Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 24, 2017

Optimistic Japanese manufacturers report best start to a year since 2014

January not only saw the strongest monthly improvement in Japanese manufacturing business conditions for almost three years, but also saw optimism about future production surge to the highest for over three-and-a-half years.

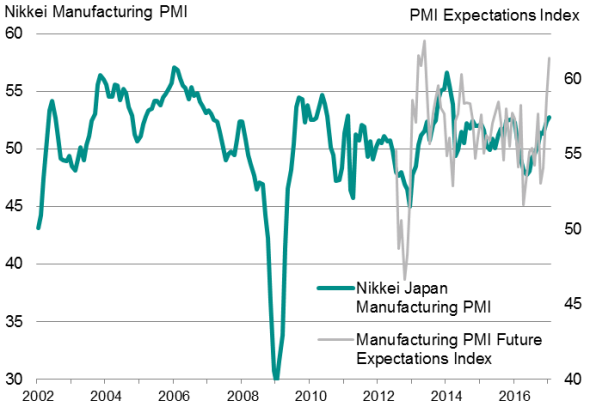

Manufacturing current and future business conditions

The Nikkei Japan Manufacturing PMI, compiled by Markit, rose from 52.4 in December to 52.8 in January, according to the flash estimate, its highest since March 2014. The improvement indicates that the manufacturing upturn continued to gain momentum at the start of 2017, recovering further from the deterioration seen in the first half of 2016.

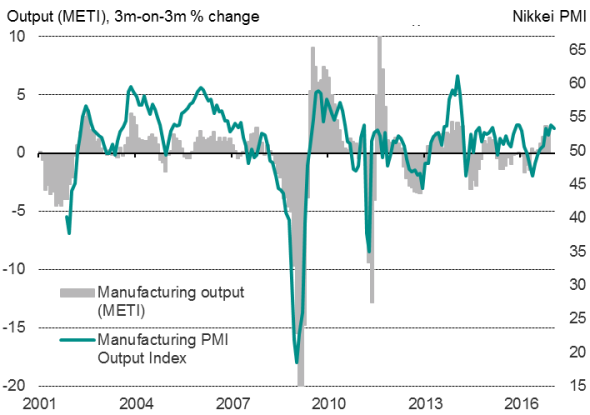

Manufacturing output

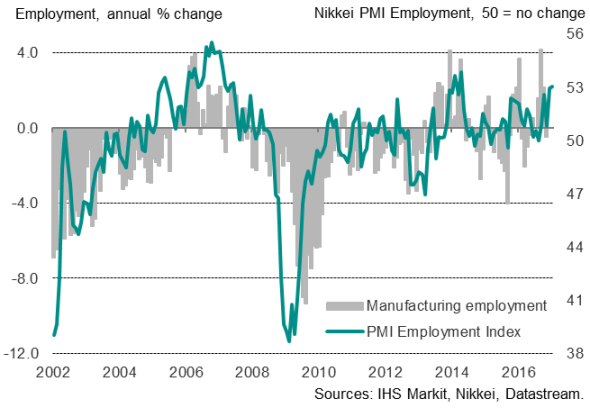

The upturn was driven by faster export-fuelled order book growth and encouraged firms to take on staff at an increased rate. However, input prices also rose to the greatest extent for almost two years.

Manufacturing employment

New future expectations indicator

Encouragingly, firms have also become more optimistic about future prospects. The January survey includes a new series tracking firms' expectations about their production levels in 12 months' time, which contrasts with the other PMI variables as it is the only index based on subjective replies. Whereas the Output, New Orders and all other PMI indices are based on questions asking how actual levels changed in the current month, the Expectations Index is based on firms' views on the outlook.

While published for the first time in January 2017, the data for the Expectations Index have been collected on a monthly basis since July 2012, meaning the index already has a four-and-a-half year history.

Any Expectations Index reading above 50 indicates that firms are on average expecting production to be higher in a year's time, while readings below 50 indicate that production is anticipated to be lower.

The January Expectations Index reading of 61.4 was up from 58.8, and therefore indicated that companies had, on balance, become more optimistic about the year ahead. The latest reading was in fact the highest recorded since May 2013.

The upturn in anticipated production for the year ahead suggests that a moderation in actual output growth seen in the January flash survey will be temporary, and that growth is expected to accelerate in coming months. However, even with the slowdown in January, production was still reported to have been expanding at one of the fastest rates seen over the past three years, consistent with approximately 2% quarterly growth.

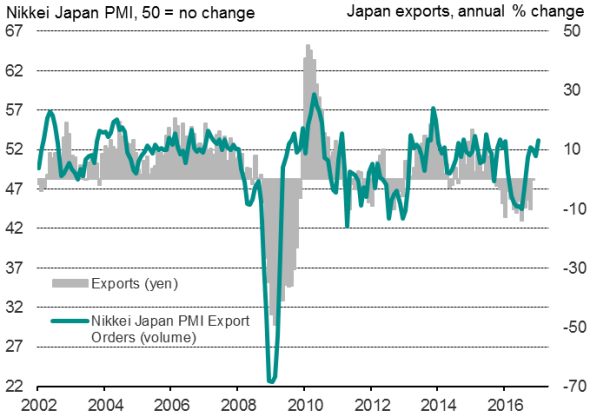

Rising exports provide order book boost

The greater optimism is partially based on signs of stronger demand at the start of the year. Manufacturers' inflows of new orders rose to the greatest extent since December 2015, buoyed by the largest rise in new export orders since November 2015.

Exports

The improved export performance was in turn linked to stronger demand in key export markets, including the US, Europe and other Asian economies, notably China, as well as the recent weakening of the yen, especially against the US dollar.

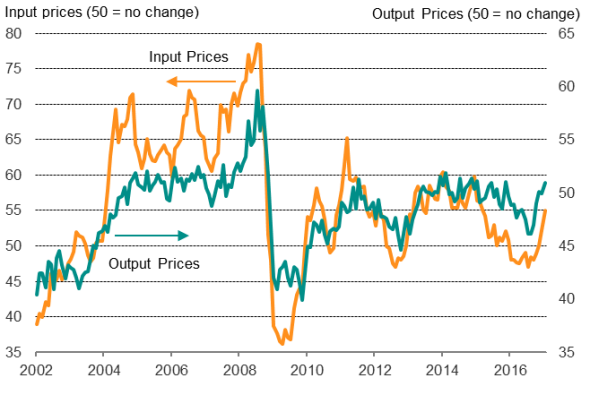

Inflationary pressures build

An additional effect of the currency's depreciation was a marked increase in producers' input costs, which rose in January at the fastest rate since March 2015.

Selling prices increased as firms passed higher costs on to customers, with factory gate prices showing the largest rise for 14 months.

Although the overall rate of increase in firms' selling prices remained relatively muted, the rise in price pressures alongside the wider manufacturing upturn will at least provide encouragement to the Bank of Japan, which expects the economic recovery to gain momentum again in 2017. IHS Markit is pencilling in GDP growth of 1.1% in 2017, up marginally from 1.0% in 2016.

Industrial prices

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24012017-economics-optimistic-japanese-manufacturers-report-best-start-to-a-year-since-2014.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24012017-economics-optimistic-japanese-manufacturers-report-best-start-to-a-year-since-2014.html&text=Optimistic+Japanese+manufacturers+report+best+start+to+a+year+since+2014","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24012017-economics-optimistic-japanese-manufacturers-report-best-start-to-a-year-since-2014.html","enabled":true},{"name":"email","url":"?subject=Optimistic Japanese manufacturers report best start to a year since 2014&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24012017-economics-optimistic-japanese-manufacturers-report-best-start-to-a-year-since-2014.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Optimistic+Japanese+manufacturers+report+best+start+to+a+year+since+2014 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24012017-economics-optimistic-japanese-manufacturers-report-best-start-to-a-year-since-2014.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}