Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 18, 2017

US manufacturing trend weakens in line with PMI

Official data showed US manufacturers continuing to struggle in August, in line with earlier survey data from IHS Markit. Output fell 0.3% since July, according to Federal Reserve data, and has only eked out one rise in the past four months.

In the latest three months, factory output has risen just 0.2%, unchanged on the meagre rate of expansion recorded in the three months to July, which was in turn the worst seen since November of last year.

The August decline came in below market expectations of a 0.3% increase in production, but the weakness had been signalled ahead by the output index from the IHS Markit PMI survey.

At the start of the month we had reported how the August IHS Markit survey had translated into disappointing signals for official data. A simple regression analysis using the PMI's Output Index to explain changes in official data indicated that the 14-month low seen in August took the survey index down to a level historically consistent with output (as measured by the Fed) falling at a quarterly 0.3% rate.

Not just hurricane impact

The survey data also suggest that September could also disappoint.

The August drop in production could in part be attributed to factories and supply chains being hit by hurricane disruption. The official data showed that production of chemicals and petrol and fuel products was down sharply. These are sectors that were especially exposed to hurricane Harvey.

However, PMI survey responses also highlighted how the recent weakness of production is not solely due to the hurricane disruption.

In particular, responding companies also reported an ongoing plight to win export sales in the face of the strong dollar. Export order volumes were broadly stagnant for a second successive month. The latest IHS Markit PMI New Orders Index reading consequently pointed to an approximate stalling in the official data relating to both factory orders and durable goods orders.

Contrasting survey signals

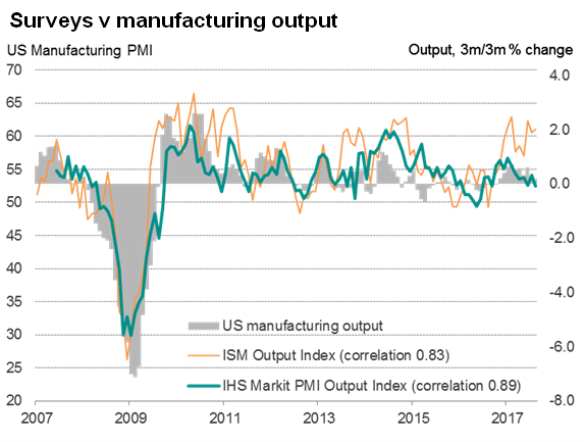

The weak production trends recorded by the recent official and IHS Markit PMI data contrast with strong expansions registered by ISM survey data. The ISM Output Index rose to 61.0 in August, indicating one of the strongest monthly expansions seen over the past six-and-a-half years. The ISM index has been booming above 60 in the last three months, contrasting with the 0.2% gain in production that has actually been eked out by manufacturers over this period and the near-stalling seen in the IHS Markit data.

Once again, the more accurate signal from the IHS Markit data is no fluke: over the past decade the series has exhibited an 89% correlation with the three-month change in the official manufacturing output data. The same correlation is seen with the PMI acting with a one-month lead. The equivalent index from the ISM exhibits a lower 83% correlation over the same period, dropping to 77% when acting with a one-month lead.

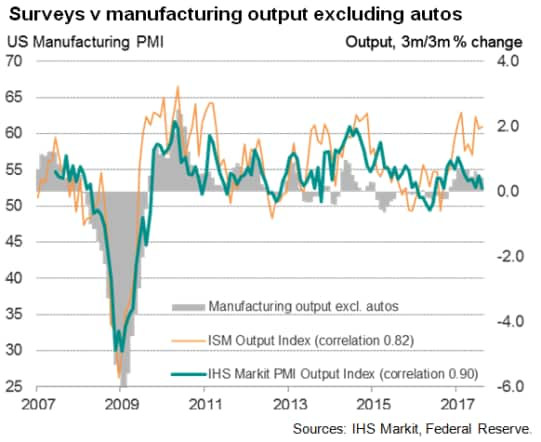

If the auto sector is excluded (in which post-financial crisis financial incentives distorted the underlying manufacturing trend compared to the surveys), the correlation with the IHS Markit PMI data rises to 90%, but drops to 82% for the ISM.

Flash PMI data will be updated by IHS Markit on September 22nd, providing a more comprehensive view of economic trends in the third quarter and the impact of the hurricanes.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18092017-economics-us-manufacturing-trend-weakens-in-line-with-pmi.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18092017-economics-us-manufacturing-trend-weakens-in-line-with-pmi.html&text=US+manufacturing+trend+weakens+in+line+with+PMI","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18092017-economics-us-manufacturing-trend-weakens-in-line-with-pmi.html","enabled":true},{"name":"email","url":"?subject=US manufacturing trend weakens in line with PMI&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18092017-economics-us-manufacturing-trend-weakens-in-line-with-pmi.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+manufacturing+trend+weakens+in+line+with+PMI http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18092017-economics-us-manufacturing-trend-weakens-in-line-with-pmi.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}