Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 24, 2017

PMI surveys show eurozone growth at near six-year high

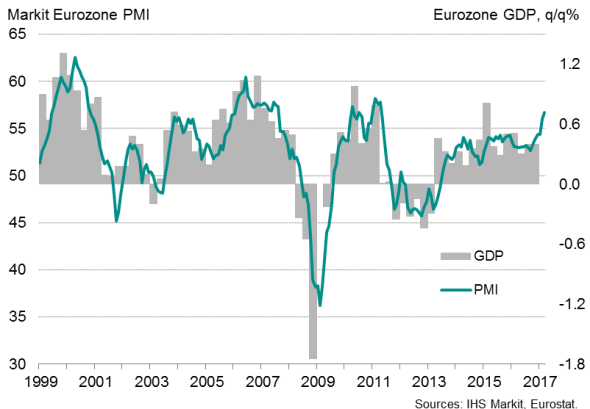

The eurozone economy's throttle opened further in March, with business activity and hiring surging higher. At 56.7, up from 56.0 in February, the March flash PMI rounded off the best quarter for nearly six years.

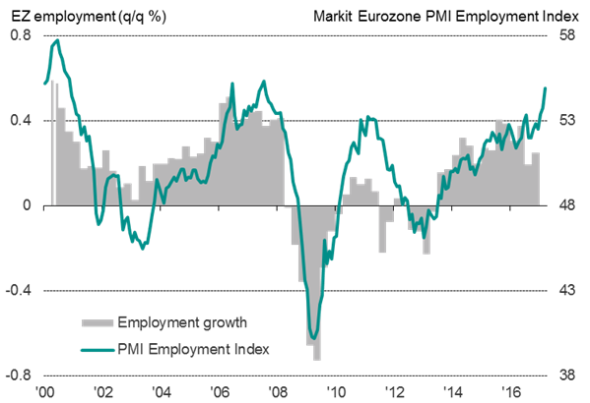

Employment growth was meanwhile the best seen for nearly a decade, but price pressures also intensified to a reach a near six-year high, raising question marks over the ECB's policy outlook.

The headline Markit Eurozone PMI readings signal GDP growth of 0.6% in the first quarter.

Eurozone PMI and GDP

Growth of service sector activity accelerated to the highest since April 2011, and manufacturing output growth eased only marginally from February's near six-year peak.

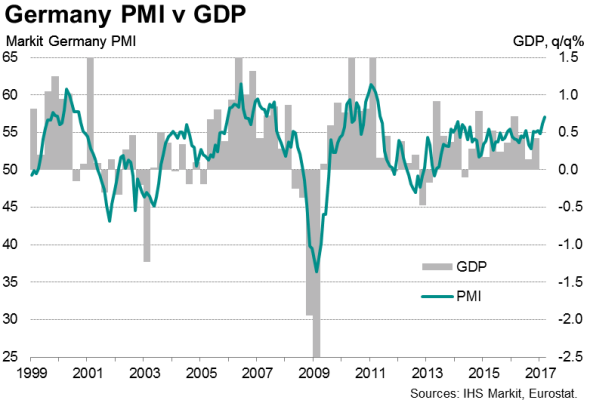

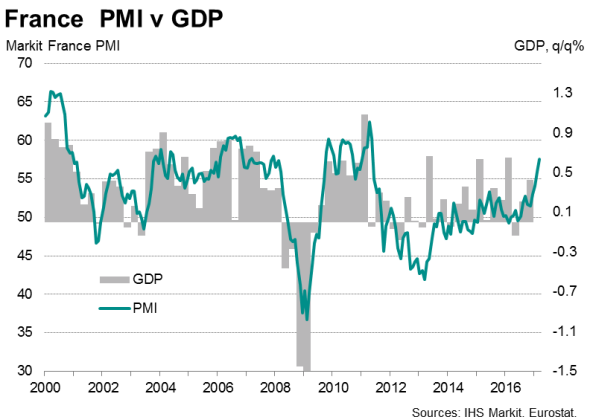

By country, growth accelerated in Germany to the strongest since May 2011, but growth in France still edged above that seen in Germany, reaching the highest since May 2011. The French upturn was led by a surge in service sector growth, while Germany's upturn was headed by manufacturing. Elsewhere, growth of output and new orders slipped lower but remained close to the best seen for almost a decade.

The average German composite PMI reading for the first quarter, at 56.0, is historically consistent with GDP expanding by 0.6%.

The average French PMI reading of 55.8 for the first quarter is meanwhile also broadly consistent with GDP growth of 0.6%.

Decade-high jobs growth

Employment showed the largest monthly improvement since July 2007 as firms sought to boost capacity in line with the recent improvement in demand. Service sector job creation was the best seen since October 2007, and factory payrolls were added to at a pace not seen since April 2011.

Eurozone employment

The German service sector was notable in seeing jobs being added at a rate not beaten in 20 years of data collection.

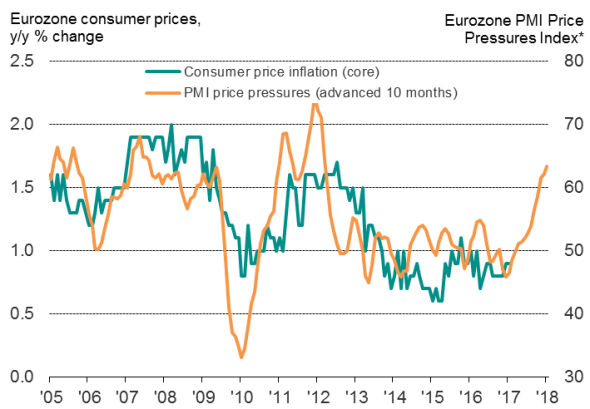

Inflationary pressures

Stronger demand also allowed increasing numbers of firms to raise prices. Average prices charged for goods and services rose at the steepest rate since June 2011.

Eurozone inflation

* Based on input prices and supplier delivery times indices

In many cases, higher prices were charged in order to pass increased costs on to customers. March's rise in average input prices was the highest since May 2011. The weakened euro was widely reported to have exacerbated the impact of increased global prices for many commodities, notably oil and energy as well as food and metals.

Some evidence of rising wage growth and supply chain price pressures were also seen. A lengthening of supplier lead times indicated that demand was often outstripping supply, allowing suppliers to push up prices. Labour markets were also reported to be tightening in some countries.

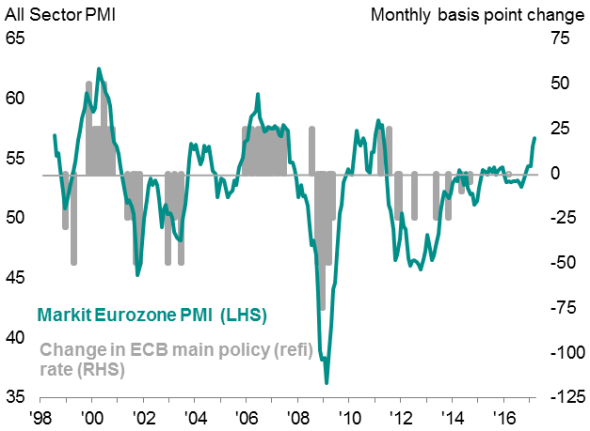

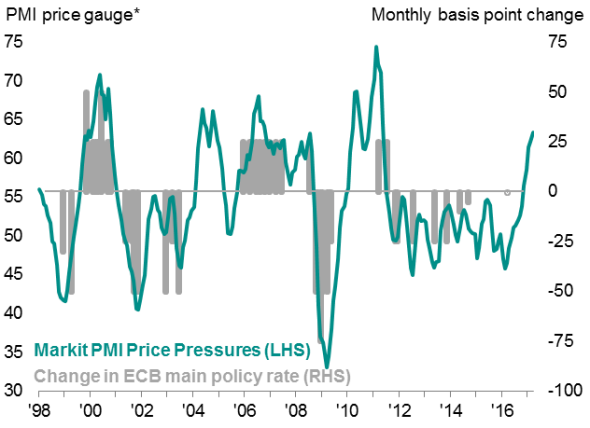

ECB policy outlook

The upturn in inflationary pressures mainly reflects increased global commodity prices and the historically-weak euro, but also reflects improved sellers' pricing power as demand lifts higher - something the ECB will need to keep a close eye on.

The PMI activity and price indices have moved well into territory which would normally be associated with the ECB tightening policy. Speculation may intensify that the central bank could risk falling behind the curve if growth continues to strengthen and inflation proves sticker than expected.

ECB policy and PMI business activity

ECB policy and PMI price pressures

* Based on input prices and supplier delivery times indices

Sources for charts: IHS Markit, ECB, Eurostat.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032017-economics-pmi-surveys-show-eurozone-growth-at-near-six-year-high.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032017-economics-pmi-surveys-show-eurozone-growth-at-near-six-year-high.html&text=PMI+surveys+show+eurozone+growth+at+near+six-year+high","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032017-economics-pmi-surveys-show-eurozone-growth-at-near-six-year-high.html","enabled":true},{"name":"email","url":"?subject=PMI surveys show eurozone growth at near six-year high&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032017-economics-pmi-surveys-show-eurozone-growth-at-near-six-year-high.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=PMI+surveys+show+eurozone+growth+at+near+six-year+high http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032017-economics-pmi-surveys-show-eurozone-growth-at-near-six-year-high.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}