Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 23, 2017

Eurozone enjoys best quarter for six years despite growth slowing in June

A further solid rise in eurozone business activity in June rounded off the strongest quarter of economic expansion for over six years, according to flash PMI" survey data.

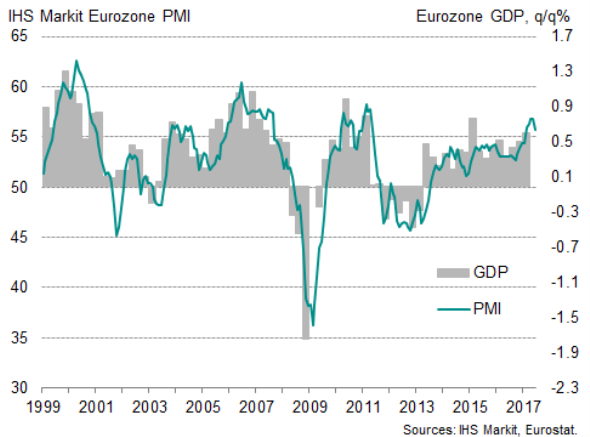

The headline IHS Markit Eurozone PMI fell from a joint six-year high of 56.8 in May to a five-month low of 55.7, according to the preliminary 'flash' estimate.

However, at 56.4, the average PMI reading for the second quarter was above the reading of 55.6 seen in the first three months of the year and was the highest since the first quarter of 2011. At these levels, the PMI is historically consistent with GDP growth accelerating from 0.6% in the first quarter to 0.7% in the three months to June.

While the June survey showed manufacturing output rising at the steepest rate since April 2011, service sector growth waned to a five-month low, albeit still remaining robust to indicate a broad-based upturn.

Eurozone PMI and GDP

Jobs boom

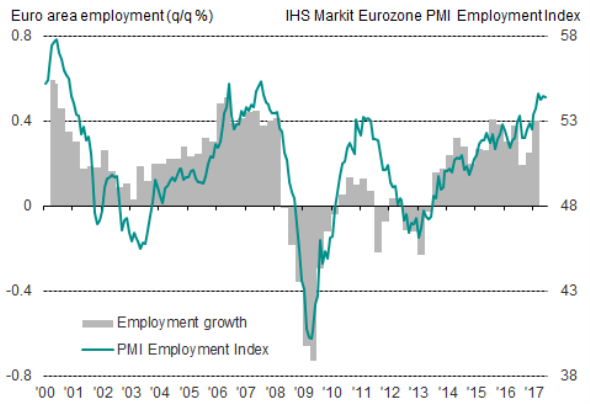

Although the rate of growth waned to a five-month low, high order book inflows and elevated levels of business confidence meant job creation remained one of the strongest recorded over the past decade as firms continued to expand capacity to meet rising demand. Factory jobs growth remained particularly buoyant, thanks in part to production requirements surging higher on the back of rising exports.

Despite the rise in employment, the surveys found some evidence of growth being constrained, especially in manufacturing, where supply delays have spiked to the highest in six years in recent months. However, with prices for many globally-traded commodities falling, notably oil, price pressures continued to ease in June.

Eurozone employment

Sources: IHS Markit, Eurostat.

Broad-based strength

Slower growth was recorded in both France and Germany, down to five- and four-month lows respectively, largely reflecting weaker rates of service sector expansion. However, headline PMI readings for manufacturing were the second-highest since April 2011 in both countries. Both nations consequently continued to record strong overall rates of expansion, with second quarter composite PMI averages signalling 0.5% growth in France and 0.7% in Germany.

Growth likewise eased across the rest of the single currency area, but the performances in terms of both business activity and hiring remained among the best seen over the past ten years.

Current upturn in context

The surprising strength of the PMI survey data in the early months of the year have been confirmed by a steady improvement in the official data, and notably the upward revision to first quarter GDP.

Similarly, the strong employment gains signalled by the PMI have been borne out by improving official labour market data, with euro area employment hitting a record high and unemployment dropping to 9.3%, its lowest since March 2009 and down from a peak of 12.1% four years ago. According to the PMI data, further gains in employment will be seen in the second quarter.

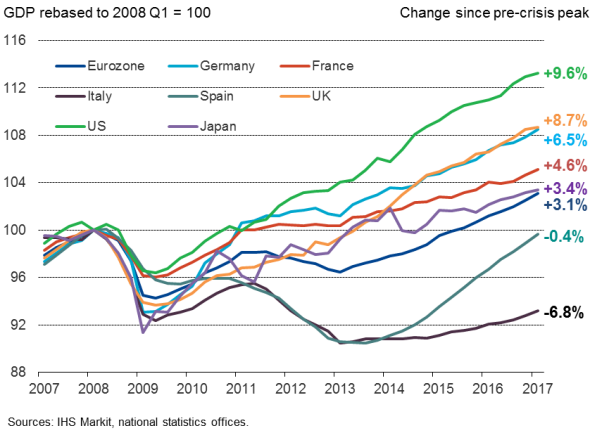

However, the high unemployment rate is a reminder that the current encouraging economic performance needs to be looked at in the context of the damage done by the global financial crisis and the region's debt crisis.

Unemployment remains historically high, with some 15 million men and women out of work across the euro area. In Greece, the jobless rate stands at 23.2%, while Spain's jobless rate is the second highest at an elevated 17.8%.

The most shocking statistics relate to youth unemployment, which still stands at almost one-in-five (18.7%) across the region as a whole. In Greece, the youth unemployment rate is 47.9%, with rates of 39.3% and 34.0% respectively seen in Spain and Italy. Every month of joblessness for younger people adds to the sense of a lost generation.

Although GDP across the region as a whole is 3.1% higher than its pre-crisis peak, this is to a large extent a reflection of Germany's recovery, having growth now 6.5% above its 2008 peak. Both Italy and Spain, in contrast, remain smaller than before the crisis. While Spain stands a good chance of regaining its prior peak in the second quarter, Italy remains some 7.5% down on its 2008 peak.

It's therefore not surprising that inflation remains subdued, reflecting a lack of demand and weak pricing power. Despite all of the stimulus in the system, the ECB has so far appeared unable to generate any meaningful increase in inflation relative to its target.

The current growth phase is nevertheless the most encouraging that we've seen since the collapse of Lehman's, and downside risks - especially political - are gradually easing, though have not fully disappeared.

The September general election in Germany remains a key date in the diary and the political situation in Italy and Spain is fragile. It is also possible that Brexit negotiations could become increasingly fraught and could hit business and consumer sentiment in the eurozone. At the very least, eurozone exports to the United Kingdom could be hit by subdued demand in the UK.

Gross domestic product comparisons

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062017-economics-eurozone-enjoys-best-quarter-for-six-years-despite-growth-slowing-in-june.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062017-economics-eurozone-enjoys-best-quarter-for-six-years-despite-growth-slowing-in-june.html&text=Eurozone+enjoys+best+quarter+for+six+years+despite+growth+slowing+in+June","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062017-economics-eurozone-enjoys-best-quarter-for-six-years-despite-growth-slowing-in-june.html","enabled":true},{"name":"email","url":"?subject=Eurozone enjoys best quarter for six years despite growth slowing in June&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062017-economics-eurozone-enjoys-best-quarter-for-six-years-despite-growth-slowing-in-june.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+enjoys+best+quarter+for+six+years+despite+growth+slowing+in+June http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062017-economics-eurozone-enjoys-best-quarter-for-six-years-despite-growth-slowing-in-june.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}