Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Feb 24, 2016

European investors increasingly turn to ETF shorting as credit risk resurfaces

Credit risk has more than doubled in the last 12 months reaching levels not seen in over two years. This has led to investors increasingly using European listed bond ETFs to express bearish views on global bonds.

- The value of European bond ETF short positions crossed the $1bn mark amidst volatility

- High Yield ETFs find themselves the most shorted with USD and Euro funds topping the list

- Five funds generate 85% of the stock lending revenue

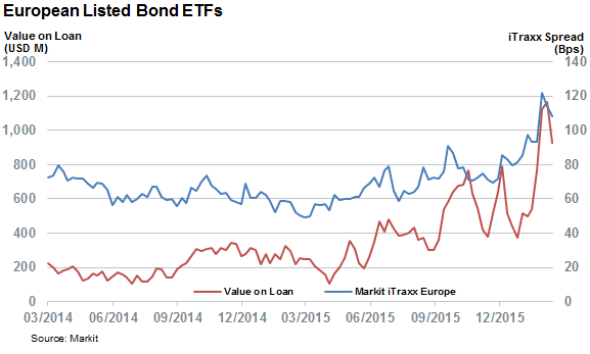

Last summer saw investors turn to shorting bond ETFs as the bond market kicked back to into life amid the Greek crisis. Volatility has continued in earnest in 2016 as the Markit iTraxx Europe index, which tracks CDS spreads across investment grade issuers, hit a three year high of 121 bps earlier this month. The surging credit risk across Europe (and globally) has seen investors short European listed bond ETFs with renewed vigour. This comes as the aggregate value of short positions across the asset class crossed the $1bn mark for the first time ever in February to top out at $1.16bn last Monday.

While short interest across the asset class has receded back under the $1bn in the last week, the current $930 of aggregate short positions is still higher than that seen at any point last year, which shows that bearish sentiment across bonds is still highly elevated.

High yield products see most bearish sentiment

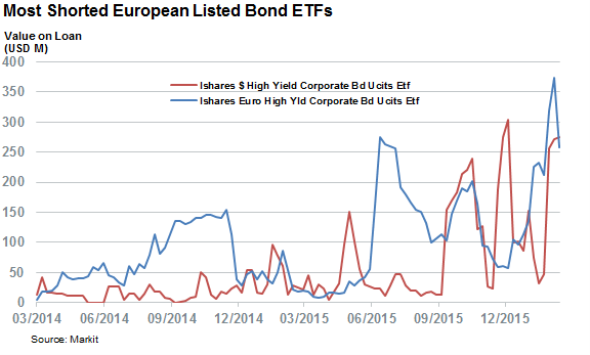

The products that have attracted the most bearish sentiment in the recent wave of shorting activity have been on the riskier end of the scale as two high yield funds currently top the list of the most borrowed European bond ETF. The two funds, the Ishares $ High Yield Corporate Bd Ucits ETF and Ishares Euro High Yld Corporate Bd Ucits ETF make up over half of the current short base as both funds now have more than $250m of shares out on loan.

Emerging market bonds have also been in the crosshairs as the Ishares J.P. Morgan $ Emerging Markets Bond Ucits ETF saw as much as $215m of borrow in recent weeks.

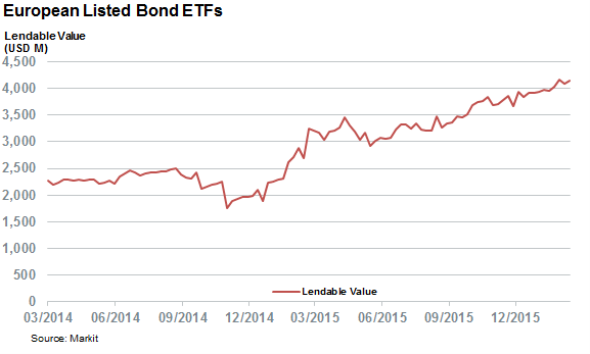

The fact that investors now use ETFs to short US high yield and emerging market bonds speaks volumes about the growth of European ETFs in recent years. Investors now use the asset class to express both long and short views on an increasingly diverse set of asset classes. In fact, investors can now access an all-time high $4.1bn of European listed bond ETFs now sitting in lending programmes, a number that has grown by 6% ytd, twice the rate of AUM growth seen by European ETFs.

The bond ETFs asset sitting in lending programmes are also proving increasingly lucrative to beneficial owners willing to lend them out. The increased demand to borrow the asset class in recent weeks has seen the stock lending revenue generated by bond ETFs sitting in lending programmes jump to a recent high of 25 bps on an annualised basis.

This trend is highly concentrated towards a minority of funds which see the most demand to borrow and in turn generate the most stock lending revenue. In fact, five funds make 85% of the current annualised stock lending revenues.

Simon Colvin, Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24022016-credit-european-investors-increasingly-turn-to-etf-shorting-as-credit-risk-resurfaces.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24022016-credit-european-investors-increasingly-turn-to-etf-shorting-as-credit-risk-resurfaces.html&text=European+investors+increasingly+turn+to+ETF+shorting+as+credit+risk+resurfaces","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24022016-credit-european-investors-increasingly-turn-to-etf-shorting-as-credit-risk-resurfaces.html","enabled":true},{"name":"email","url":"?subject=European investors increasingly turn to ETF shorting as credit risk resurfaces&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24022016-credit-european-investors-increasingly-turn-to-etf-shorting-as-credit-risk-resurfaces.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=European+investors+increasingly+turn+to+ETF+shorting+as+credit+risk+resurfaces http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24022016-credit-european-investors-increasingly-turn-to-etf-shorting-as-credit-risk-resurfaces.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}