Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 17, 2015

US core inflation upturn adds to rate hike pressure

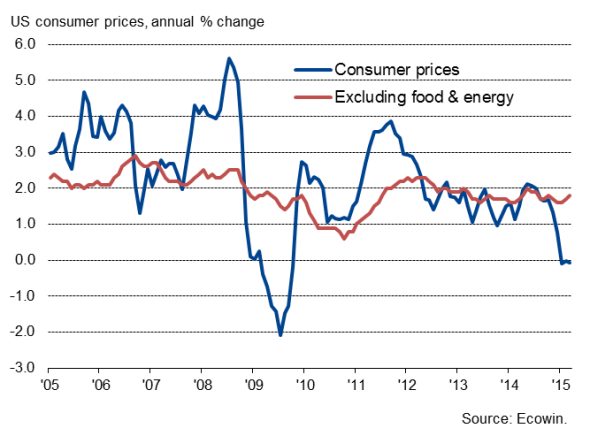

Headline US inflation fell to -0.1% in March from zero in February, but core inflation rose from 1.7% to a five-month high of 1.8%. While the fall in the headline rate is good news for households, the upturn in core inflation adds to the possibility of interest rates rising later this year.

Lower prices boost consumer mood

Headline consumer price inflation has fallen sharply due to the halving in the price of oil since last summer, and the drop in prices provides households with a meaningful boost their spending power, compensating for ongoing disappointing pay growth.

Consumer spending rose at a 4.6% annualized rate in the fourth quarter of 2014, its fastest rate of increase since 2006, but retail sales data turned down sharply at the turn of the year to hint at weaker economic growth as consumers reined in spending. However, sales picked up again in March, suggesting the drop in inflation (and lower fuel prices in particular) is helping drive consumer spending higher again, something which is supported by a sharp rise in the University of Michigan's consumer confidence index.

Worries about the damaging impact of deflation on demand are therefore looking overplayed. There is little evidence to suggest that lower prices are causing households to defer spending decisions, not least because the drop in inflation was linked to falling energy and food prices. Prices in fact rose for many items including motor vehicles, clothing and household furnishings. Core inflation, which excludes volatile food and energy prices, picked up slightly from 1.7% in February to a five-month high of 1.8%.

Rate hike pressure mounts

The upturn in the core rate will add to pressure on policymakers to start hiking interest rates this year rather than delaying any tightening of policy into 2016. Some hawkish FOMC members are already of the view that it would be appropriate to start hiking in June. Fed Chair Janet Yellen has stressed that the Fed only needs to feel confident that inflation is heading back towards to their 2% target to start the rate hiking process.

However, convincing other FOMC members may prove difficult amid worries that the slowdown of the economy in recent months may not be temporary, and that the higher exchange rate in particular is hurting corporate earnings, which will in turn hit economic growth and investment.

Much will therefore depend on whether the pace of economic growth shows signs of picking up again in the second quarter. In this respect, April's flash manufacturing and service sector PMI data, published 23rd and 27th April respectively, will provide the first insights.

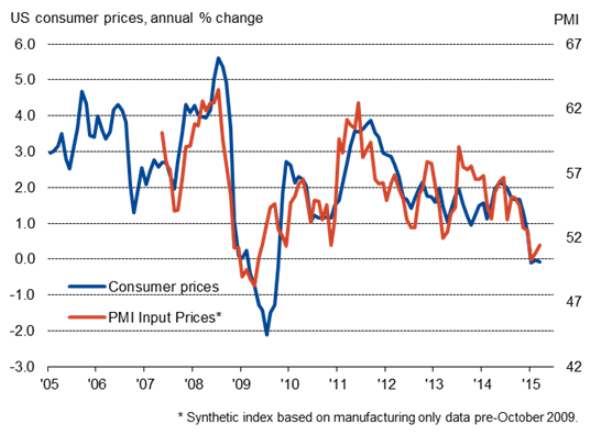

As well as be scoured for clues as to whether the economy is picking up speed again, the PMI reports will be watched for signs that the stronger dollar might be helping drive down import costs, which should therefore bear down on core inflation in coming months - a factor which may help delay any rate hikes even if the pace of economic growth shows signs of reviving.

Inflation

Inflation vs. Input Prices PMI

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17042015-economics-us-core-inflation-upturn-adds-to-rate-hike-pressure.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17042015-economics-us-core-inflation-upturn-adds-to-rate-hike-pressure.html&text=US+core+inflation+upturn+adds+to+rate+hike+pressure","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17042015-economics-us-core-inflation-upturn-adds-to-rate-hike-pressure.html","enabled":true},{"name":"email","url":"?subject=US core inflation upturn adds to rate hike pressure&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17042015-economics-us-core-inflation-upturn-adds-to-rate-hike-pressure.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+core+inflation+upturn+adds+to+rate+hike+pressure http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17042015-economics-us-core-inflation-upturn-adds-to-rate-hike-pressure.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}