Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 18, 2017

UK household finances under greatest pressure for three years

Recent months have seen UK household finances deteriorate at the steepest rate for three years, with a renewed downward lurch in September likely to mean consumer spending will remain subdued.

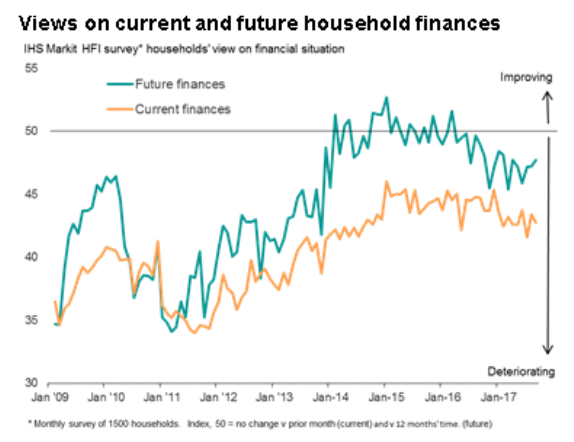

The IHS Markit Household Finance Index" (HFI"), which is intended to anticipate changing consumer behaviour accurately and is the first consumer survey published each month, registered 42.8 in September, down from 43.4 in August. The average index reading dropped to 42.6 in the third quarter, which was the lowest since the third quarter of 2014.

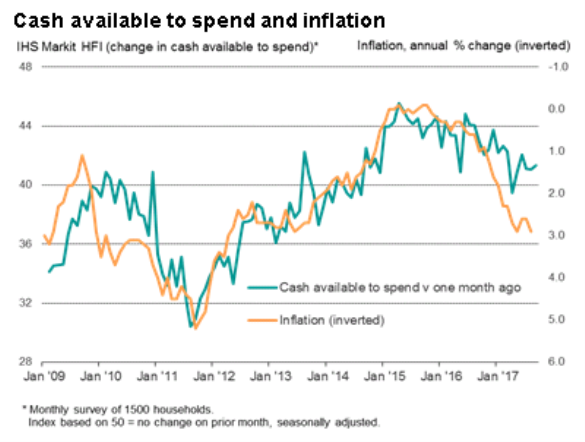

The strain on household finances comes at a time when inflation is rising faster than pay, pointing to falling real wages, and economic growth has slowed.

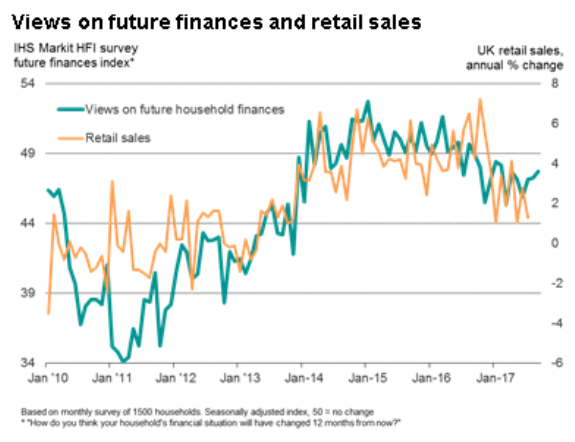

The amount of cash available to spend consequently continued to fall in September at one of the steepest rates seen over the past three years. Such a decline points to further downward pressure on consumer expenditure and retail sales. However, spending was reported to have risen again, and at an increased rate, fuelled by a combination of modest growth of income from employment and reduced savings.

Recent months have in fact seen income from employment rise to the greatest degree since the financial crisis, albeit still only modestly. However, it should be noted that such income will be affected by the amount of work done (hours worked and overtime, etc.) so will not necessarily signal an improvement in wage growth.

Gloomy outlook

The subdued picture looks unlikely to change any time soon. While pessimism about future finances eased somewhat in September, sentiment about the financial outlook remained among the gloomiest seen over the past three-and-a-half years. Worries about future inflation also remained elevated, suggesting rising prices will continued to eat into families' spending power.

The trend of spending being supported by people eating into their savings is also clearly not sustainable in the long-run.

Rate hike impact

The survey data were collected between the 6th and 11th September, before the ONS reported that inflation spiked higher to 2.9% and before the Bank of England stepped-up its rhetoric regarding the potential need for higher interest rates.

With the Bank of England sounding increasingly eager to start hiking interest rates, the prospect of higher borrowing costs and increased mortgage payments is likely to hit households further. The survey showed that the amount of cash that families have available to spend is already falling sharply - dropping in the third quarter at one of the steepest rates since 2014.

On the other hand, an interest rate hike will of course benefit savers and have a positive impact on living costs if tighter policy helps bring future inflation down.

The worry is that policy changes take a while to feed through to inflation, meaning in the short-term a rate hike may exacerbate the current squeeze on household finances, subduing spending further and jeopardising already lackluster economic growth.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18092017-Economics-UK-household-finances-under-greatest-pressure-for-three-years.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18092017-Economics-UK-household-finances-under-greatest-pressure-for-three-years.html&text=UK+household+finances+under+greatest+pressure+for+three+years","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18092017-Economics-UK-household-finances-under-greatest-pressure-for-three-years.html","enabled":true},{"name":"email","url":"?subject=UK household finances under greatest pressure for three years&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18092017-Economics-UK-household-finances-under-greatest-pressure-for-three-years.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+household+finances+under+greatest+pressure+for+three+years http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18092017-Economics-UK-household-finances-under-greatest-pressure-for-three-years.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}