Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 24, 2017

US flash PMI signals solid Q4 growth, robust hiring and rising prices

November 'flash' PMI data pointed to another encouraging though unspectacular month for corporate America and the economy as a whole. The survey data recorded sustained growth of both manufacturing and services activity, accompanied by robust hiring, though also found signs of rising inflationary pressures.

At 54.6, the headline IHS Markit PMI remained well above the 50 no-change level in November, according to the flash reading, which is based on an early cut of the monthly survey responses (final data are published at the start of each month).

Although down from 55.2 in October, it must be borne in mind that the October number was boosted by business returning to normal in many areas that had been affected by September's hurricanes, so some payback was always likely.

Steady Q4 GDP growth signalled

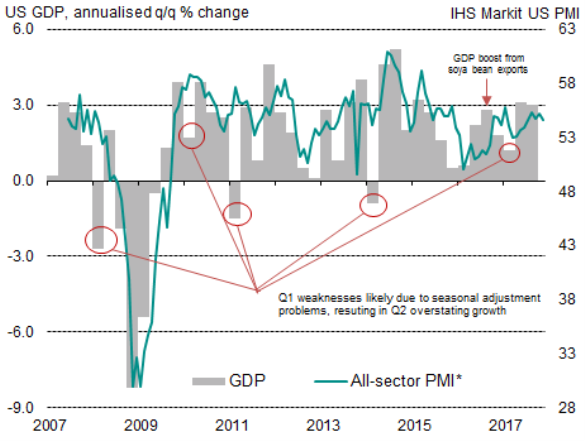

The November reading brings the PMI average for the fourth quarter so far down to 54.9. A simple regression analysis suggests that this is consistent with annualised GDP growth of just over 2% in the fourth quarter. The official estimate of GDP growth may of course be quite different: it's not unusual for GDP to be affected by so-called residual seasonality (which seems to result in a consistently weak first quarter of growth), or spurious events such as a short-lived agricultural export spike (see chart).

If some of the residual seasonality is stripped out, using a centered moving average of the GDP data, the correlation of the IHS PMI with GDP rises to 88%. As such, the PMI may be viewed as an alternative, yet accurate and timely, guide to the underlying pace of economic growth.

Sluggish manufacturing growth

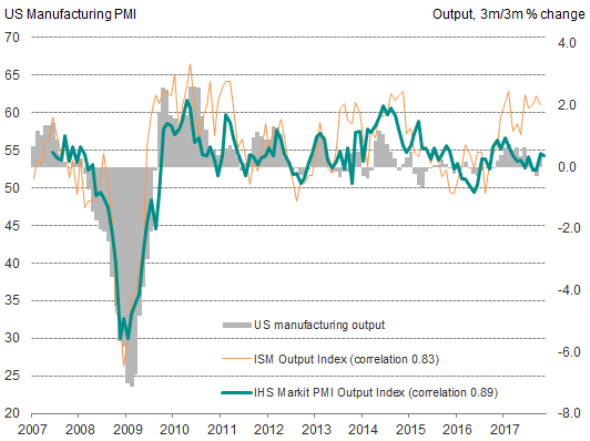

The manufacturing output index from the PMI survey also correlates closely with comparable official data, exhibiting an 89% correlation, as does the PMI new orders index when compared against official durable goods orders (or factory orders).

The survey data accurately foretold of the soft-patch encountered by manufacturing as a result of the recent hurricanes and the subsequent October rebound. Using regression analysis to convert the PMI into official data signals, a dip in November means the PMI data point to the Fed's official measure of manufacturing rising at a quarterly rate of just 0.2% (0.8% annualised), though a stronger (c.3% annualised) rate of increase is signalled for durable goods orders.

Solid hiring

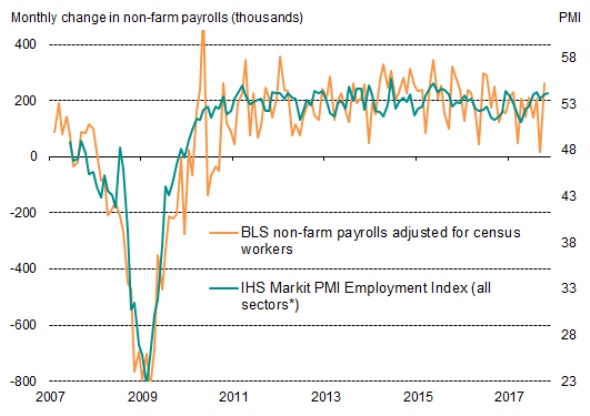

There was good news on hiring, according to the flash November PMI, with a slight uptick in the composite employment index meaning the surveys are indicating non-farm payroll growth of just over 200,000 in November.

As with GDP, the survey index does not pick up all of the volatility in the official data, but instead helps identify the underlying trend. The composite PMI employment index (a weighted average of the manufacturing and services surveys) in fact exhibits a 94% correlation with non-farm payrolls, the latter using a centered three-month moving average to reduce some of the volatility in the official series.

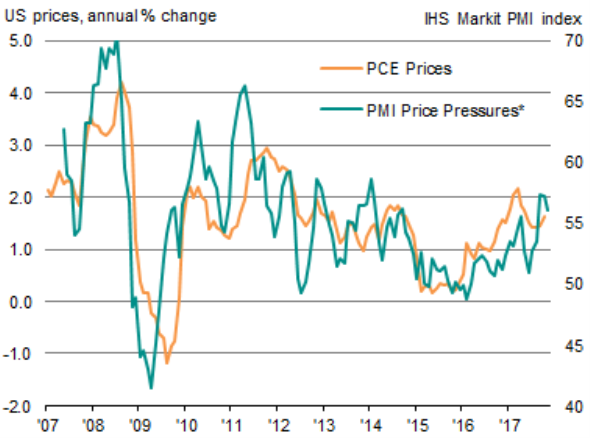

Rising prices

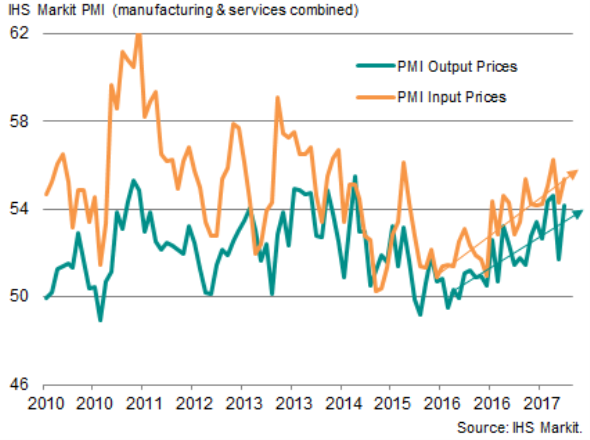

Finally, the November survey found that both input cost and selling price inflation picked up, suggesting the upturn is feeding though to higher price pressures.

In manufacturing, the overall rate of cost inflation was one of the fastest seen in the past five years, which contributed to the sharpest increase in factory gate prices since September 2014.

However, at least some of the manufacturing price hikes were attributable to lingering short-term effects of the hurricane-related supply chain disruptions, as indicated by a further lengthening of supplier delivery times. December survey data may therefore provide a clearer picture of underlying price pressures.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24112017-Economics-US-flash-PMI-signals-solid-Q4-growth-robust-hiring-and-rising-prices.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24112017-Economics-US-flash-PMI-signals-solid-Q4-growth-robust-hiring-and-rising-prices.html&text=US+flash+PMI+signals+solid+Q4+growth%2c+robust+hiring+and+rising+prices","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24112017-Economics-US-flash-PMI-signals-solid-Q4-growth-robust-hiring-and-rising-prices.html","enabled":true},{"name":"email","url":"?subject=US flash PMI signals solid Q4 growth, robust hiring and rising prices&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24112017-Economics-US-flash-PMI-signals-solid-Q4-growth-robust-hiring-and-rising-prices.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+flash+PMI+signals+solid+Q4+growth%2c+robust+hiring+and+rising+prices http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24112017-Economics-US-flash-PMI-signals-solid-Q4-growth-robust-hiring-and-rising-prices.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}