Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 19, 2016

UK labour market shows signs of cooling, households grow gloomier

The UK labour market showed only mild signs of cooling over the summer, but surveys suggest the slowdown has further to run.

The latest batch of data from the Office for National Statistics showed employment continuing to rise at a solid pace, with a net 106,000 new jobs added in the three months to August. However, this is down from prior readings of over 170,000. Furthermore, the number of people unemployed edged up by 10,000 over the same period, marking the first rise in joblessness since the three months to February. The more timely claimant count measure of unemployment also ticked higher by 700 in September to reach its highest since last November.

Although the headline unemployment rate held steady at a near 11-year low of 4.9% in the three months to August, the one-month measure moved up to 5.0%. It's generally unwise to read too much into the single month figures, but the upward move in August adds to the sense that the labour market has begun to cool slightly.

Surveys have also indicated a waning in the hiring trend recently, and suggest that we're likely to see a more severe weakening of the official labour market data in coming months.

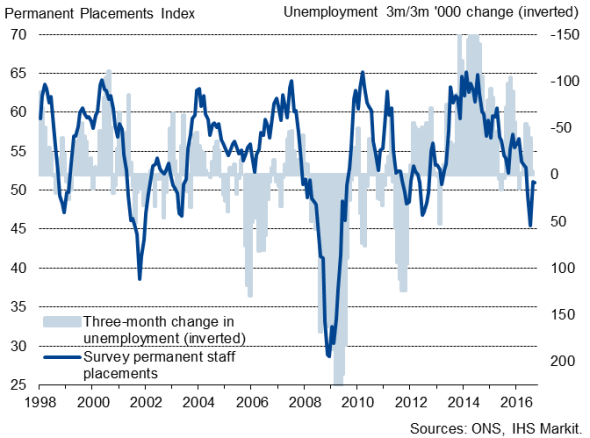

The REC recruitment industry survey shows the number of people placed in permanent jobs by agencies has either fallen or risen only modestly in recent months. The respective index is at a level consistent with unemployment rising (see chart), albeit rebounding somewhat in September from the low seen in July.

Recruitment activity and unemployment

Similarly, PMI survey data indicate that employment growth remains stunted compared to earlier in the year amid widespread anxiety about committing to new hires given the uncertain political and economic outlook.

Gloomier households

The latest survey on household finances (providing the first insight into trends in October), also published today, meanwhile showed a gloomier mood developing, especially among those working in the private sector, linked to a cocktail of inflation worries, weaker income growth and rising job insecurity.

The survey data showed expectations of future prices rising in October to the highest since December 2014, suggesting inflation is anticipated to rise further from the 1.0% rate recorded in September.

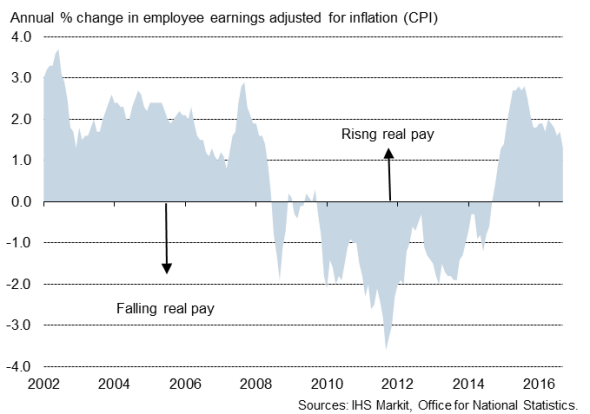

The worry is that rising inflation will erode already-weak earnings growth. The latest official data showed average weekly earnings rising at an annual rate of just 2.3% in the three months to August.

Inflation adjusted 'real' pay growth

Pay growth is likely to come under increasing pressure in coming months, meaning inflation-adjusted pay could soon start falling, perhaps as early as the opening months of 2017.

Employers are likely to seek ways to offset the rising costs of imports resulting from the pound's recent slide. Cutting pay (and potentially also jobs) is therefore likely to be high on the agenda if the exchange rate remains weak.

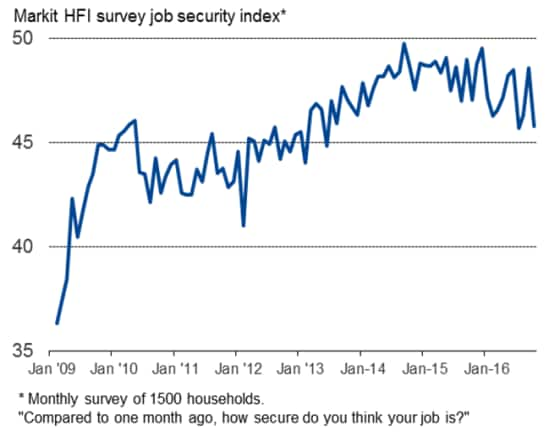

Employees are meanwhile already starting to feel less secure in their jobs, which will inevitably dampen workers' pay-negotiating powers. The survey data showed private sector job security falling back to its second-lowest in over three years in October, almost matching the low seen in July in the immediate aftermath of the Brexit vote.

Private sector job security

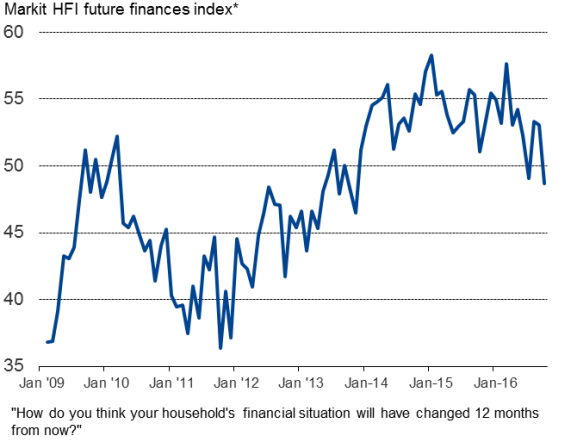

The combination of a weakened labour market, rising inflation and sluggish pay growth looks set to squeeze living standards and consumer spending in coming months, effectively removing one of the major supports to economic growth so far this year and leaving the economy vulnerable to a further slowdown.

Private sector view on future finances

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19102016-Economics-UK-labour-market-shows-signs-of-cooling-households-grow-gloomier.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19102016-Economics-UK-labour-market-shows-signs-of-cooling-households-grow-gloomier.html&text=UK+labour+market+shows+signs+of+cooling%2c+households+grow+gloomier","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19102016-Economics-UK-labour-market-shows-signs-of-cooling-households-grow-gloomier.html","enabled":true},{"name":"email","url":"?subject=UK labour market shows signs of cooling, households grow gloomier&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19102016-Economics-UK-labour-market-shows-signs-of-cooling-households-grow-gloomier.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+labour+market+shows+signs+of+cooling%2c+households+grow+gloomier http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19102016-Economics-UK-labour-market-shows-signs-of-cooling-households-grow-gloomier.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}