Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 16, 2016

Week Ahead Economic Overview

There's a big focus on monetary policy during the week, with central banks in the US and Japan announcing their latest interest rate decisions. Meanwhile, flash PMI results will provide data watchers and analysts with more important information on global economic trends in the third quarter.

All eyes will turn to Washington D.C. on Wednesday, when the Federal Reserve announces its latest monetary policy decision. There have been mixed signals about the future path of interest rates in recent weeks and it seems there's a lack of consensus at the Fed.

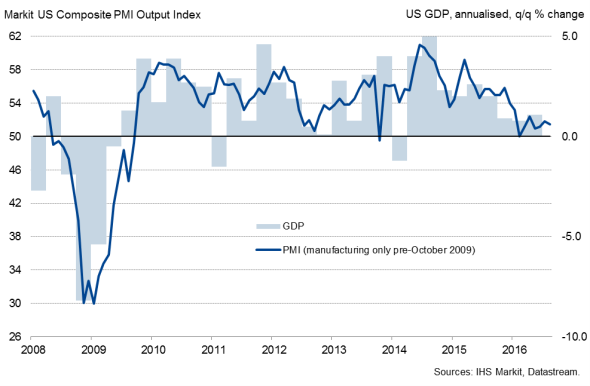

US GDP and the PMI

On the one hand, Chair Janet Yellen in August said that the case for raising rates "has strengthened in recent months". With the jobless rate at just 4.9% and expected moderate economic growth, there would be some arguments for tightening monetary policy.

However, other Fed officials argue that the strong labour market is failing to boost wages and generate inflation as much as expected. Some are also unconvinced of the robustness of growth, with latest PMI data from IHS Markit pointing to only lacklustre third quarter growth.

Futures markets signal only a 12% likelihood of the Fed raising rates in September, with a 51% probability of a move by December. Two days after the Fed meeting, IHS Markit publishes flash PMI results for the US manufacturing sector in September.

Over in Japan, policymakers will meet on Wednesday and there is a strong possibility that Bank of Japan boss Haruhiko Kuroda will announce more stimulus. Prices in Japan continued to slide in July, with CPI remaining well below the bank's 2% target and Mr Kuroda stating that "it is often argued that there is a limit to monetary easing but I do not share such a view". Moreover, second quarter GDP growth came in below expectations and latest PMI results highlight that the country's economy continued to struggle in the third quarter. Two days after the Bank of Japan announcement, latest flash manufacturing PMI results are published by Nikkei.

ECB policymakers will meanwhile scrutinise latest flash PMI results and consumer confidence numbers for more information on the health of the eurozone economy in the third quarter.

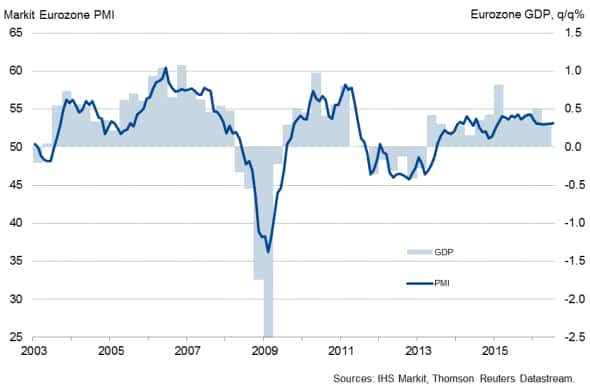

Euro area GDP grew 0.3% in the second quarter, following a 0.5% rise in the opening three months of the year. However, there are some downside risks to the growth outlook. Official data showed the largest annual decline in industrial production since 2014 and the Markit Eurozone PMI fell to a 19-month low in August. September PMI data are updated on Thursday. Policymakers will hope to see an improvement in consumer confidence after the European Commission's measure fell to -8.5 in August. Further weak data points in coming weeks could strengthen the case for the ECB to loosen monetary policy further.

Eurozone GDP and the PMI

Monday 19 September

China sees the release of latest house price figures.

Retail sales, unemployment and wage data are published in Russia.

Current account numbers are updated in the eurozone.

Jobs data and the latest IBC Economic Activity Index are issued in Brazil.

In the US, the latest NAHB Housing Market Index is published.

Tuesday 20 September

House price figures are released in Australia.

In Russia, monthly GDP numbers are out.

Germany sees the publication of producer price data.

Housing starts and building permit figures are meanwhile issued in the US.

Wednesday 21 September

August trade numbers are issued in Japan. Moreover, the Bank of Japan announces its latest monetary policy decision.

Inflation figures are updated in South Africa.

Public sector borrowing data are meanwhile published in the UK. Moreover, IHS Markit publishes its latest Household Finance Index.

Wholesale trade numbers are out in Canada.

The Federal Reserve Bank announces its latest monetary policy decision.

Thursday 22 September

The South African Central Bank announces its latest monetary policy decision.

Consumer confidence numbers are out in the euro area, while France sees the release of business sentiment data.

CBI industrial orders figures are issued in the UK.

In the US, initial jobless claims and existing home sales numbers and the Chicago Fed National Activity Index are published.

Friday 23 September

Flash PMI results are published in Japan, France, Germany, the eurozone and the US.

Final second quarter GDP numbers are released in France.

Latest inflation and retail sales figures are meanwhile published in Canada.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16092016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16092016-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16092016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16092016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16092016-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}