Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 20, 2017

UK retail sales buoyed by hot weather in June, but spending trend has weakened

UK retail sales surprised to the upside in June, but with spending likely to have been buoyed by sunny weather, the upturn does little to change the underlying picture of an economy that seems to be losing momentum as we move into the second half of the year.

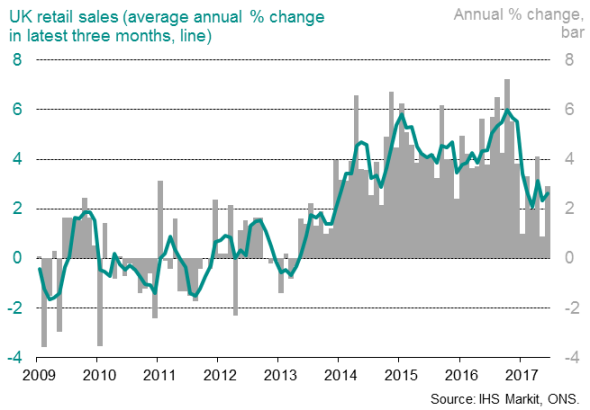

Retail sales rose 0.6% in June, partially reversing a 1.1% drop in May, according to the Office for National Statistics. The upturn meant sales were up 1.5% in the second quarter, pointing to a welcome rebound after the 1.4% decline seen in the opening quarter of the year.

UK retail sales

The fact that retail sales growth picked up in the second quarter adds to signs from PMI business survey data that economic growth likely perked up after the lackluster 0.2% expansion seen in the first three months of the year.

The improvement needs to be treated with some caution, however, as sales were boosted by particularly sunny weather, suggesting some pay-back in seasonal spending may be seen later in the summer. Retailers apparently reported that clothing sales in particular had been boosted by the warmer weather in June, rising 6.2% on a year ago.

Furthermore, the latest Visa UK Consumer Spending Index data, which tracks spending across a wider range of activities than just retail, showed consumers pulling back on their expenditure for a second successive month in June, rounding off the worst quarter for almost four years.

What's more, although the PMI data have signalled a reasonable second quarter as a whole, the surveys showed that the economy was losing momentum at the end of the quarter, a slowdown which was largely linked to weaker growth of consumer spending.

Business confidence also slumped in June following the general election, with companies growing increasingly worried about the weakened government and the potential implications of Brexit. A sister survey to the monthly PMI surveys showed UK business optimism about the year ahead falling to its lowest since late-2011, dropping below levels of sentiment seen in the eurozone and contrasting with brighter prospects reported in other major developed countries such as the US and Japan.

With the economy showing signs of losing momentum and inflation showing a surprise fall to 2.6%, the latest data suggest that August could well see the Bank of England revise down its forecasts for the economy and put to bed the prospect of a rate hike any time soon, albeit with the door left open for a tightening of policy if the economic data surprise to the upside as we move through the second half of the year. However, given the recent disappointing flow of economic data, policymakers should also acknowledge the risk that policy may need to be loosened to help the economy through this soft patch if conditions deteriorate further.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20072017-Economics-UK-retail-sales-buoyed-by-hot-weather-in-June-but-spending-trend-has-weakened.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20072017-Economics-UK-retail-sales-buoyed-by-hot-weather-in-June-but-spending-trend-has-weakened.html&text=UK+retail+sales+buoyed+by+hot+weather+in+June%2c+but+spending+trend+has+weakened","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20072017-Economics-UK-retail-sales-buoyed-by-hot-weather-in-June-but-spending-trend-has-weakened.html","enabled":true},{"name":"email","url":"?subject=UK retail sales buoyed by hot weather in June, but spending trend has weakened&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20072017-Economics-UK-retail-sales-buoyed-by-hot-weather-in-June-but-spending-trend-has-weakened.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+retail+sales+buoyed+by+hot+weather+in+June%2c+but+spending+trend+has+weakened http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20072017-Economics-UK-retail-sales-buoyed-by-hot-weather-in-June-but-spending-trend-has-weakened.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}