Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 17, 2016

UK pay growth remains subdued despite record vacancies and employment rate

The UK employment rate and number of job vacancies have risen to record highs, but the tightening labour market once again failed to drive up wages.

More recent survey data add to fears that low inflation is continuing to hold down pay growth in February, sending a dovish signal for central bank policy.

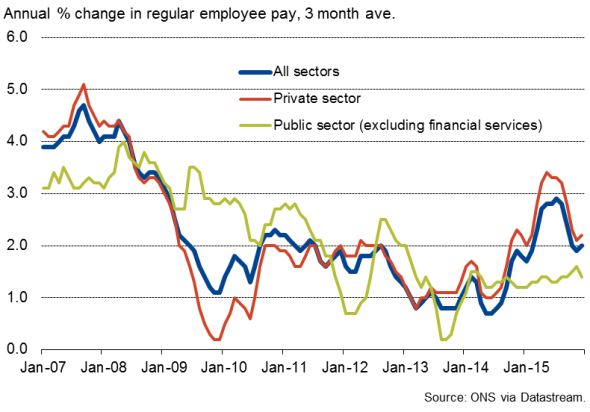

Annual pay growth, including bonuses, slipped from 2.1% to 1.9%, according to the Office for National Statistics, its lowest since last February. Although pay growth rose from 1.9% in the three months to November to 2.0% in the three months to December once bonuses are excluded, pay pressures clearly remain subdued by historical standards, especially given the current low rate of unemployment and strong demand for staff.

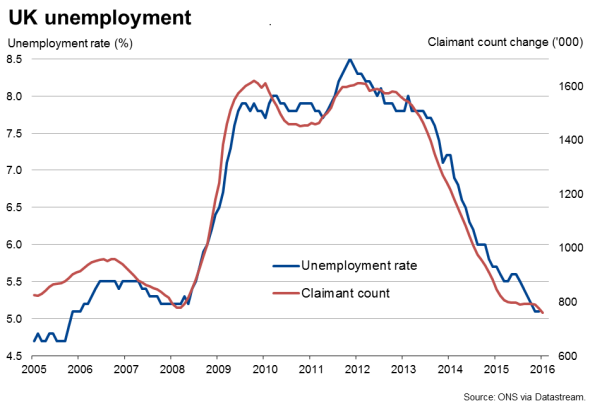

The jobless rate held steady at 5.1% in the three months to December, though that's still the lowest since the start of 2006. The employment rate meanwhile rose to 74.1%, the highest since comparable records began back in 1971.

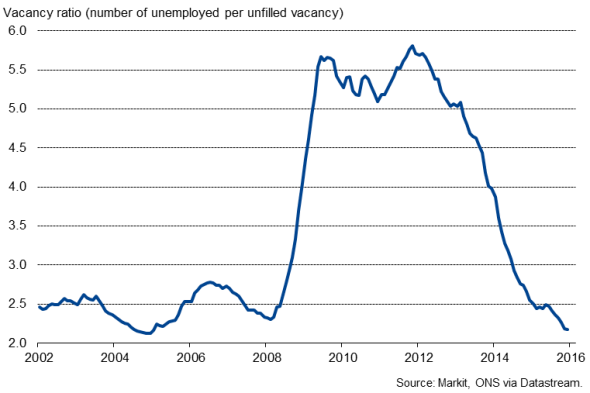

There were also 776,000 unfilled job vacancies in the three months to January, the highest since the series began in 2001. With only 1.69 million people unemployed, the jobless to vacancy ratio is the lowest for a decade.

Unemployed per vacancy

The fact that pay growth has failed to rise in such a tight job market remains one of the biggest concerns of the recovery, highlighting how economic growth is failing to feed through to average workers' incomes.

The weak pay data, alongside yesterday's news that consumer price inflation remained just 0.3%, supports the Bank of England's dovish view on inflation and interest rates. The concern is, however, that weak inflation is becoming entrenched into employee pay reviews, darkening the inflation outlook further and raising the likelihood of the next move by the Bank of England being more stimulus.

Survey data collected in mid-February showed a dramatic change in households' views on when interest rates are likely to start rising. The representative poll of 1,500 households showed the proportion of respondents expecting a hike in the next 12 months has dropped below 50% for the first time for over two years, plunging from 71% in January to 46% in February, its lowest since October 2013.

At 8%, the proportion expecting the Bank's next move to be an interest rate cut meanwhile edged up to the highest ever recorded by the survey which began in July 2013.

Pay

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17022016-Economics-UK-pay-growth-remains-subdued-despite-record-vacancies-and-employment-rate.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17022016-Economics-UK-pay-growth-remains-subdued-despite-record-vacancies-and-employment-rate.html&text=UK+pay+growth+remains+subdued+despite+record+vacancies+and+employment+rate","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17022016-Economics-UK-pay-growth-remains-subdued-despite-record-vacancies-and-employment-rate.html","enabled":true},{"name":"email","url":"?subject=UK pay growth remains subdued despite record vacancies and employment rate&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17022016-Economics-UK-pay-growth-remains-subdued-despite-record-vacancies-and-employment-rate.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+pay+growth+remains+subdued+despite+record+vacancies+and+employment+rate http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17022016-Economics-UK-pay-growth-remains-subdued-despite-record-vacancies-and-employment-rate.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}