Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Sep 22, 2015

Volkswagen woes drag peers into the fray

Volkswagen's admission that its diesel engines sidestepped US emissions regulations has severely dented both its and its German peers' credit risk.

- Volkswagen CDS spread has more than doubled in the last two days to a six year high

- Volkswagen's bond yields have widened across the maturity curve

- Daimler and BMW have seen their spread jump by over 50% on these developments

Yesterday's shock admission that German carmaker Volkswagen's diesel engines were designed to circumvent US environmental regulation sent its shares into free fall. The second day of the crisis brought little relief for the company's shares, which tumbled by as much as 20% as the market digested the news that it was facing investigations on both sides of the Atlantic after the number of cars affected by the scandal grew to 11 million worldwide, over 20 times the number affected in the US. Volkswagen has set aside $7.3bn to deal with the initial costs of the scandal and some now reporting that its CEO will step down as soon as this week.

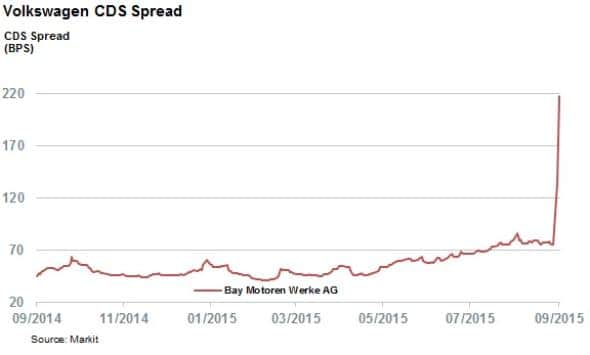

CDS spreads jump

The uncertainty around the situation has not been contained to the equities market as Volkswagen's CDS spread has surged in the wake of the breaking scandal. Volkswagen's five year CDS spread jumped by over 55bps on Monday after closing at 75bps on Friday. Today's developments have seen that spread widen further with the spread hitting 208bps as of 13:30 GMT. This deterioration has seen the spread widen to past the 200bps mark for the first time since 2009, ironically the year the company started selling diesel cars in North America.

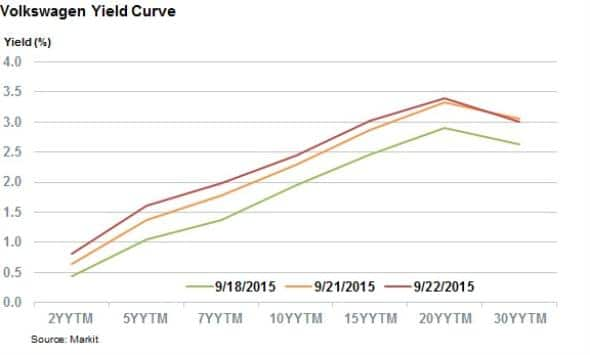

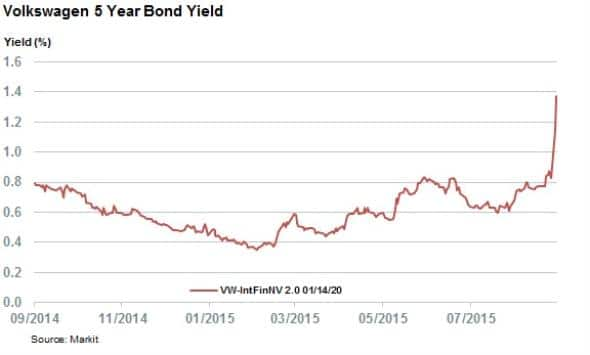

Bonds fall across the board

The widening CDS spread reflects a wider gloom around the company's bonds, which have seen their yields surge across the maturity curve yesterday, according to Markit's evaluated bond service. Today's announcements have seen that trend continue.

The company's five year 2.0 issue due in January 2020 yielded 1.37% intraday, over 50bps more than at Friday's market close.

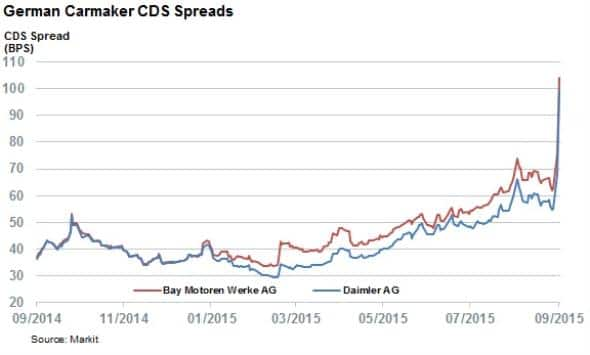

Collateral damage

Perhaps the most surprising development to bear out of the recent saga has been the fact that its German peers Daimler and BMW have seen their CDS spreads surge in line with Volkswagen. The former has adamantly denied any involvement in the saga in a statement yesterday, which looks to have had little effect on investors as its CDS spread jumped by a further 31bps today, taking its spread to a new three year high.

Whether this collateral damage has any impact on the German brand going forward looks to be seen, but investors are taking a cautious approach to the situation as both of Volkswagen's competitors have seen their shares suffer due to the company's woes.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22092015-credit-volkswagen-woes-drag-peers-into-the-fray.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22092015-credit-volkswagen-woes-drag-peers-into-the-fray.html&text=Volkswagen+woes+drag+peers+into+the+fray","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22092015-credit-volkswagen-woes-drag-peers-into-the-fray.html","enabled":true},{"name":"email","url":"?subject=Volkswagen woes drag peers into the fray&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22092015-credit-volkswagen-woes-drag-peers-into-the-fray.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Volkswagen+woes+drag+peers+into+the+fray http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22092015-credit-volkswagen-woes-drag-peers-into-the-fray.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}