Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 21, 2015

Chinese export slump keeps manufacturing in decline for third month running

China's manufacturing economy contracted for a third successive month in May, with factory output falling at the steepest rate for just over a year.

At 49.1, the HSBC China Manufacturing PMI, compiled by Markit, remained below the 50.0 no-change level in May, according to the preliminary 'flash' reading, signalling a deterioration of business conditions for a third successive month and the fifth time in the past six months.

New orders fell for a third straight month, causing factories to reduce production to the greatest extent since April of last year.

The survey raises the prospect of industrial production growth slowing from the 5.9% annual rate seen in April, edging closer to the low of 5.4% seen at the height of the global financial crisis.

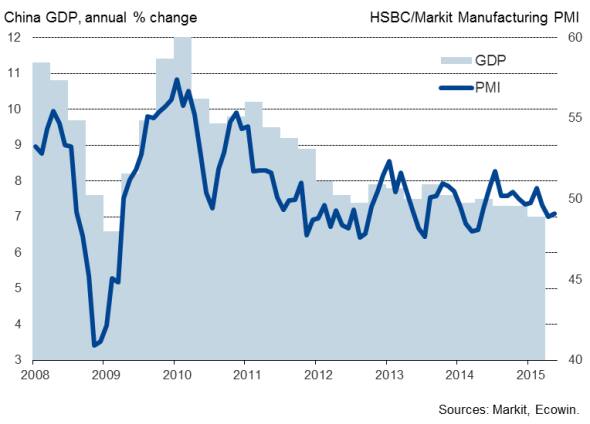

China economic growth and the PMI

Second quarter growth worries

The downturn in production adds to the likelihood of growth in the wider economy having slowed further in the second quarter, weakening from the already disappointing 7.0% annual pace seen in the first three months of the year. As such, the government's target of the economy expanding 7% in 2015 - which would be the weakest expansion for a quarter of a century - is looking increasingly under threat.

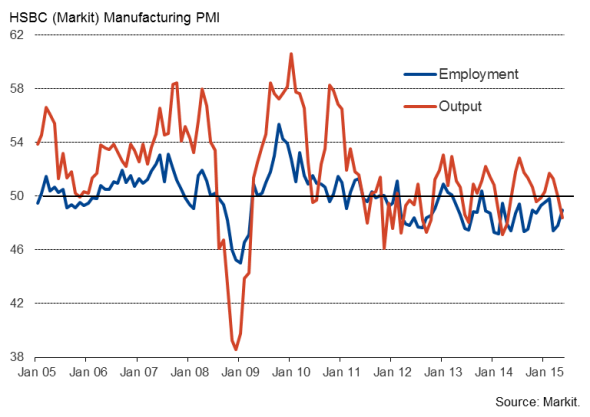

A glimmer of hope is provided by the rate of decline of new orders slowing slightly, which is likely to have been a factor behind companies reducing their headcounts at the weakest pace in three months.

However, the ongoing cull in factory jobs will be a concern to a government that is worried about the potential impact of the economic slowdown on the labour market.

Stimulus offset by weak exports

Beijing will also be concerned that stimulus measures already in place - which have included three interest rate cuts in the past six months - have yet to have the desired effect of boosting economic growth.

However, the failure of policy to revive growth in the manufacturing sector is in part due to the main source of weakness being foreign demand. The May flash survey indicated that export sales declined at the fastest rate for almost two years (since June 2013).

Chinese goods producers are suffering from especially lacklustre demand in other Asian markets, notably Japan, while domestic demand also shows few signs of reviving. Retail sales growth slowed to 10% in March. While strong by developed world standards, it was the weakest rate of expansion for a decade.

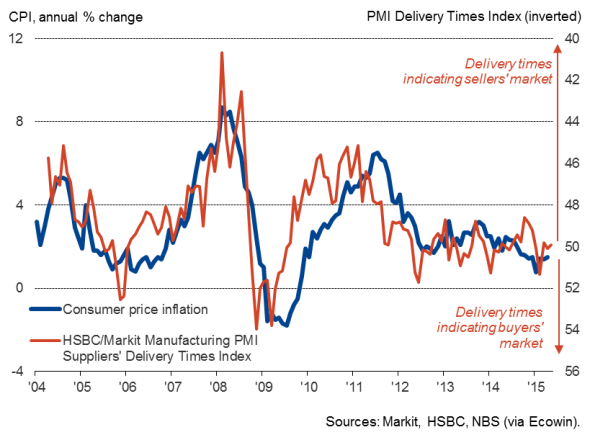

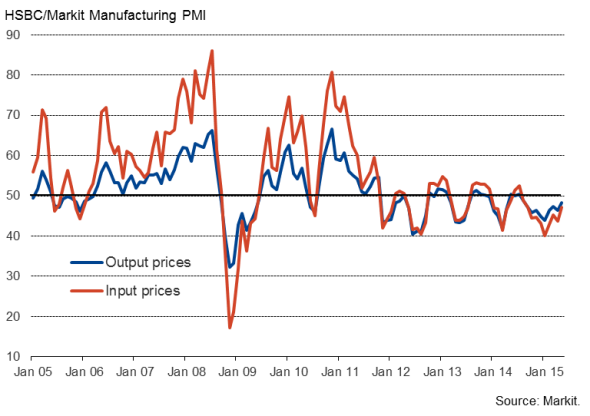

More stimulus measures therefore look likely to be unveiled by the central bank in coming months to combat both the threat of slower than expected economic growth and deflationary pressures - the survey showed input costs and factory gate prices falling once again in May, albeit at reduced rates.

Suppliers' delivery times - a key gauge of underlying inflationary pressures - also showed few signs of sellers being able to push prices higher.

Inflation

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21052015-economics-chinese-export-slump-keeps-manufacturing-in-decline-for-third-month-running.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21052015-economics-chinese-export-slump-keeps-manufacturing-in-decline-for-third-month-running.html&text=Chinese+export+slump+keeps+manufacturing+in+decline+for+third+month+running","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21052015-economics-chinese-export-slump-keeps-manufacturing-in-decline-for-third-month-running.html","enabled":true},{"name":"email","url":"?subject=Chinese export slump keeps manufacturing in decline for third month running&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21052015-economics-chinese-export-slump-keeps-manufacturing-in-decline-for-third-month-running.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Chinese+export+slump+keeps+manufacturing+in+decline+for+third+month+running http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21052015-economics-chinese-export-slump-keeps-manufacturing-in-decline-for-third-month-running.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}