Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 17, 2016

US industry sees signs of renewed life in third quarter

Signs of the health of the US manufacturing sector improving in September add to indications that the economy has gained some growth momentum in the third quarter, further fuelling suggestions that the Fed looks poised to hike rates later in the year.

Industrial production rose 0.1% in September, according to data from the Federal Reserve. The narrower gauge of manufacturing output, which excludes the struggling energy sector, indicated that factory output was up 0.2%.

The improvements represent a modest rebound from 0.5% declines in both industrial production and manufacturing output in August. The upturn in industrial production also means the sector grew 0.4% in the third quarter, pulling out of a downturn that started in the fourth quarter of last year.

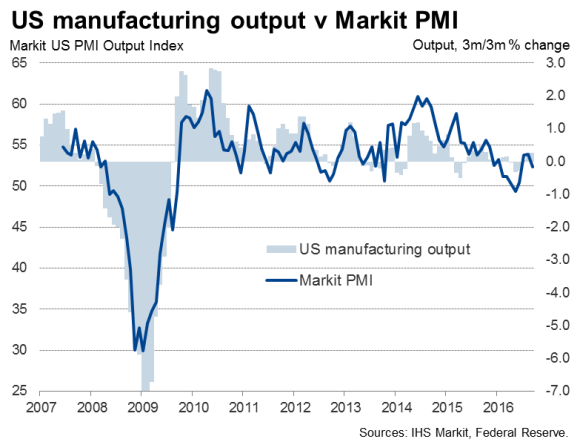

Manufacturing output was up 0.3% over the third quarter as a while, reversing the 0.3% decline seen in the second quarter. The improvement corroborates manufacturing PMI surveys, which also showed the goods-producing sector enjoyed its best quarter so far this year.

However, growth clearly remains weak, with producers under pressure from the strong dollar. The September survey recorded the smallest rise in new orders of 2016 to date, with export orders in decline.

The production data also follow mixed news from the retail sector. Total retail sales rose 0.6% in September, but core sales, which strip out erratic items and tend to give a better guide to underlying consumer spending, showed a meagre 0.1% increase, finishing the worst quarter for just over three years.

The overall picture from the industrial production numbers and the retail sales reports is therefore one of the economy perhaps picking up some steam but once again only mustering modest growth in the third quarter. IHS Markit's PMI surveys also suggest the pace of economic growth remained subdued in the third quarter, similar to the 1.0-1.5% annualised pace seen in the first half of the year.

With minutes from the September Fed meeting highlighting how the decision to hike rates or stay put was a 'close call', the data will do little to alter expectations that policy will be tightened in December. The news that industry is pulling out of its downturn will boost the case of the hawks. However, the underlying weak pace of economic growth signalled for the third quarter will support the case for policy to be held steady until the economy shows more convincing signs of generating significant inflationary pressures, meaning the December hike is by no means a done deal.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17102016-Economics-US-industry-sees-signs-of-renewed-life-in-third-quarter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17102016-Economics-US-industry-sees-signs-of-renewed-life-in-third-quarter.html&text=US+industry+sees+signs+of+renewed+life+in+third+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17102016-Economics-US-industry-sees-signs-of-renewed-life-in-third-quarter.html","enabled":true},{"name":"email","url":"?subject=US industry sees signs of renewed life in third quarter&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17102016-Economics-US-industry-sees-signs-of-renewed-life-in-third-quarter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+industry+sees+signs+of+renewed+life+in+third+quarter http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17102016-Economics-US-industry-sees-signs-of-renewed-life-in-third-quarter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}