Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 20, 2016

Shorts cover ahead of vote, avoid squeeze

A review of how short positions have changed ahead of the UKs referendum vote this week. The tight vote sees short sellers unwilling to take a clear path as the market rally sees continued covering as uncertainty climaxes ahead of the vote.

- Rally sees shorts cover since February, clouding names possibly targeted for Brexit/remain

- Miners lead covering, while Costa Coffee parent sees significant short interest in past weeks

- 30% of positions covered in UK new home builder Berkeley

Finding referendum shorts

Polls are split on the UK's referendum outcome this week and while bookies now have the Remain campaign in the lead, short sellers have continued to cover positions on average.

Developing trading strategies based on the binary outcome to the UK's referendum vote this week, has proven easier than distilling down the ultimate views of short sellers across the UK's largest 350 stocks.

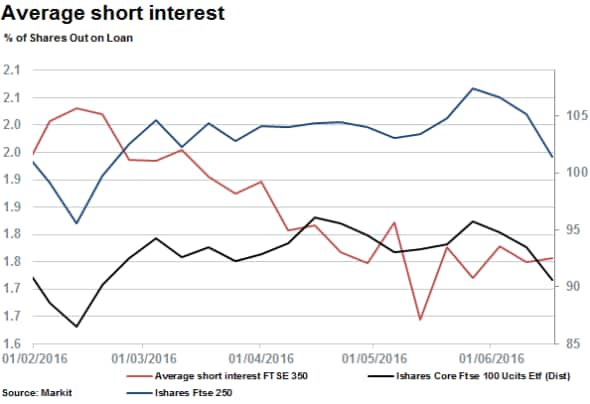

However, since February 20th, the date on which the referendum was first announced (June 23rd), average short interest across the FTSE 350 has declined by 13% with the FTSE 100 and 250 rallying some 6.6 and 7.6% respectively reaching highs in mid-April and early May.

Subsequently, the indices have lost ground erasing almost all of these gains. However, news on June 20th regarding new found Remain momentum, has seen the FTSE 100 rally, looking set to post its largest one day gain in almost four years.

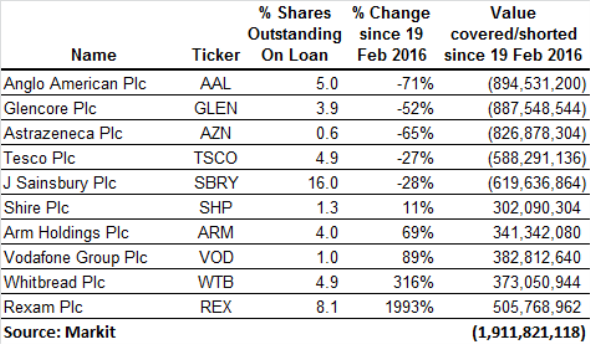

These elevated levels of price volatility coupled with uncertainty could explain the reluctance from short sellers to take clear positions on the upcoming vote. This has seen substantial covering across heavily shorted and targeted names in the past few months with commodity miners seen leading the retreat. In total over $17bn in short positions have been covered since February.

Shorts have covered over $1.7bn in Anglo American and Glencore as both stocks have recovered on higher commodity prices. Short sellers covered 71% and 53% of positions in Anglo and Glencore respectively.

While UK beverage can maker Rexam leads in terms of new short positions by value with $500m in new short positions and short interest of 8.1%. This is due to recent EU approval of the company's merger with Ball Corporation .

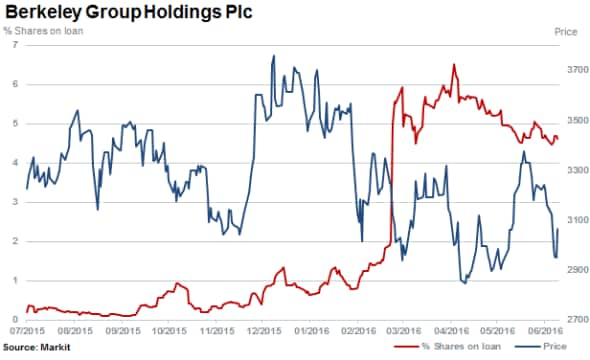

After returning to UK new homebuilder Berkeley Group, short sellers have covered close to 30% of positions ahead of the referendum with short interest declining to 4.6%. Shorts have meanwhile held positions steady in Capital and County, with 6.2% of shares outstanding on loan.

Rising shorts

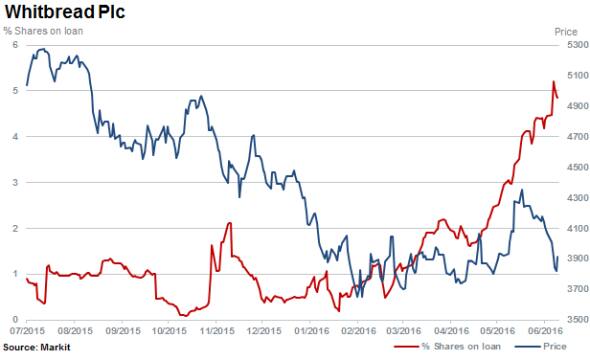

Costa coffee and Premier Inns owner Whitbread has seen short sellers increase positions by $372m in the stock with short interest just shy of 5% currently. Whitbread is one the most targeted stocks and has been since the referendum was confirmed with short interest surging since February.

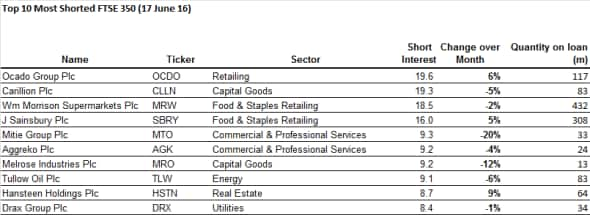

However, ahead of the referendum online retailer Ocado takes the lead as the most shorted stock across the FTSE 350. With 19.6% of shares outstanding on loan at Ocado, Carillion has slid from the top spot with short interest of 19.3% as short sellers trim positions.

Interestingly, while Ocado had been targeted since 'losing out' to Morrisons with an Amazon food partnership, Morrisons and peer Sainsbury's do not trail far behind among the top five most shorted stocks in the UK ahead of the referendum.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20062016-equities-shorts-cover-ahead-of-vote-avoid-squeeze.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20062016-equities-shorts-cover-ahead-of-vote-avoid-squeeze.html&text=Shorts+cover+ahead+of+vote%2c+avoid+squeeze","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20062016-equities-shorts-cover-ahead-of-vote-avoid-squeeze.html","enabled":true},{"name":"email","url":"?subject=Shorts cover ahead of vote, avoid squeeze&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20062016-equities-shorts-cover-ahead-of-vote-avoid-squeeze.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Shorts+cover+ahead+of+vote%2c+avoid+squeeze http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20062016-equities-shorts-cover-ahead-of-vote-avoid-squeeze.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}