Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jun 20, 2016

CDS market fears recede as Brexit odds sink

European credit spreads are enjoying a unanimous rally today as the odds of the UK leaving the European Union recede.

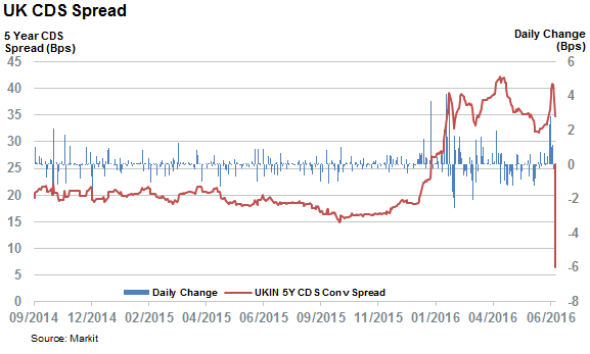

- UK sovereign CDS spreads tighten by 6bps, the highest since new ISDA rules

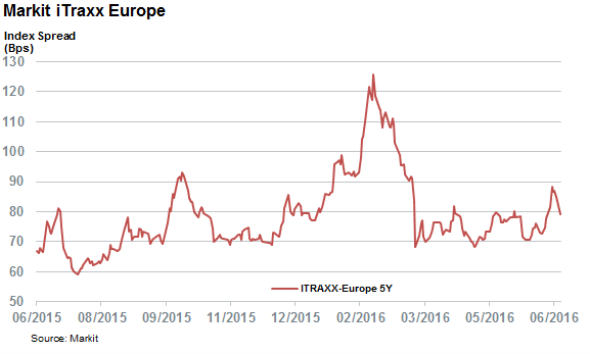

- Markit iTraxx Europe index sees the largest one day improvement since March

- UK financials lead the tightening with Aviva, RBS and Barclays seeing spreads recede by 12%

The campaign for the UK to leave the European Union has lost momentum in the lead-up to Thursday's vote, and the credit market has been re-pricing to reflect these developments.

The UK's five year CDS spreads, which had touched yearly highs off the back of the surging "leave" sentiment last week, have been the most directly impacted by this morning's developments. Spreads are now over 6bps tighter this morning which puts the spreads on course for their largest one day tightening since the new ISDA definitions were implemented in 2014.

Current CDS spreads are still running at twice the levels seen 12 months ago, which indicates that some investors remain on the fence, but today's spread tightening takes the level of credit risk priced into UK sovereign debt to levels not seen since the "remain" camp had a clear lead in the polls.

Corporate credit also benefits

This morning's developments are also being felt in the corporate space where the Markit iTraxx Europe, is enjoying its largest one day spread tightening since the European Central Bank decided to expand its quantitative easing in program back in March. The index had risen by one-tenth last week, but today's developments have seen the index give up much of these advances.

Unsurprisingly, UK firms have disproportionally benefited from today's developments, with three of the country's financials featuring among the four best performing CDS names of this morning.

Insurance firm Aviva is chief among the firms seeing falling credit risk as its five year CDS spread retreated by 13bps in European morning trading. The other three UK firms among the best performing credit names this morning are banks Barclays and RBS. All three of these names have seen their spreads tighten by roughly twice the level seen in the wider market.

While the recent volatility has been most acutely felt by UK firms, the spread widening seen last week was evenly distributed across both UK and non-UK domiciled issuers. This trend is in reverse this morning with every single of the index's 120 constituents now trading with a tighter spread.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20062016-Credit-CDS-market-fears-recede-as-Brexit-odds-sink.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20062016-Credit-CDS-market-fears-recede-as-Brexit-odds-sink.html&text=CDS+market+fears+recede+as+Brexit+odds+sink","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20062016-Credit-CDS-market-fears-recede-as-Brexit-odds-sink.html","enabled":true},{"name":"email","url":"?subject=CDS market fears recede as Brexit odds sink&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20062016-Credit-CDS-market-fears-recede-as-Brexit-odds-sink.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=CDS+market+fears+recede+as+Brexit+odds+sink http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20062016-Credit-CDS-market-fears-recede-as-Brexit-odds-sink.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}