Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 24, 2017

Bank of Thailand policy on hold as PMI signals growth slowdown at start of Q2

Despite economic growth picking up in the opening quarter of 2017, the Bank of Thailand (BOT) left interest rates at a near-record low in May, citing lingering downside risks to future economic expansion.

Recent PMI survey data suggested that manufacturing activity had deteriorated at the start of the second quarter, adding to concerns that the acceleration of GDP growth in the first quarter may prove short-lived.

Signs of weakening confidence about future prospects among PMI respondents meanwhile added to the view that the central bank is right to be cautious about the economic outlook.

Slower manufacturing activity

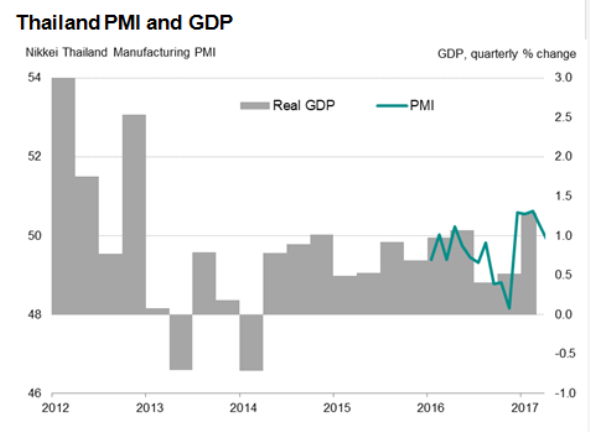

Official data showed that the Thai economy expanded at the fastest pace in four years during the first quarter, underpinned by stronger household consumption and export growth. The pick-up had been signalled in advance by the Nikkei PMI, but the renewed dip in the PMI during April suggests that growth may lose momentum in the second quarter.

Furthermore, despite recent improvements in global trade conditions, the PMI showed that growth of Thailand's new export orders eased in April. The trade deterioration could also weigh on second quarter GDP, and validates the central bank's concerns regarding external risks.

Easing inflation

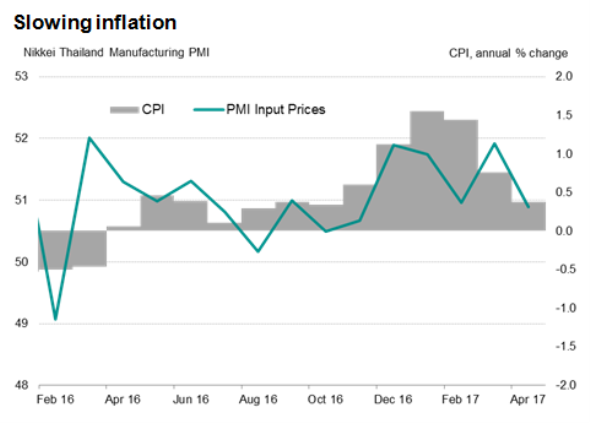

Meanwhile, softening manufacturing activity was accompanied by a moderation in inflationary pressures in April. Cost increases had been driven by supply-side factors, such as higher raw material prices and greater import taxes, rather than from greater demand.

The Ministry of Commerce announced that the consumer price index (CPI) rose 0.4% in April compared to a year ago, which was the weakest annual increase since October last year.

The lack of demand-led inflation should allow the BOT to maintain current accommodative monetary policy to support economic growth, especially if activity slows further in the second quarter.

Monetary policy

At the moment, the central bank views current policy settings as sufficiently accommodative to sustain economic growth. However, a slowdown in growth momentum in the second quarter may provoke the BOT into considering additional measures, especially when inflation does not appear to be a concern.

The next Nikkei Thailand Manufacturing PMI results are released on June 1st and will provide further clues as to the underlying economic and inflation trends of Thailand's economy, well ahead of the next BOT Monetary Policy Committee meeting in early July.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24052017-Economics-Bank-of-Thailand-policy-on-hold-as-PMI-signals-growth-slowdown-at-start-of-Q2.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24052017-Economics-Bank-of-Thailand-policy-on-hold-as-PMI-signals-growth-slowdown-at-start-of-Q2.html&text=Bank+of+Thailand+policy+on+hold+as+PMI+signals+growth+slowdown+at+start+of+Q2","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24052017-Economics-Bank-of-Thailand-policy-on-hold-as-PMI-signals-growth-slowdown-at-start-of-Q2.html","enabled":true},{"name":"email","url":"?subject=Bank of Thailand policy on hold as PMI signals growth slowdown at start of Q2&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24052017-Economics-Bank-of-Thailand-policy-on-hold-as-PMI-signals-growth-slowdown-at-start-of-Q2.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Bank+of+Thailand+policy+on+hold+as+PMI+signals+growth+slowdown+at+start+of+Q2 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24052017-Economics-Bank-of-Thailand-policy-on-hold-as-PMI-signals-growth-slowdown-at-start-of-Q2.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}