Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 17, 2015

UK employment surges to all-time high, but weak pay growth remains a concern

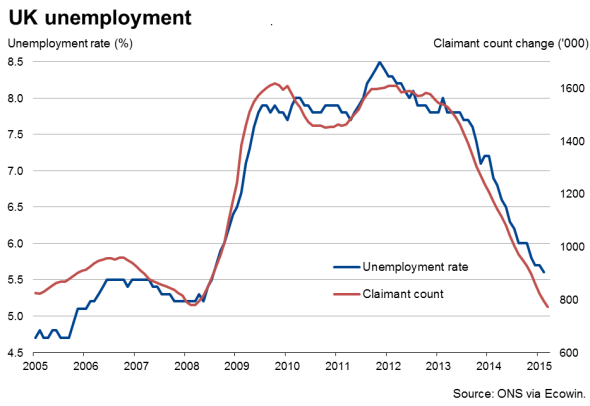

Employment has surged to an all-time high, and the unemployment rate has slipped to a near seven-year low, adding further evidence to suggest that the UK economy continued to grow strongly in the opening months of 2015.

However, weak wage growth remains the bug-bear of the economy, slowing further in the three months to February. The weakness of wage growth leaves the consumer-led economic upturn reliant on low inflation to drive household spending, posing a risk to growth if inflation picks up later this year.

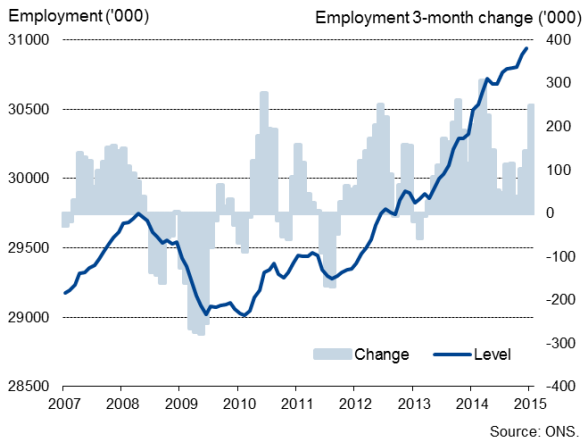

Employment at all-time high

Data from the Office for National Statistics showed that the rate of employment hit a record high of 73.4% in the three months to February. The number of people with jobs rose by 248,000, the largest increase for almost a year.

Employment

The number of unemployed meanwhile tumbled by 76,000 over the same period, pushing the jobless rate down to 5.6%, its lowest since the summer of 2008. A further 20,000 fall in the claimant count in March and strong demand for staff signalled by recruitment industry survey data suggest the jobless rate should continue to trend lower in coming months.

Wage growth slips

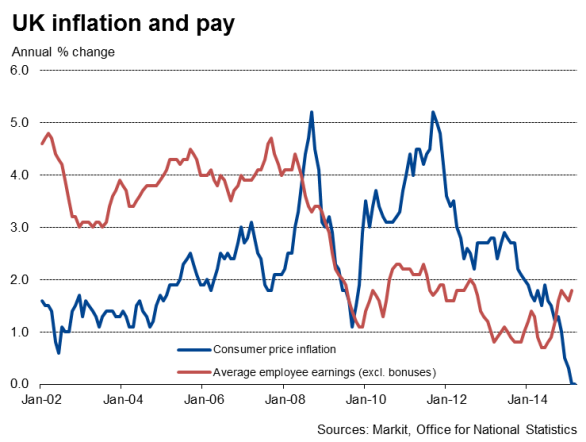

However, while employment and unemployment are improving, pay growth is moving in the wrong direction, most likely as a result of wage reviews reflecting the recent drop in inflation.

Average weekly earnings rose just 1.7% on a year ago in the three months to February, dropping further from 1.9% in the three months to January and 2.1% at the end of last year.

If bonuses are stripped out, the picture is somewhat brighter, with the rate of increase picked up from 1.6% to 1.8%, and rising to 2.2% in the private sector. These are the joint-highest rates of growth of regular pay seen since the third quarter of 2012.

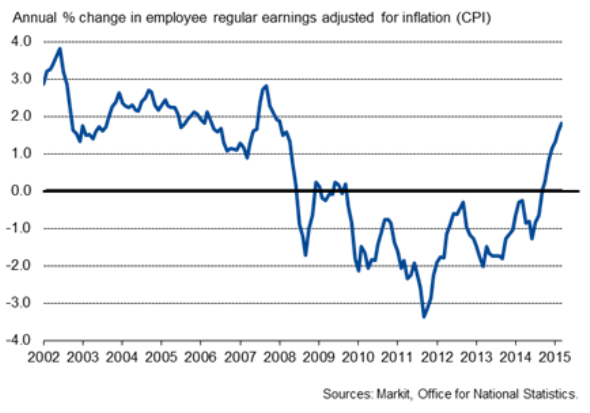

Furthermore, the recent tumbling of inflation to zero means that real regular pay growth (excluding bonuses) is at 1.8%, its highest since January 2008.

Real pay growth

The boost to spending power from the rise in real pay appears to be a big factor behind the country's ongoing economic upturn in recent months, as households are taking advantage of lower prices.

However, there are question marks over how long this boost to consumer spending power will last. An analysis of expected salary reviews suggest that employees are anticipating their pay to increase by an average of just 1.1% this year.

If inflation starts to pick up again, as is anticipated later this year, real pay growth could well slow again, acting as a dampener on consumer spending power and the wider economic upturn.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17042015-economics-uk-employment-surges-to-all-time-high-but-weak-pay-growth-remains-a-concern.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17042015-economics-uk-employment-surges-to-all-time-high-but-weak-pay-growth-remains-a-concern.html&text=UK+employment+surges+to+all-time+high%2c+but+weak+pay+growth+remains+a+concern","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17042015-economics-uk-employment-surges-to-all-time-high-but-weak-pay-growth-remains-a-concern.html","enabled":true},{"name":"email","url":"?subject=UK employment surges to all-time high, but weak pay growth remains a concern&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17042015-economics-uk-employment-surges-to-all-time-high-but-weak-pay-growth-remains-a-concern.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+employment+surges+to+all-time+high%2c+but+weak+pay+growth+remains+a+concern http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17042015-economics-uk-employment-surges-to-all-time-high-but-weak-pay-growth-remains-a-concern.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}