Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 17, 2014

Factory output growth trend fades at start of fourth quarter in the US

The latest data on the health of US factories show ongoing expansion at the start of the fourth quarter, but the data also add to signs that the pace of economic growth is waning as we move towards the end of the year. Combined with a weakening of inflationary pressures, the slowing trend in the economy suggests that policymakers may increasingly feel that there is no rush to raise interest rate.

Production falls after September jump

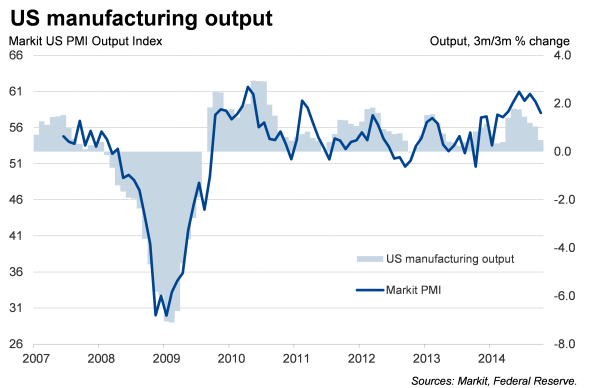

Industrial production fell 0.1% in October after a 0.8% increase in September, which was revised down from an initial estimate of 1.0%, according to official data compiled by the Federal Reserve.

Manufacturing output rose 0.2% after a similar increase in September. Worryingly, motor vehicle production fell by 1.2%, adding to strong declines seen in previous recent months.

Slowing trend

The change over the latest three month period, which gives a better idea of the underlying trend than the volatile monthly data, shows industrial production 0.8% higher in the three months to October, unchanged on the increase seen in the second quarter and still indicative of reasonably robust growth. However, that compares with a 1.4% rise in the second quarter and 1.0% growth in the first three months of the year.

More worrying is the manufacturing trend, which shows output up just 0.5% in the latest three months, its weakest performance since bad weather caused the sector to record a mere 0.4% increase in the first three months of the year. Manufacturing output rose 1.5% and 1.0% in the second and third quarters respectively, and even the latter looks unlikely to be matched in the fourth quarter.

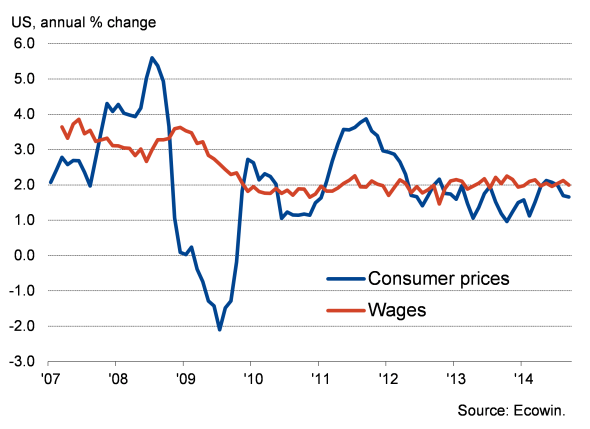

Policymakers to show caution amid signs of slowdown and lower inflation

While the data add to signs that the US economy continues to grow, the pace of expansion has cooled, and possibly to an extent that may start to worry policymakers.

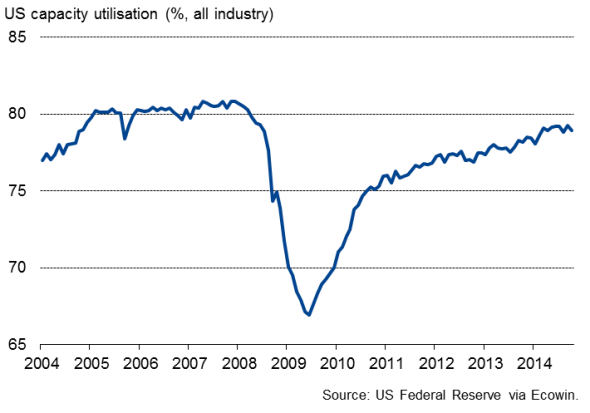

The drop in production caused capacity utilisation to slip from 79.3% in September to 78.9% and still below its long-run average. Manufacturing capacity utilisation slipped from 77.3% to 77.2%. Spare capacity is a key gauge of future inflation trends and therefore the timing and pace of interest rate hikes.

Capacity utilisation

At present the markets are pricing in mid-2015 as the most likely date of the first rate rise. However, with inflation down to 1.7% and likely to fall further, wage growth running at a lacklustre 2% and the economy showing signs of slowing, we may see more analysts pushing back their rate hike expectations into the second half of next year.

Wages and inflation

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17112014-Economics-Factory-output-growth-trend-fades-at-start-of-fourth-quarter-in-the-US.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17112014-Economics-Factory-output-growth-trend-fades-at-start-of-fourth-quarter-in-the-US.html&text=Factory+output+growth+trend+fades+at+start+of+fourth+quarter+in+the+US","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17112014-Economics-Factory-output-growth-trend-fades-at-start-of-fourth-quarter-in-the-US.html","enabled":true},{"name":"email","url":"?subject=Factory output growth trend fades at start of fourth quarter in the US&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17112014-Economics-Factory-output-growth-trend-fades-at-start-of-fourth-quarter-in-the-US.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Factory+output+growth+trend+fades+at+start+of+fourth+quarter+in+the+US http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17112014-Economics-Factory-output-growth-trend-fades-at-start-of-fourth-quarter-in-the-US.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}