Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 21, 2017

European short sellers join global covering

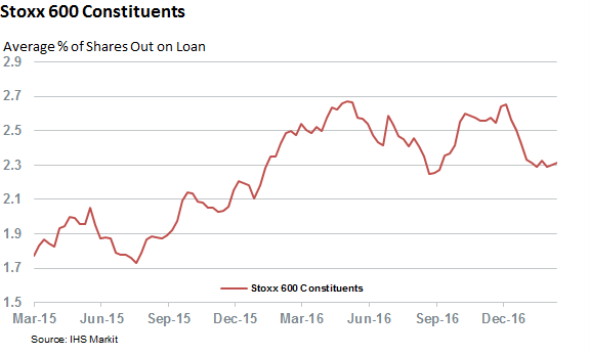

Borrow demand across Stoxx 600 constituents has atrophied to a four month low since January 1st.

- Average short interest across Stoxx 600 constituents down by 10% in 2017

- Norway now most shorted market in Europe after skipping the trend

- Pearson, Marks and Spencer see rising short interest this year to date

The wave of short covering that has swept up US and UK equities in the last three months has reached the shores of mainland Europe. The relatively high level near term political and economic uncertainty hasn't inspired short sellers as the Markit Securities Finance data base has witnessed a 10% decrease in the average demand to borrow constituents of the Stoxx 600.

The current average short interest across the index now sits at 2.3% of shares outstanding which is the lowest average registered since September of last year. This sustained wave of short covering marks a stark contrast to that seen in the opening weeks of last year when short sellers were busy building their positions to multi-year highs following the commodities slump.

No one market has been responsible for this covering given that the average demand to borrow has fallen across 11 of the 15 countries which make up the index. Spanish stocks have seen the largest fall overall in short interest as short sellers covered a fifth of their positions on average.

France, where the political waters are the murkiest, has also been swept up by this wave of short covering as the country's 83 constituents which feature in the index have seen an 11% decrease in demand to borrow their shares since early January. This covering means that the French stocks which feature in the Stoxx 600 now see roughly a fifth less shorting activity on average than the wider index.

Norway tied for most shorted

One key exception from the covering is Norway, where the 10 constituents which feature in the Stoxx 600 have seen a slight increase in demand to borrow over the last six weeks. Running against the tide ensures that Norway is now tied with its Scandinavian neighbor Sweden as the most shorted country in the Stoxx 600. Both countries now have 3% of their shares out on loan on average. This is a tenth more than Italian shares which are the third most shorted constituents of the Stoxx 600.

Norway's current high conviction short positions include Marine Harvest which has 8.3% of its shares out on loan and Subsea 7 with 10%. It's worth noting that both firms have convertible bonds outstanding which means that a large part of the borrow demand is most likely to be driven by arbitrage driven investors as opposed to those betting against both firms' share price.

Some firms buck the trend

While Norway is the only market level holdout, short sellers have been getting increasingly active in several single names over the last few weeks.

One such name is Air France KLM which has experienced a doubling in the demand to borrow its shares. This ultimately proved to be a losing bet for short sellers however as the airline's shares surged dramatically after the company announced better than expected earnings.

Short sellers have also increased their positions in several of the index's UK constituents. Publisher Pearson, which released a disastrous profit warning that knocked 30% off the value of its shares, and retailer Marks and Spencer which has had to content with headwinds in the UK retail space, have been the favorite short targets so far this year. Short sellers have borrowed increased their short bets in both firms by over 3% year to date which means that Pearson now sees 9.5% of its shares shorted while its retail compatriot has 6.7%.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21022017-Equities-European-short-sellers-join-global-covering.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21022017-Equities-European-short-sellers-join-global-covering.html&text=European+short+sellers+join+global+covering","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21022017-Equities-European-short-sellers-join-global-covering.html","enabled":true},{"name":"email","url":"?subject=European short sellers join global covering&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21022017-Equities-European-short-sellers-join-global-covering.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=European+short+sellers+join+global+covering http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21022017-Equities-European-short-sellers-join-global-covering.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}