Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 21, 2015

Eurozone flash PMI ticks higher as growth accelerates in Germany and outside of the 'big-two' nations

August business survey data signalled that growth of eurozone economic output held broadly steady at a solid pace.

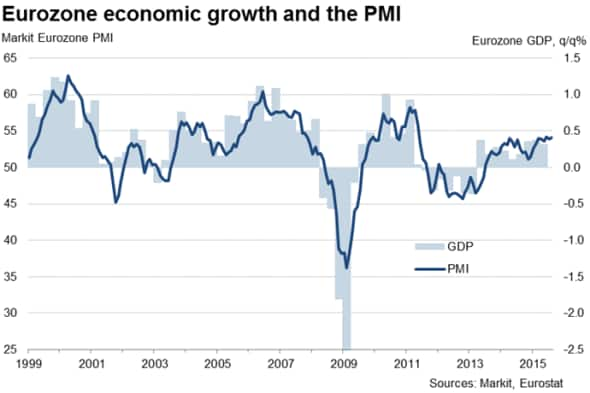

At 54.1, the Markit Flash Eurozone PMI" ticked higher from July's reading of 53.9 and remained at an expansionary level for the twenty-sixth successive month. The pace of increase was one of the fastest seen over the past four years.

The flash PMI suggests that the eurozone is still experiencing one of its best periods of economic growth and job creation during the past four years. GDP growth is tracking close to 0.4% so far in the third quarter, slightly above the 0.3% seen in quarter 2, highlighting the resilience of the economy through last month's rollercoaster events of the Greek debt crisis and the ongoing negotiations to tie up the full details surrounding the third bailout.

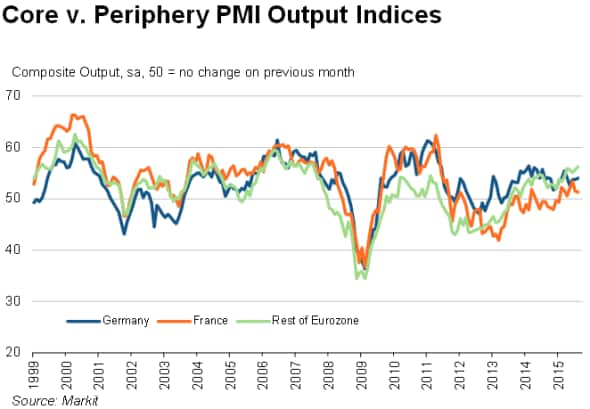

Growth strongest in 'periphery'

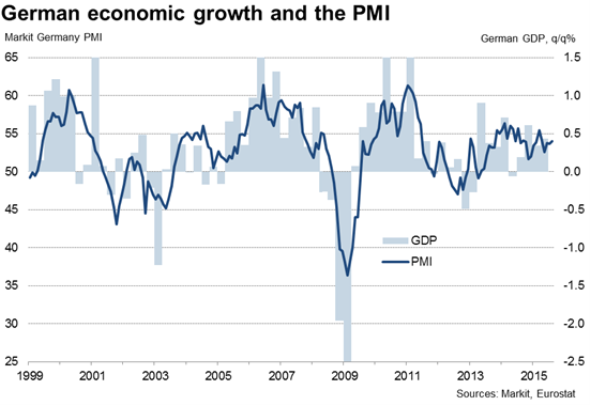

Stronger rates of expansion in Germany and outside of the 'big-two' nations were the main growth spurs in August. Economic growth accelerated to a four-month high in the bloc's largest nation, with the pace remaining above its second quarter average. Subsequently, job creation hit a 44-month peak.

Outside the 'big-two' nations output growth accelerated to its highest since July 2007, leading to further solid increases in staffing levels at manufacturers and service providers alike, which was particularly pleasing given some countries are still struggling with double-digit rates of unemployment.

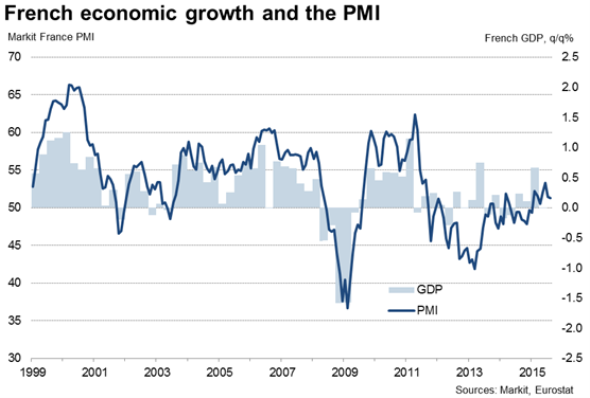

On that score, it was disappointing to see further job losses reported in France. The performance of France indeed remained subdued, but still positive overall with economic output rising for the seventh straight month. However, while the French service sector continued to expand, manufacturing production fell further.

Upturn set to continue

The outlook for the eurozone economy remained on the upside during August. Alongside growth in new orders and employment, backlogs of work rose at the strongest pace in 51 months, suggesting that current demand was still testing capacity at a number of firms.

Meanwhile, business optimism at service providers remained moderately positive despite slipping to an eight-month low. Confidence eased in Germany and outside of the big-two nations, but stepped up to its highest level since March 2012 in France.

Deflationary pressures contained for now

On the price front, average selling prices held broadly steady across the eurozone in August, while cost inflation was registered for the seventh successive month. While this suggests that deflationary pressures remain contained at present, falls in the indices for both price measures during the latest survey ensure a watchful eye will be kept on the trend in coming data releases.

Final PMI data are scheduled for release on September 1 (manufacturing) and 3 (services), providing greater details as to the economic trends outside of the 'big-two' euro nations.

Rob Dobson | Economics Director, IHS Markit

Tel: +44 149-146-1095

rob.dobson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21082015-Economics-Eurozone-flash-PMI-ticks-higher-as-growth-accelerates-in-Germany-and-outside-of-the-big-two-nations.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21082015-Economics-Eurozone-flash-PMI-ticks-higher-as-growth-accelerates-in-Germany-and-outside-of-the-big-two-nations.html&text=Eurozone+flash+PMI+ticks+higher+as+growth+accelerates+in+Germany+and+outside+of+the+%27big-two%27+nations","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21082015-Economics-Eurozone-flash-PMI-ticks-higher-as-growth-accelerates-in-Germany-and-outside-of-the-big-two-nations.html","enabled":true},{"name":"email","url":"?subject=Eurozone flash PMI ticks higher as growth accelerates in Germany and outside of the 'big-two' nations&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21082015-Economics-Eurozone-flash-PMI-ticks-higher-as-growth-accelerates-in-Germany-and-outside-of-the-big-two-nations.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+flash+PMI+ticks+higher+as+growth+accelerates+in+Germany+and+outside+of+the+%27big-two%27+nations http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21082015-Economics-Eurozone-flash-PMI-ticks-higher-as-growth-accelerates-in-Germany-and-outside-of-the-big-two-nations.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}