Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 24, 2015

Fed rate rise on the cards as US flash PMI signals upsurge in services activity

Stronger growth of service sector activity in February puts a June Fed rate rise firmly on the table, although low price pressures imply the Fed will take a cautious approach to the speed at which policy will be tightened.

While Markit's flash PMI results for February found that parts of the East coast struggled in the face of adverse weather, other regions basked in unusually warm temperatures, boosting business above seasonal norms. Activity levels surged higher and inflows of new business boomed as a result.

The service sector Business Activity Index jumped from 54.2 in January to 57.0, its highest since October. The New Business Index staged its biggest one-month rise in the survey's history.

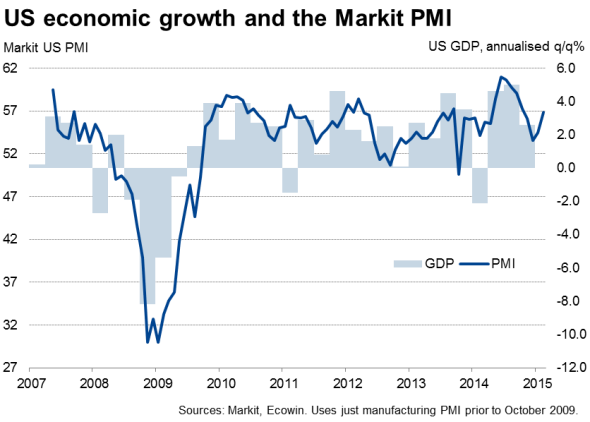

Alongside the upturn signalled by the sister 'flash' manufacturing PMI survey, the improved performance of the service sector in February means the economy looks to be enjoying yet another spell of robust growth in the first quarter. The combined output measure from the two PMI surveys rose from 54.4 in January to a four-month high of 56.8, meaning the surveys are so far running at a level consistent with at least 3.0% annualised GDP growth in the first quarter.

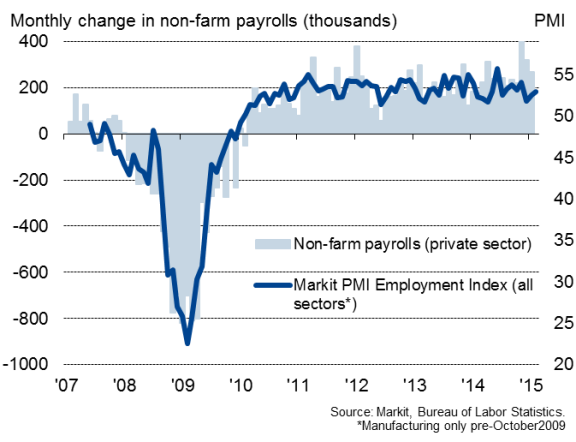

While the overall rate of business expansion has cooled from the surging pace seen in the middle of last year, growth remains buoyant and, importantly, strong enough to drive yet another month of impressive job creation. The Employment Index from the two surveys rose to a three-month high, signalling another month of c200,000 non-farm payroll growth.

Employment

The Fed will no doubt be encouraged by the resilience of the economy in the face of global headwinds such as the Greek and Russian crises, and increasingly minded to start the process of normalising monetary policy, possibly as soon as June, on the basis of these impressive survey results.

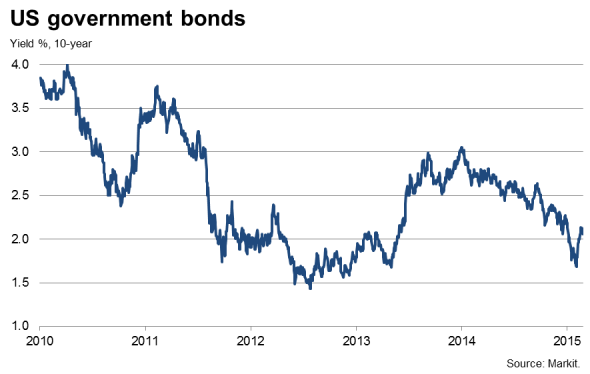

Bond markets juggle signs of strong growth and low inflation

The bond market is showing signs of waking up to the prospect of higher interest rates. Having fallen to a low of under 1.7% at the end of January, yields on benchmark 10-year US treasuries have risen higher in February, closing at 2.130% last week, albeit falling back slightly so far this week according to Markit data. The yield has risen from January's lows on the growing belief that the Fed will start to hike interest rates later this year, reflecting consensus-beating non-farm payroll growth and signs of ongoing economic growth so far this year.

However, with 10-year yields hovering around the 2% mark, there's clearly still not much rate-hiking being priced into the bond market. With oil prices having tumbled, inflation is expected to remain low and prevent the need for aggressive Fed rate hikes.

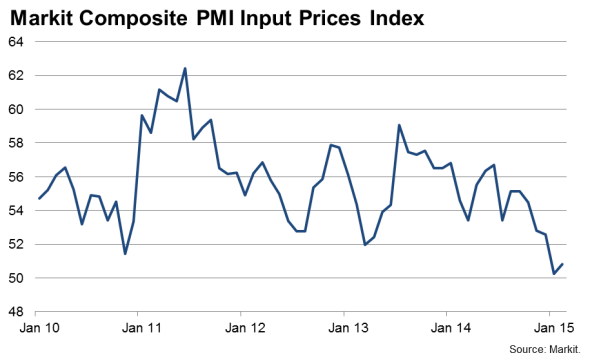

The PMI surveys certainly support the view that the economy is facing few near-term inflation worries. Average input costs across the manufacturing and service sectors barely grew for a second successive month in February. The lack of cost growth so far in 2015 sits in striking contrast with rising costs seen in previous years.

There are also some areas of concern which could deter rate hikes at the Fed.

First, the strong dollar is hurting corporate earnings, most notably for exporters. The flash manufacturing survey showed barely any export growth in February, a trend which will worsen if rate hike expectations build and push the dollar up higher.

Second, it is unclear the extent to which the growth surge recorded by the services survey in February was driven by the weather, with record hot temperatures in states such as Florida boosting seasonal trade in tourism and related industries beyond normal levels. However, with extreme weather in some parts of the East Coast disrupting business and trade flows, the Fed may wish to wait to see more readings of the economy's health over the spring before making any decisions on interest rates.

While the Fed may therefore be encouraged that the US economy is able to withstand an initial tightening of policy in the summer, the lack of inflationary pressures and worries about the prevailing global economic environment suggest that the path of rate hikes will be slow and gradual.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24022015-Economics-Fed-rate-rise-on-the-cards-as-US-flash-PMI-signals-upsurge-in-services-activity.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24022015-Economics-Fed-rate-rise-on-the-cards-as-US-flash-PMI-signals-upsurge-in-services-activity.html&text=Fed+rate+rise+on+the+cards+as+US+flash+PMI+signals+upsurge+in+services+activity","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24022015-Economics-Fed-rate-rise-on-the-cards-as-US-flash-PMI-signals-upsurge-in-services-activity.html","enabled":true},{"name":"email","url":"?subject=Fed rate rise on the cards as US flash PMI signals upsurge in services activity&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24022015-Economics-Fed-rate-rise-on-the-cards-as-US-flash-PMI-signals-upsurge-in-services-activity.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Fed+rate+rise+on+the+cards+as+US+flash+PMI+signals+upsurge+in+services+activity http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24022015-Economics-Fed-rate-rise-on-the-cards-as-US-flash-PMI-signals-upsurge-in-services-activity.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}