Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 20, 2017

Most shorted ahead of earnings

We reveal how short sellers are positioning themselves in companies announcing earnings in the coming week

- Tesla shares continue to experience high short interest despite recent rally

- Short sellers increase their bets in Pearson heading into earnings

- Australian software firm Aconex most heavily shorted stock in Asia

North America

Next week's standout short target from the 17 North American companies which have more than a fifth of their shares shorted is carmaker Tesla. Tesla was by far the highest conviction short of 2016 and short sellers are holding the course in 2017 despite the fact that its shares have surged by more than 40% in the post-election bull rally. Shorts were initially willing to double down on their Tesla positions in the first few weeks of the bull rally as the number of Tesla shares out on loan increased by a tenth to a new recent high. This willingness to ride the rally has eroded somewhat in the last month however as short sellers have covered a tenth of their positions from the recent high.

One stock that hasn't fared so well in the post-election market is Strum Ruger as investors viewed the incoming administration as much less likely to pass gun control legislation. Previous efforts by the Obama administration to control gun ownership in the US had the opposite effect on gun sales as sales more than doubled in the eight years he was in power. Strum Ruger shares fell by a quarter immediately following the election and short sellers are preparing for more declines as demand to borrow the gun maker's shares has more than quadrupled since the election to just under a quarter of all outstanding shares.

While high, Tesla and Strum Ruger's short interest pales in comparison to that seen in the most shorted company announcing earnings this week, restaurant firm Zoe's Kitchen. Zoe's short interest now represents a massive 40% of its shares outstanding after bears targeted the firm in the the wake of a disappointing Q2 of last year.

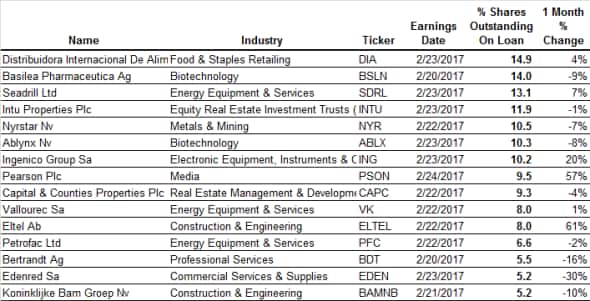

Europe

The firm with the largest amount of short interest in Europe announcing earnings next week is Spanish supermarket firm Distribuidora Internacional De Alimentacion SA (DIA). The stock has been a bit of a roller coaster for investors since being spun out from Carrefour back in 2011, much like its European supermarket peers. Short sellers have always been active DIA shares and the grocer's last set of disappointing spurred on short interest to the current highs which represent 15% shares outstanding.

UK real estate firms are a key play for short sellers this week and we see Intu Property and Capital & Counties heavily targeted by short sellers heading into earnings. Short sellers in both firms have been emboldened since the Brexit referendum back in June of last year.

Another UK short target announcing earnings this week is publisher Pearson. The firm recently announced a profit warning due to weakness in the US schoolbook market which knocked over 25% off the value of its shares. This also prompted short sellers to increase their positions by over 50% to the current 9.5% of shares outstanding.

Asia

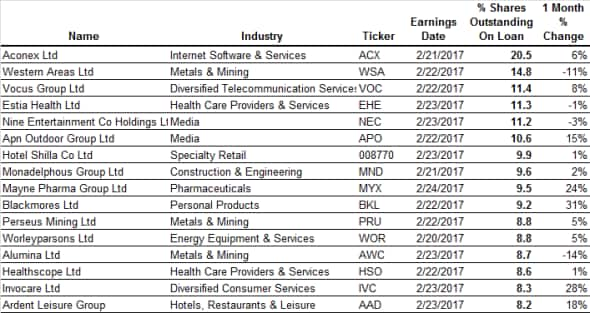

Australian firms make up the vast majority of heavily shorted Asian names announcing earnings this week.

This list is led by software firm Aconex which has a fifth of its shares now out on loan to short sellers. Short sellers started to target Aconex in August of last year when investors first started to raise questions about the firms' sky high valuation. This scepticism was rewarded last month when Axonex shares lost over 40% of their value as the company trimmed its growth guidance. Short sellers have since stayed put despite the fact that Aconex shares have more than halved in the last six months.

Mining firms continue to feature heavily on the list of favourite short targets and this week is no exception as Western Areas, Perseus Mining and Alumina all make the list of heavily shorted stocks announcing earnings.

The only non-Australian firm to make this week's list of heavily shorted companies announcing earnings is Korean hotel and duty free operator Hotel Shilla which has a tenth of its shares out on loan. The latter of the Hotel Shilla's two main business lines has been the largest cause for concern after the Korean government opened up the market to new entrants. This new competition has knocked over a third off the value of Shilla's shares in the last 12 months.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20022017-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20022017-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20022017-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20022017-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20022017-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}