Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 17, 2014

UK households buoyed by revived wage growth and falling inflation

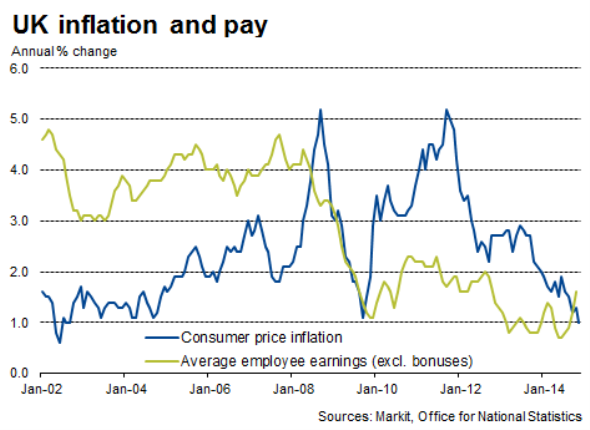

Wage growth is picking up, highlighting how a further improvement in the labour market is feeding through to the benefit of households. Real regular pay, excluding bonuses but taking inflation into account, is rising for the first time since September 2009.

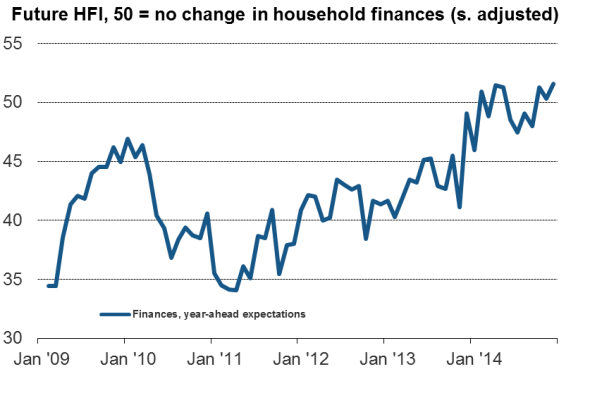

The combination of lower inflation, being busier at work and feeling more secure in terms of employment means households' views on the outlook for their finances has risen to a post-recession high in December, according to Markit's Household Finance Index, also released today.

Household optimism on future finances

Faster pay and the improved outlook for household finances will add to pressure on policymakers to start the process of lifting interest rates off the current all-time low.

The latest minutes from the Bank of England's Monetary Policy Committee remained split on the appropriate policy course, with Martin Weale and Ian McCafferty again voting to take an early pre-emptive hike in interest rates, though others saw lower oil prices adding to the case for rates to remain on hold.

Although inflation is set to fall further in coming months, having already dropped to 1.0% in November, that won't necessarily stop interest rates from rising next year. Instead, it is likely that a gradual recovery of wages growth over the next year will be a key factor persuading increasing numbers of policymakers that it is appropriate to start the process of bringing interest off current emergency record low levels.

However, what's important to note is that the additional downward pressure on inflation from lower oil and commodity prices reinforces the view that interest rates will rise only very gradually, even if wage growth surprises to the upside next year.

Real-terms pay growth

Excluding bonuses, regular pay was up 1.6% on a year ago in the three months to October, up from 1.2% in the three months to September and the strongest rise for two years, according to the Office for National Statistics. The improvement means real pay rose by 0.3%, its fastest rate of increase since September 2009.

Including bonuses, pay was up 1.4% against a 1.0% rise in the three months to September, likewise beating inflation.

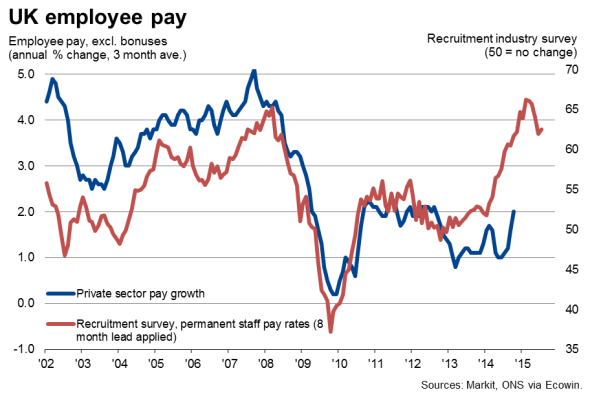

Private sector pay excluding bonuses was up 2.0% in the three months to October compared to 1.6% in the three months to September, enjoying the strongest rise for just over two years. Public sector pay growth lagged behind at 0.9%.

Note that the headline rate of growth of regular private sector pay in the three months to October, at 2.0%, in fact masked a steep upturn in the single month rate of pay growth from 1.4% in August to 2.3% in October.

Labour market showing signs of cooling

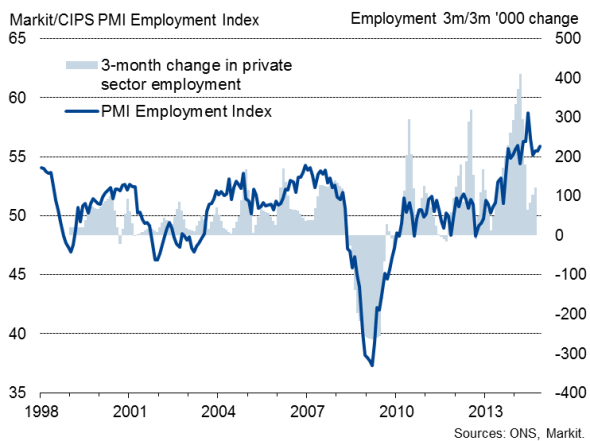

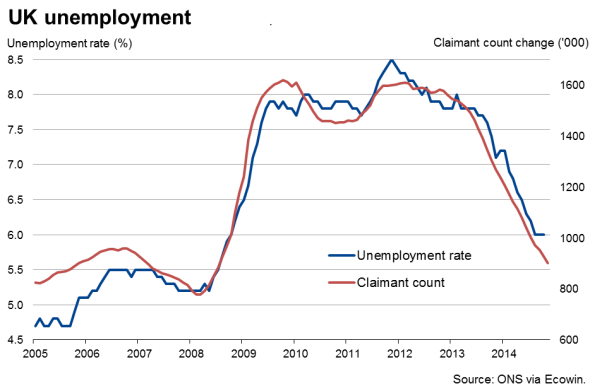

Survey data suggest the labour market improvement continued into November, with recruitment consultants reporting further strong growth of hiring and ongoing upward pressure on starting salaries as the job market tightened. The PMI surveys likewise indicated another strong month of payroll growth at UK companies.

UK employment growth (private sector)

However, both the PMI and the recruitment survey suggest that the pace of hiring has waned compared to earlier in the year, in line with signs of slower economic growth. This easing is being confirmed by the official data, which showed employment rising by 115,000 in the three months to October, the rate of job creation having slowed from a recent peak of over 300,000 in the three months to April.

Similarly, the rate of unemployment meanwhile remained unchanged at 6.0% in the three months to October, and the 63,000 fall in the number of unemployed was in fact the smallest decline since the third quarter of 2013.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17122014-Economics-UK-households-buoyed-by-revived-wage-growth-and-falling-inflation.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17122014-Economics-UK-households-buoyed-by-revived-wage-growth-and-falling-inflation.html&text=UK+households+buoyed+by+revived+wage+growth+and+falling+inflation","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17122014-Economics-UK-households-buoyed-by-revived-wage-growth-and-falling-inflation.html","enabled":true},{"name":"email","url":"?subject=UK households buoyed by revived wage growth and falling inflation&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17122014-Economics-UK-households-buoyed-by-revived-wage-growth-and-falling-inflation.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+households+buoyed+by+revived+wage+growth+and+falling+inflation http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17122014-Economics-UK-households-buoyed-by-revived-wage-growth-and-falling-inflation.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}