Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 22, 2017

Asian economy maintains steady growth, with trade picking up

The following is an extract from Markit's Asia monthly economic overview. For the full report please click the link at the bottom of the article.

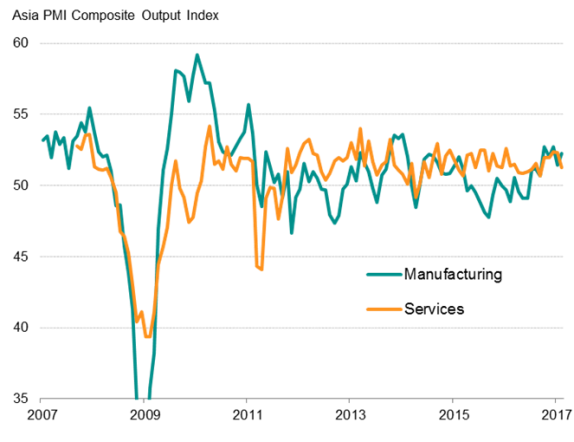

PMI data indicated that Asia lost some growth momentum for a second month in a row in February. The Asia Composite PMI, compiled by Markit from its various national surveys, edged down from 52.0 in January to 51.6 in February, signalling the slowest rate of growth in five months. However, the pace of expansion remained above that seen throughout much of last year.

Asia PMI & economic growth

The data are consistent with Asia GDP rising at an annual rate of 5% in the first quarter. Steady expansions in both the manufacturing and service sectors continued to drive the Asian upturn. Manufacturing output growth accelerated, while the pace of expansion of services activity slowed.

Manufacturing & service sectors

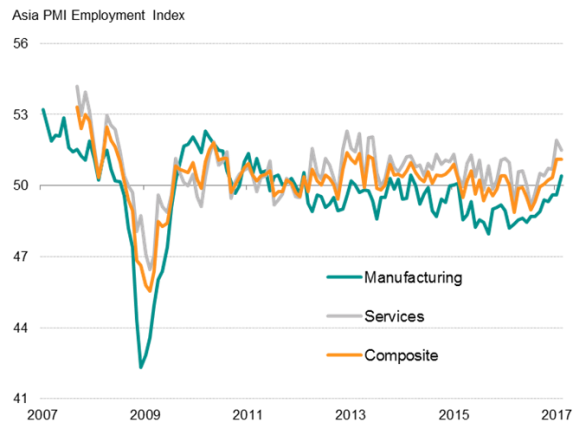

Asia hiring remains at 3" year high despite cost worries

Although slowing, the still-robust strength of Asian economic growth encouraged firms to raise staff numbers. Asia's employment levels rose at an identical rate to January's 3" year high. Notably, manufacturing jobs increased for the first time in two years, reflecting recent improvements in the sector across the region.

Employment

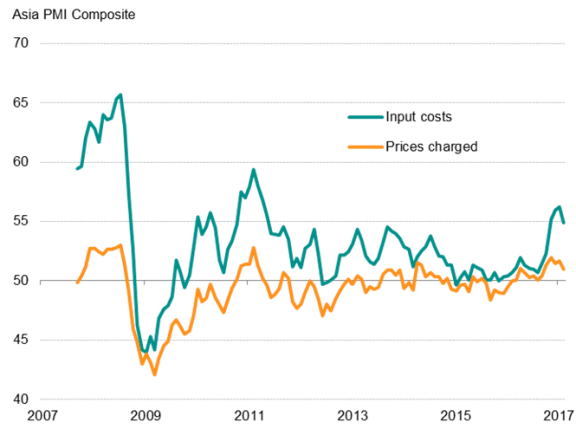

The rate of job creation remained only modest, however, in part reflecting cost worries. Average input costs rose sharply again in Asia during February, albeit at a slower rate than the near six-year high seen in January. Cost increases were again especially marked in the manufacturing sector, widely linked to higher commodity prices. Average prices charged for goods and services meanwhile rose as firms passed some of the increase in costs on to customers.

Asian price pressures

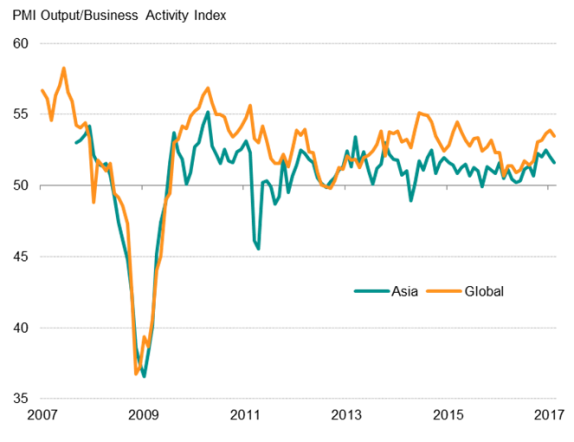

Asia underperforms global growth

Business activity growth in Asia continued to underperform relative to the global rate of expansion seen in February. A strengthening manufacturing upturn in the developed world (and the eurozone in particular) drove the improvement in business conditions.

Asia growth v. global

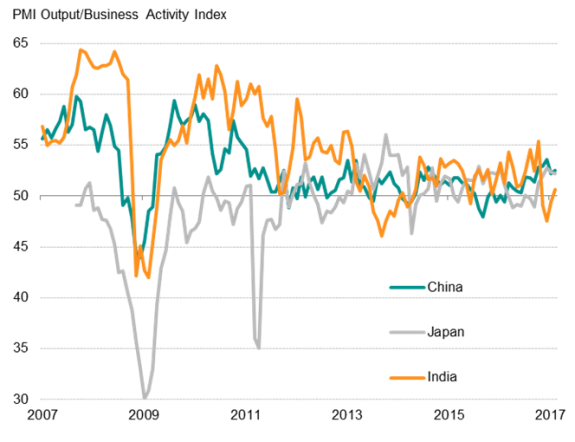

Subdued growth in Asian emerging markets was key to the continued underperformance relative to the global picture. Growth in Japan remained among the highest seen in the past three years, according to the Nikkei PMI surveys, but in India and China growth rates remained below long-run averages. India nevertheless showed signs of recovery in February, after the implementation of the demonetisation policy had disrupted business and consumer spending in the previous three months.

Major Asian economies

Sources: IHS Markit, Nikkei, Caixin

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22032017-economics-asian-economy-maintains-steady-growth-with-trade-picking-up.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22032017-economics-asian-economy-maintains-steady-growth-with-trade-picking-up.html&text=Asian+economy+maintains+steady+growth%2c+with+trade+picking+up","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22032017-economics-asian-economy-maintains-steady-growth-with-trade-picking-up.html","enabled":true},{"name":"email","url":"?subject=Asian economy maintains steady growth, with trade picking up&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22032017-economics-asian-economy-maintains-steady-growth-with-trade-picking-up.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Asian+economy+maintains+steady+growth%2c+with+trade+picking+up http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22032017-economics-asian-economy-maintains-steady-growth-with-trade-picking-up.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}