Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 22, 2016

Bank of Japan recalibrates monetary policy framework as growth slows

The Bank of Japan has kept the policy rate unchanged at -0.1% but modified the monetary policy framework. The central bank's re-calibration of policy comes amid signs of the pace of economic growth slowing and deflationary pressures mounting.

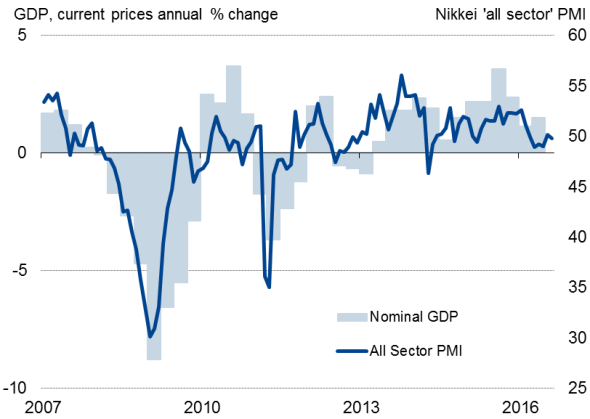

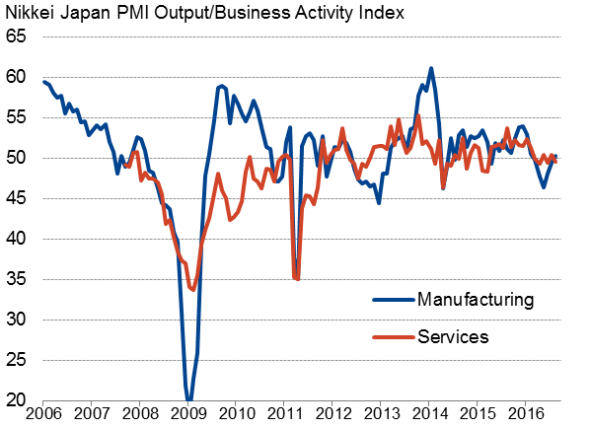

Despite prior policy stimulus, Japan's economy continues to struggle. Nikkei PMI survey data have pointed to a near-stalling of nominal GDP growth in recent months. The August PMI data showed manufacturing conditions stabilising but remaining weak. Similarly, services activity remained near-stagnant.

Nikkei PMI and GDP

Among the changes made, a commitment to overshoot their 2% inflation target was one of the most interesting. Not only does it promote the idea that the BoJ is going to maintain loose policy for an extended period, the higher target is designed to help lift inflation expectations.

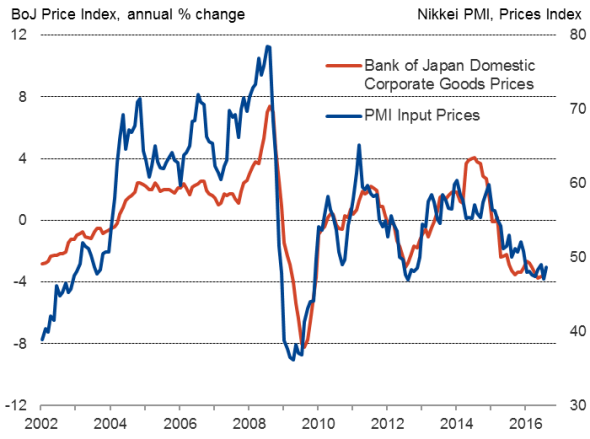

In the Bank's view, two of the main obstacles to achieving the price stability target of 2% are exogenous factors and subdued inflation expectations.

The first obstacle is mitigated by recent stability in oil prices and the postponement of the second consumption tax hike. The second obstacle, however, is what the BoJ plans to tackle in the new policy framework, and this is considered essential to reaching the inflation goal.

At the core is the 'QQE with yield curve control', where the Bank aims to strengthen two policy frameworks - the negative interest rate policy and the asset purchase programme.

But there is a concern that the absence of new ideas in the policy framework suggests that Japan's monetary policy is approaching its limits. Tellingly, possible options for additional easing outlined by the BoJ were not new measures.

However, while the changes in the policy framework are not so much of a policy shift than a rebranding exercise, there is still some significance. The new framework provides greater policy flexibility. For example, they have scrapped the hard monetary base target of "80 trillion a year, and allowed the pace of JGB purchases to fluctuate in the short term. This will likely reduce financial market speculation, as market volatility has affected price stability and pushed up the value of yen.

Manufacturing output and services activity

Monetary policy reaching limits?

Nonetheless, a widespread view persists that monetary policy is not enough to bolster economic growth, and that fiscal policy needs to fill the gap amid sluggish economic growth. For the moment, it appears likely that the BoJ is prone to maintain status quo in the coming months, unless we see a dramatic deterioration in the country's economic performance.

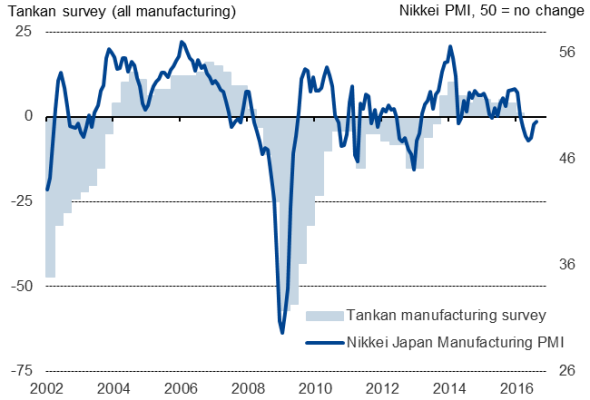

Nikkei PMI v BoJ Tankan manufacturing survey

Industrial prices

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22092016-Economics-Bank-of-Japan-recali.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22092016-Economics-Bank-of-Japan-recali.html&text=Bank+of+Japan+recalibrates+monetary+policy+framework+as+growth+slows","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22092016-Economics-Bank-of-Japan-recali.html","enabled":true},{"name":"email","url":"?subject=Bank of Japan recalibrates monetary policy framework as growth slows&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22092016-Economics-Bank-of-Japan-recali.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Bank+of+Japan+recalibrates+monetary+policy+framework+as+growth+slows http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22092016-Economics-Bank-of-Japan-recali.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}