Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jul 21, 2015

European bond ETFs shorted amid volatility

The growing popularity of European bond ETFs has been reflected in the securities lending market, with growing numbers of investors borrowing the newly accessible bond ETF supply in the wake of the recent market volatility.

- European bond ETF inventory has doubled in the last two years, driving borrow fees lower

- The aggregate value of European listed bond short positions has breached the €500m mark

- The most borrowed fund has been the iShares Euro High Yield Corporate Bond UCITS ETF

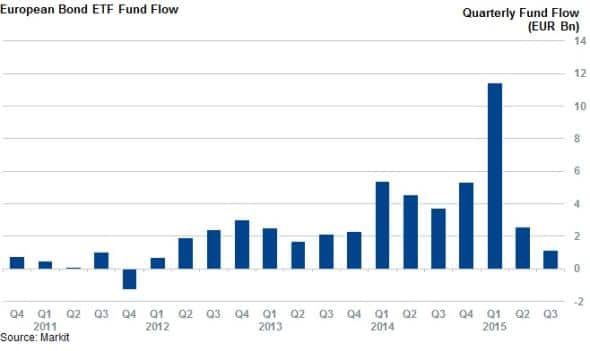

Bond ETFs have had a successful start to the opening months of the year as investors turned to the asset class in the wake of the ECB QE programme. This macro-driven play saw investors add over €11.4bn of new assets into the around 450 European listed bond ETFs in the opening quarter; over twice the previous record inflows seen in Q4 of last year. Bond ETFs have continued to resonate with European investors in the subsequent months, with funds gathering €3.6bn since the end of March.

One significant result of this surge in AUM is that European bond ETFs are now much more readily available to short sellers.

ETF lendable surges

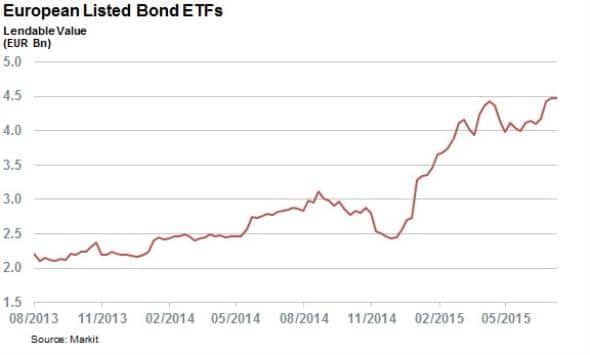

A portion of these inflows have been making their way to securities lending programmes, as the value of European bond ETFs sitting in lending programmes has jumped by €1.7bn since the start of January to a new all-time high of €4.5bn.

This boost in new supply means that 58% of the current European bond ETF landscape by AUM has ample availability in the securities lending market, as defined by having a lendable inventory greater than €10m.

Fees have been down

This increased availability also appears to have benefited borrowers, as the fees charged by lenders have fallen in step with the new inventory. The weighted average fee of to borrow a European bond ETF stood at 2.2% two years ago. The rise in lendable inventory has seen that number fall by over 50bps and the fee has now hovered in the 1.5% range over the last 12 months.

Bonds shorted amid bond volatility

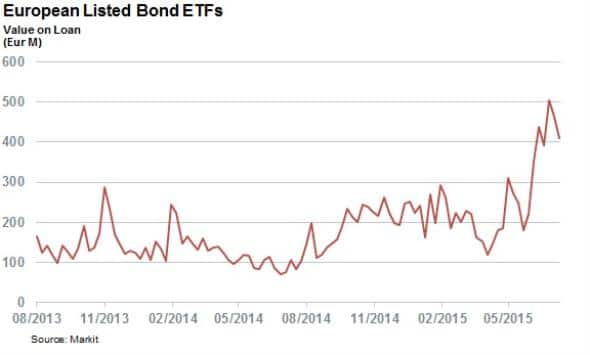

This rising supply has come at an opportune time for lenders as the recent bond market volatility has seen the demand to borrow European bond ETFs jump to a new all-time high in the past few weeks.

Both corporate and government bonds sold off heavily in the six weeks since the end of April driven by the Greek crisis and a surge in bund yields. As a result, the aggregate balance of European bond ETFs crossed the €500m threshold for the first time ever in the first week of July.

This represents a doubling of the aggregate demand to borrow the same group of ETFs from the start of the year. The growing demand to borrow highlights that the end usage of European ETFs continues to grow in sophistication as investors chose the asset class to express both long and short views on the bond market.

Volatile products most popular

Not surprisingly, the funds that have proved most popular for short sellers in the last few weeks have been high yield and emerging market products, both of which have been historically more susceptible to wider market downturns.

On the high yield space, the iShares Euro High Yield Corporate Bond UCITS ETF was the most popular with short sellers, with its borrow topping out at €255m in the recent downturn.

Dollar denominated high yield also attracted significant numbers of short sellers in the last few weeks, with the iShares $ High Yield Corporate Bond UCITS seeing its borrow approach the €100m mark in April.

The fund of choice for investors looking to express a view on emerging market bonds has been the iShares J.P. Morgan $ Emerging Markets Bond UCITS whose borrow crossed the €100m mark last week.

Simon Colvin, Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21072015-Credit-European-bond-ETFs-shorted-amid-volatility.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21072015-Credit-European-bond-ETFs-shorted-amid-volatility.html&text=European+bond+ETFs+shorted+amid+volatility","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21072015-Credit-European-bond-ETFs-shorted-amid-volatility.html","enabled":true},{"name":"email","url":"?subject=European bond ETFs shorted amid volatility&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21072015-Credit-European-bond-ETFs-shorted-amid-volatility.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=European+bond+ETFs+shorted+amid+volatility http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21072015-Credit-European-bond-ETFs-shorted-amid-volatility.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}