Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 22, 2015

Short's tide rising in Europe

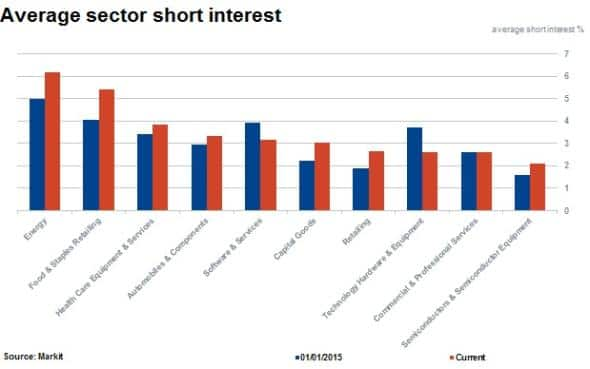

Average short interest across the largest companies in Europe has increased in recent weeks, rising back to "grexit" levels as equity markets come under pressure after erasing the year to date gains in August.

- Average short interest increases for 80% of STOXX 600 sector constituents

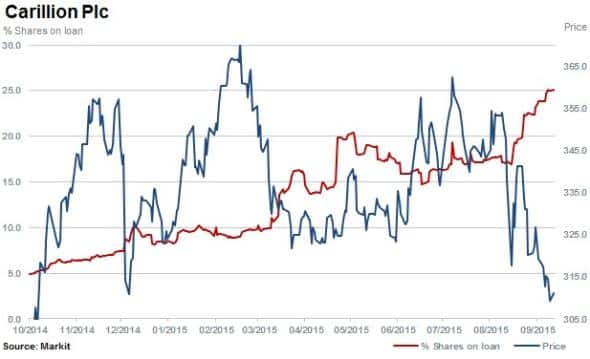

- Carillion is the most short sold in the STOXX 600 with a quarter of shares outstanding on loan

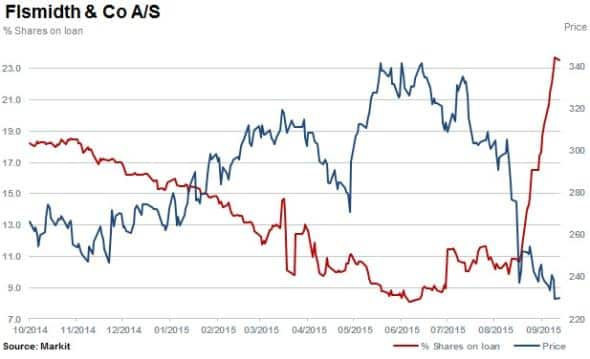

- Danish cement and minerals firm FLSmidth sees a 120% surge in short interest

STOXX sold short

Last week Markit Securities Finance data revealed that average short interest across the S&P 500 had increased to three year highs. This was against a backdrop of an emerging market selloff in August, fuelled by disappointing economic data, continued weak commodities prices and falling Chinese equity markets.

The STOXX 600 index tracks equities across 18 European countries and is down 14% from highs reached pre selloff. The recent decline has attracted short sellers with average short interest across the index rising to 2.2%, levels last seen during Greece's prolonged bailout negotiations.

The energy sector remains the most shorted across the STOXX 600, but increases in short selling have been wide spread, with the majority of sectors seeing an increase in average short interest.

No escape for energy

Energy names in Europe have seen an average of 24.6% in short interest year to date with the sector average increasing to 6.2%, triple that of the index average. Engineering, commercial services firms and capital goods & services, however, feature predominantly in the top ten most shorted stocks. UK-based Carillion is currently the most short sold stock in the STOXX 600.

Carillion, an essential services and infrastructure provider, has seen short interest climb twofold to 25.1% while the stock has slid 9.3% year to date. Short interest has continued to increase in 2015 despite the firm posting strong numbers for the first half of 2015.

The elevated shorting activity may relate to earlier campaigns carried out by hedge funds after the company's failed attempt to buy rival Balfour Betty in 2014.

Short interest in FLSmidth surged in the last month with shares outstanding on loan rising 120% to 23.5%. This has propelled the stock to be the second most shorted constituent in the STOXX 600. Shares in the Danish cement and equipment maker have fallen 24% in the last three months.

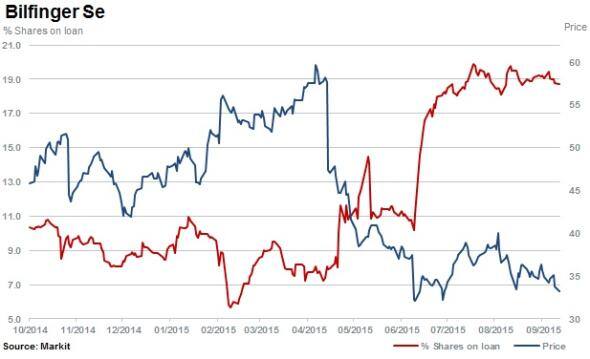

Short interest in German civil and construction firm Bilfinger has climbed to 18.7%. Shares have fallen 42% since the end of April when the company provided profit warnings and guided for a difficult trading period for the balance of the year.

Shorts stock UK retailers and Swatch

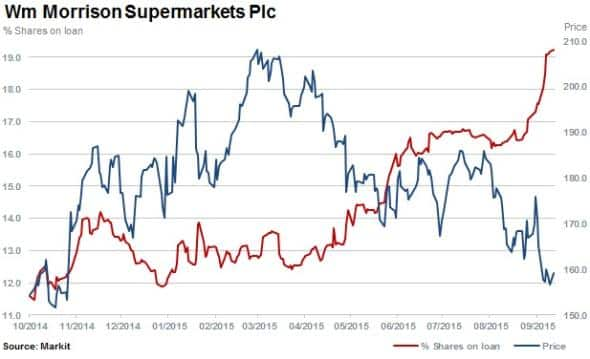

Short sellers continue to target troubled UK retailers Sainsbury's and Morrisons, who remain under pressure from German-based discounters.

Short interest in Sainsbury's remains relatively flat year to date at 15.9%. However, shares outstanding on loan for Morrisons have seen a 55% increase to 19.2% currently.

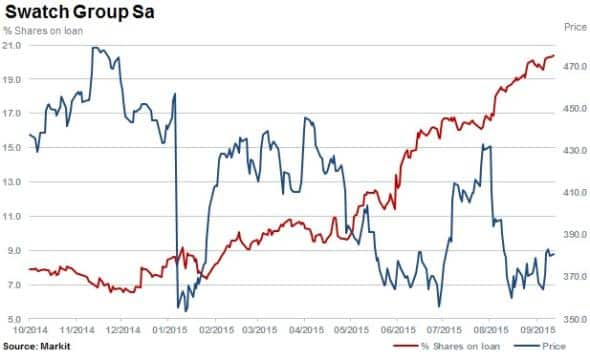

Short sellers have continued to target Swatch Group, with short interest rising consistently year to date to 20.4%. The stock has fallen back to levels last seen when the Swiss National Bank removed the franc's exchange rate cap in January 2015.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22092015-Equities-Short-s-tide-rising-in-Europe.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22092015-Equities-Short-s-tide-rising-in-Europe.html&text=Short%27s+tide+rising+in+Europe","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22092015-Equities-Short-s-tide-rising-in-Europe.html","enabled":true},{"name":"email","url":"?subject=Short's tide rising in Europe&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22092015-Equities-Short-s-tide-rising-in-Europe.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Short%27s+tide+rising+in+Europe http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22092015-Equities-Short-s-tide-rising-in-Europe.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}