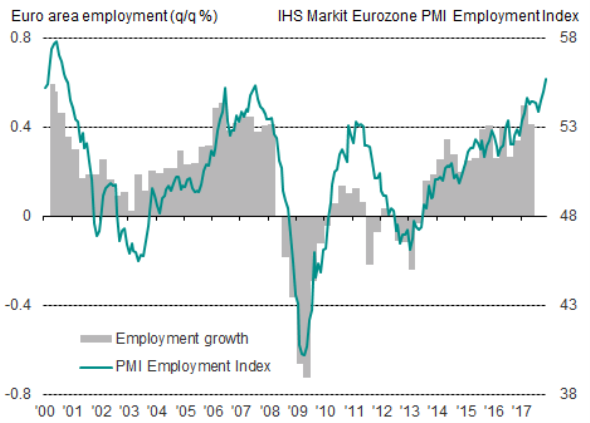

Eurozone employment

The latest survey data also showed that new jobs are being created at the fastest rate since the dot-com boom. Record manufacturing job gains were accompanied by the largest increase in service sector jobs for a decade.

Prices rise amid capacity constraints

However, despite the increase in operating capacity signalled by the steep rise in employment, firms are struggling to meet demand. Backlogs of uncompleted work were reported to have grown at the fastest rate for over a decade, often resulting in a sellers' market as customers struggle to source goods and services. Nowhere was a lack of capacity more evident than in manufacturing supply chains, where delays in the supply of goods hit the highest for 17 years.

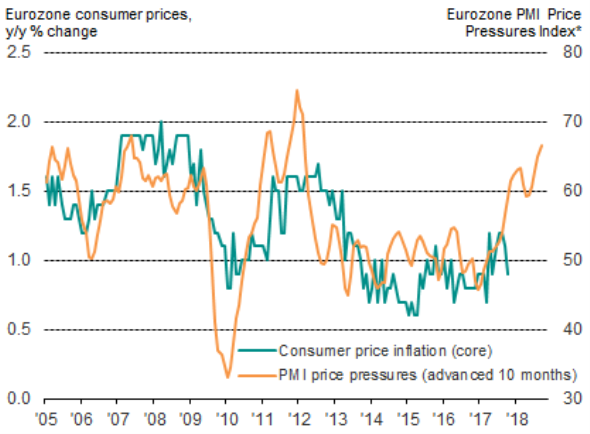

Eurozone inflation

Sources: IHS Markit, Eurostat.

Prices are consequently rising at an increased rate. Average input cost inflation and growth of prices charged for goods and services rose to the highest since mid-2011.

Strong end to the year likely

There were signs that political uncertainty linked to separatism in Spain and the German elections appears to have subdued business optimism a little. Expectations about the next 12 months cooled slightly in both sectors in November, indicating one of the lowest degrees of optimism seen over the past year.

Optimism nonetheless remained elevated by historical standards, and the broad-based nature of the upturn, and notably the rate at which rising demand is feeding through to the labour market, adds to the likelihood that the eurozone will see a strong end to 2017 and enter 2018 on a firm footing.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23112017-Economics-Eurozone-PMI-output-demand-employment-and-inflation-indicators-hit-multi-year-highs.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23112017-Economics-Eurozone-PMI-output-demand-employment-and-inflation-indicators-hit-multi-year-highs.html&text=Eurozone+PMI+output%2c+demand%2c+employment+and+inflation+indicators+hit+multi-year+highs","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23112017-Economics-Eurozone-PMI-output-demand-employment-and-inflation-indicators-hit-multi-year-highs.html","enabled":true},{"name":"email","url":"?subject=Eurozone PMI output, demand, employment and inflation indicators hit multi-year highs&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23112017-Economics-Eurozone-PMI-output-demand-employment-and-inflation-indicators-hit-multi-year-highs.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+PMI+output%2c+demand%2c+employment+and+inflation+indicators+hit+multi-year+highs http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23112017-Economics-Eurozone-PMI-output-demand-employment-and-inflation-indicators-hit-multi-year-highs.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}