Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 20, 2017

Week Ahead Economic Preview

A number of countries see third quarter GDP releases while the flash October PMI data for the US, eurozone and Japan will provide early insights into the health of these major economies at the start of the fourth quarter. The Eurozone PMI will be in particular focus, as markets will be on tenterhooks ahead of the ECB policy meeting, awaiting news of any changes to the bank's asset purchase programme. Other data highlights include US home sales and durable goods orders, as well as inflation figures for Japan and Australia.

Eurozone in the spotlight

The ECB meeting next week will be scrutinised because of widespread expectations that the central bank will outline plans on how to wind down its €60 billion monthly asset purchases. Analysts are generally expecting the ECB to extend its quantitative easing programme by six months to June next year, but at the same time lowering the amount it buys each month from next year. There were reports of the ECB considering cutting the amount by at least half to €30 billion euros starting January 2018, the key message being that purchases will be made lower but for longer.

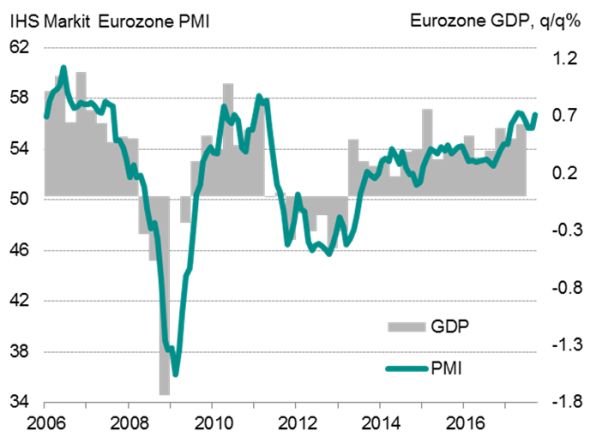

The eurozone economy has been performing strongly recently, with PMI surveys showing that growth is becoming increasingly broad-based in terms of geographical spread, and also accompanied by rising price pressures. Both the degree to which output is rising and the extent to which price pressures have intensified are consistent with the ECB starting to rein in its stimulus. The flash October PMI data will therefore play an essential role in gauging the health of the economy as we approach the end of the year, and thereby provide further insights on future monetary policy.

Hurricane impact

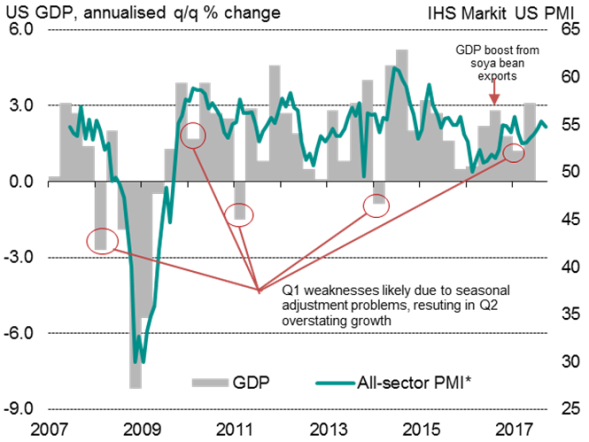

Preliminary estimates of US third quarter GDP figures are released, which are likely to show the pace of economic growth having softened as a result of hurricane-related impacts. IHS Markit's PMI data suggest a quarterly economic growth rate of just over 2%, marking a slowdown from the second quarter.

Nonetheless, the latest PMI survey data indicate that the US economy showed encouraging resilience despite hurricane disruption. The Q3 average was in fact the highest since the closing quarter of 2015. Retail sales also rebounded strongly, lifted - most likely temporarily - by auto sales. Markets will look to signs of post-hurricane rebuilding efforts, thus increasing the focus on the release of flash PMI data for October. Other key data highlights include personal consumption expenditure, housing stats and durable goods orders.

GDP data ahead of Bank of England rate decision

The UK is also announcing flash estimates of third quarter GDP; which will be one of the last major data releases before the Bank of England's next policy meeting. PMI data suggest the GDP numbers will show another lacklustre 0.3% expansion in the three months to September, matching the performance seen in the first half of the year. Even such a modest GDP expansion would be unlikely to change the views of the hawks on the Monetary Policy Committee, but a weaker number could lead to rates remaining on hold at the November meeting. A stronger number would be seen by many as sealing the deal on a hike.

Japan PMI

In Japan, the Nikkei flash manufacturing PMI for October will provide an early signal on the performance of the economy at the start of the fourth quarter. Despite a recent slowing in services activity, manufacturing conditions have been improving amid strengthening external demand for Japanese goods. Japan's inflation data are also updated, and will be scoured for signs of rising price pressures.

Eurozone PMI and economic growth

US PMI and economic growth

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20102017-Economics-Week-Ahead-Economic-Preview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20102017-Economics-Week-Ahead-Economic-Preview.html&text=Week+Ahead+Economic+Preview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20102017-Economics-Week-Ahead-Economic-Preview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20102017-Economics-Week-Ahead-Economic-Preview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20102017-Economics-Week-Ahead-Economic-Preview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}