Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 17, 2015

Resurgent UK pay growth removes major barrier to higher interest rates

A surge in UK wage growth to a six-year high brings welcome news that the economic recovery is feeling through to pay packets, but also ups the odds of interest rates rising this year.

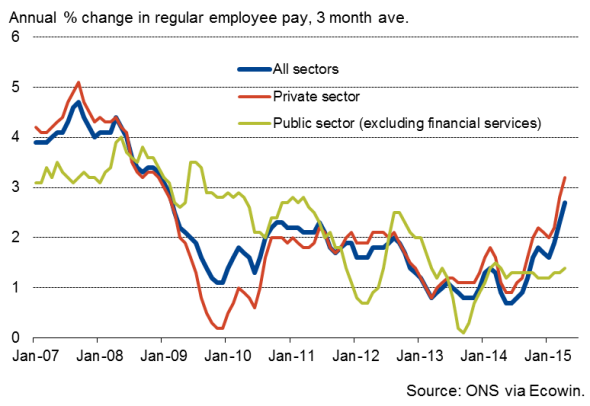

Regular pay was 2.7% higher than a year ago in the three months to April, up from 2.3% in the three months to March and its fastest rate of increase since early-2009. Including bonuses, the rate of increase also accelerated from 2.3% to 2.7%, according to the Office for National Statistics.

Annual pay growth

Tighter labour market

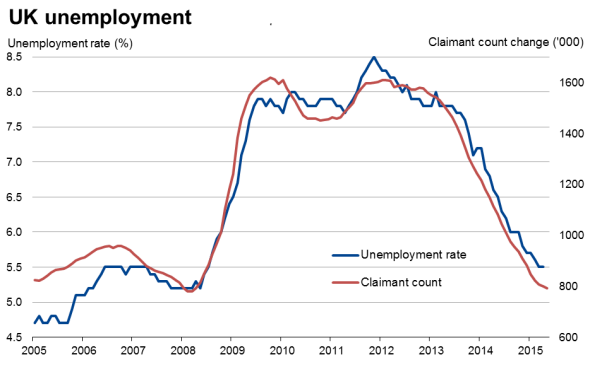

Wage growth is showing signs of reviving as the labour market continues to tighten. The unemployment rate stood at 5.5% in the three months to April, its lowest since 2008, as joblessness fell by 43,000.

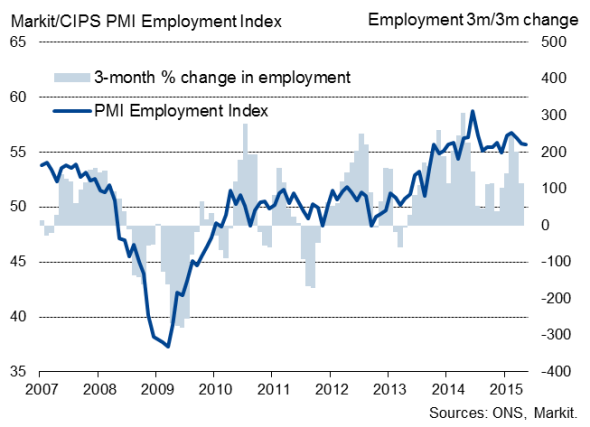

Employment increased by 114,000 in the latest three months, representing a slowing in the pace of job creation as the economy likewise slowed at the start of the year. Nevertheless, the employment rate rose to 74.3%. Business surveys also point to ongoing robust job creation in May.

Employment

Pay to worry policymakers

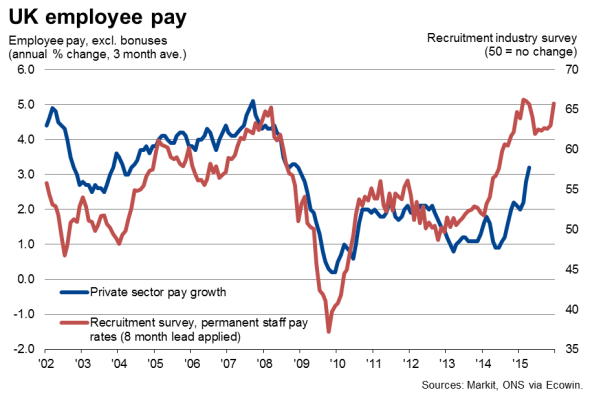

It's uncertain as to how much pay growth will continue to accelerate, as low inflation, currently running at just 0.1%, will hold down annual pay reviews. However, wage pressures have already built to an extent that would normally start to worry policymakers.

Private sector pay excluding bonuses rose at an annual rate of 3.2% in the three months to April, the best seen since 2008 (rates of 3.6% and 3.3% were seen in the single-month data for March and April, respectively). Service sector pay rose at an annual rate of 2.9% in the latest three months, the highest since early-2009, with a 3.6% rate seen in financial services and 3.9% in retail, hotels & restaurants.

Construction pay growth rose to a post-crisis high of 4.0%. Manufacturing pay growth lagged behind at 1.0%, though even here the pace has picked up markedly since the start of the year.

Rate hike pressure to build

Some policy makers will therefore be getting increasingly twitchy trigger fingers given the encouraging news on pay growth, and a chance of a rate hike this year has risen substantially.

The argument to hold off from raising rates will be led by calls that more time is needed to assess whether a recent slowdown seen across the economy is only temporary (linked to uncertainty surrounding the general election) or the precursor to a renewed weak patch (caused by the stronger pound and worries relating to issues such as Greece and the UK's position in the EU).

The implication is that, if the pace of economic growth revives, as widely expected, the recent upturn in pay takes away the main remaining argument to hold off with raising interest rates, and pressure to tighten policy looks set to build significantly as we move into the second half of the year.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17062015-economics-resurgent-uk-pay-growth-removes-major-barrier-to-higher-interest-rates.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17062015-economics-resurgent-uk-pay-growth-removes-major-barrier-to-higher-interest-rates.html&text=Resurgent+UK+pay+growth+removes+major+barrier+to+higher+interest+rates","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17062015-economics-resurgent-uk-pay-growth-removes-major-barrier-to-higher-interest-rates.html","enabled":true},{"name":"email","url":"?subject=Resurgent UK pay growth removes major barrier to higher interest rates&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17062015-economics-resurgent-uk-pay-growth-removes-major-barrier-to-higher-interest-rates.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Resurgent+UK+pay+growth+removes+major+barrier+to+higher+interest+rates http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17062015-economics-resurgent-uk-pay-growth-removes-major-barrier-to-higher-interest-rates.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}