Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 17, 2014

UK unemployment drops to 6.2%, but MPC shows no rush to raise rates

UK unemployment continued to fall in July, but wage growth remained stuck at an all-time low. There was little therefore in the latest official labour market report that will worry most policymakers into hiking interest rates. If anything, although revealing that two of the nine policymakers comprising the Bank of England Monetary Policy Committee again voted to raise interest rates, the minutes from the Bank's September MPC meeting suggest that policymakers have grown increasingly worried about the economic outlook.

The latest data from the Office for National Statistics showed the rate of unemployment falling from 6.4% in the second quarter to 6.2% in the three months to July, its lowest since late-2008. The more up-to-date but narrower measure of claimant count unemployment also fell sharply again in August, down by 37,000, to suggest that the headline unemployment rate will continue to fall in August.

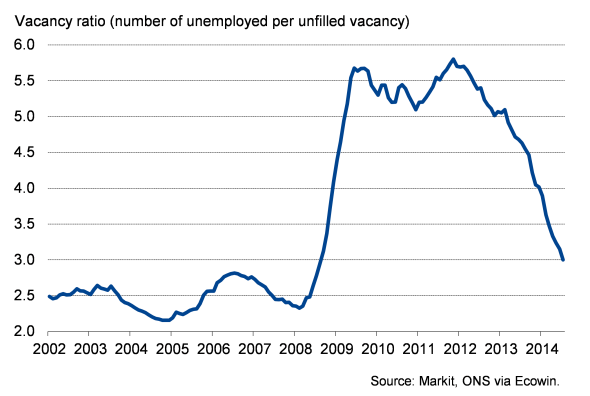

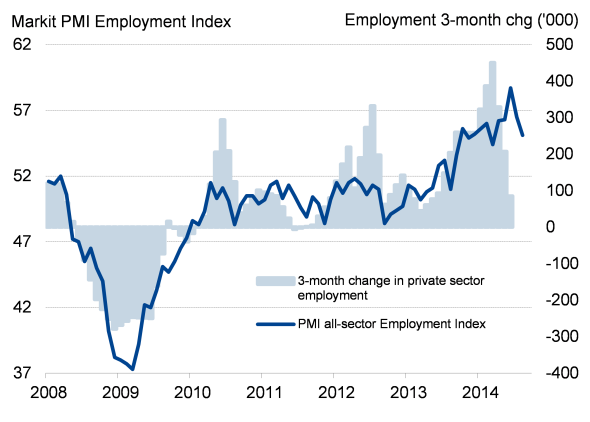

Employment meanwhile rose by 74,000 in the three months to July, which represents the smallest increase for a year but nevertheless is still a respectably strong gain. Other data sources, such as the monthly recruitment industry survey, pointed to continued buoyancy of demand for staff in August and suggest that any downturn in the rate of hiring may be due, at least in part, to growing skill shortages rather than a reticence to take on extra staff. The vacancy ratio also points to a tightening labour market. The number of people unemployed per unfilled vacancy now stands at 3.0, down from 5.1 at the start of last year.

Private sector employment

Vacancy ratio

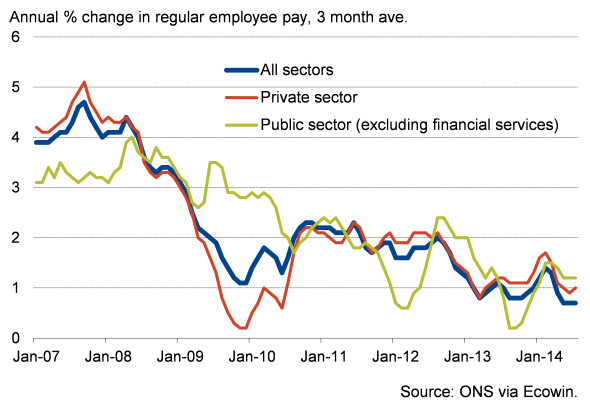

However, the missing element of the recovery remains pay growth, which is now seen as the main driver of policy. Regular pay rose just 0.7% on a year ago in the three months to July, unchanged on the upwardly revised rate seen in the second quarter but still the lowest seen since records began in 2001.

Regular pay growth (excluding bonuses)

Pay including bonuses rose 0.6%, recovering from the 0.1% annual decline seen in the three months to June.

The majority of policymakers at the Bank of England will want to see pay rising in real terms before deeming higher interest rates appropriate. With inflation at 1.5% in August, the return of real pay growth (especially if bonuses are included) remains some way off, though will inevitably creep closer as we move towards the end of the year.

The minutes from the Bank of England's September Monetary Policy Committee confirmed that although two members, Martin Weale and Ian McCafferty, voted to hike interest rates to 0.75% for a second successive month, the other MPC members appear in no rush to raise interest rates. The minutes cited concerns over the recent weakness of the manufacturing sector (the sector's PMI fell to its lowest for over a year in August), ongoing worries about the eurozone and signs of the domestic housing market starting to cool. The MPC is also focusing on unit labour costs which, the minutes suggest, point to few worrying inflationary pressures building up.

While it seems possible that more will join the two MPC dissenters in coming months if wage growth picks up, it looks a long way to go before a majority on the MPC vote to raise interest rates.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17092014-UK-unemployment-drops-to-6-2-but-MPC-shows-no-rush-to-raise-rates.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17092014-UK-unemployment-drops-to-6-2-but-MPC-shows-no-rush-to-raise-rates.html&text=UK+unemployment+drops+to+6.2%25%2c+but+MPC+shows+no+rush+to+raise+rates","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17092014-UK-unemployment-drops-to-6-2-but-MPC-shows-no-rush-to-raise-rates.html","enabled":true},{"name":"email","url":"?subject=UK unemployment drops to 6.2%, but MPC shows no rush to raise rates&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17092014-UK-unemployment-drops-to-6-2-but-MPC-shows-no-rush-to-raise-rates.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+unemployment+drops+to+6.2%25%2c+but+MPC+shows+no+rush+to+raise+rates http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17092014-UK-unemployment-drops-to-6-2-but-MPC-shows-no-rush-to-raise-rates.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}