Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 21, 2017

US PMI surveys signal further loss of growth momentum in April

IHS Markit's PMI data suggest the US economy lost further momentum at the start of the second quarter. Both business activity and hiring slowed again in April, though some signs appeared to suggest that growth could perk up in coming months.

Weaker GDP growth signalled

At 52.7 in April, down from 53.0 in March, the seasonally adjusted Markit Flash US Composite PMI Output Index signalled a further slowdown in private sector output growth. The latest reading pointed to the weakest rate of expansion since September 2016.

The moderation in private sector growth reflected a loss of momentum in both the service economy ('flash' index at 52.5 in April) as well as the manufacturing sector ('flash' index at 53.4).

The vast services economy in fact saw the weakest monthly expansion for seven months. The manufacturing sector has meanwhile showed signs of growth slowing since the near two-year high seen at the start of the year, despite export orders lifting higher in April. The latest PMI reading is indicative of a near-stalling of factory output growth.

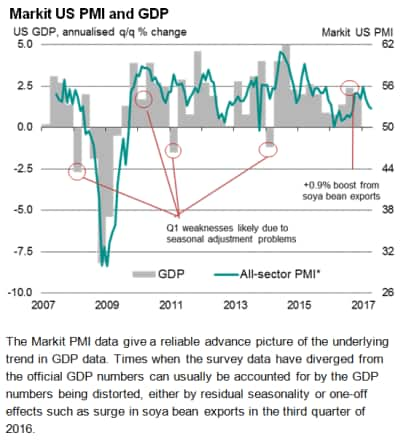

According to historical comparisons (see charts), the composite index is signalling a GDP growth rate of 1.1% at the start of the second quarter, representing a further slowdown from the 1.7% indicated by the surveys for the first quarter.

Hiring slowdown

The surveys signalled a marked step-down in the pace of hiring in March which has continued into April. Latest data saw the weakest rise in private sector payroll numbers since February 2010, driven by a softer pace of staff hiring among service providers. The latest survey data are consistent with only around 100,000 non-farm payroll growth.

There were signs of a squeeze on operating margins in April, as input price inflation reached its strongest since June 2015. At the same time, prices charged by U.S. private sector firms increased only marginally and at the slowest pace since November 2016.

Brighter outlook

While the survey responses indicate that some froth has come off the economy since the post-election bounce seen at the end of last year, there are at least some indications that growth could revive again in coming months. First, inflows of new business picked up slightly in April after hitting a six-month low in March, buoyed by stronger export sales. Second, business optimism about the year ahead also brightened, lifting to a three-month high.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21042017-Economics-US-PMI-surveys-signal-further-loss-of-growth-momentum-in-April.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21042017-Economics-US-PMI-surveys-signal-further-loss-of-growth-momentum-in-April.html&text=US+PMI+surveys+signal+further+loss+of+growth+momentum+in+April","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21042017-Economics-US-PMI-surveys-signal-further-loss-of-growth-momentum-in-April.html","enabled":true},{"name":"email","url":"?subject=US PMI surveys signal further loss of growth momentum in April&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21042017-Economics-US-PMI-surveys-signal-further-loss-of-growth-momentum-in-April.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+PMI+surveys+signal+further+loss+of+growth+momentum+in+April http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21042017-Economics-US-PMI-surveys-signal-further-loss-of-growth-momentum-in-April.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}