Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 17, 2018

US PMI factory orders as a leading indicator of manufacturing output

- IHS Markit’s New Orders Index has been a more reliable indicator of official manufacturing output growth than official factory orders data

- The IHS Markit PMI also outperforms ISM data

For analysts wanting an advance guide to US durable goods orders, factory orders and manufacturing output, IHS Markit’s PMI survey New Orders Index offers valuable insight into the latest trends, exhibiting a correlation of 89% with official data.

Using orders to predict output

The Bureau of Census issues two monthly releases of manufacturing orders data: an advance report on orders for durable goods (items intended to last the user many years, such as automobiles and televisions) which is followed later in the month by a more complete picture of total factory orders. Durable goods orders are thought to be especially important, as orders for such goods may affect factory production in future months. Some are even made-to-order, so won’t be met from existing inventory stock.

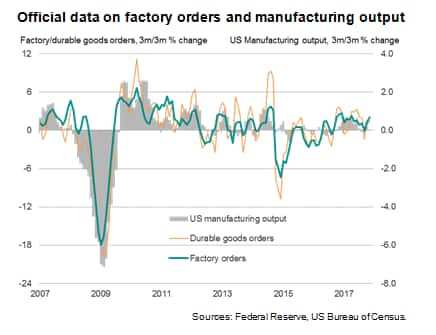

Importantly, durable orders are available ahead of official manufacturing production data from the Federal Reserve and, as our first chart below shows, the correlation with manufacturing output is indeed close. Over the last decade, durable goods orders and factory orders exhibit a correlation of 81% and 80% respectively, using a quarterly (or three-month-on-three-month) rate of change.

However, the predictive power of the Bureau of Census orders data over output is let down by a major false signal in 2014-2015, when orders data were far more volatile than official output data.

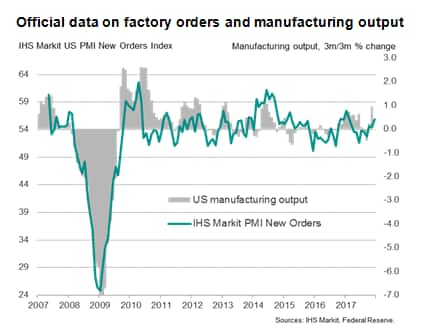

A more reliable indicator of output is in fact provided by IHS Markit’s PMI survey, from which the manufacturing New Orders Index has exhibited an 89% correlation with Federal Reserve manufacturing output data over the past decade. As with the Bureau of Census data, the fit from the PMI is weaker between 2014 and 2015, though the PMI survey appears to have a closer fit with the output series.

Predicting orders data

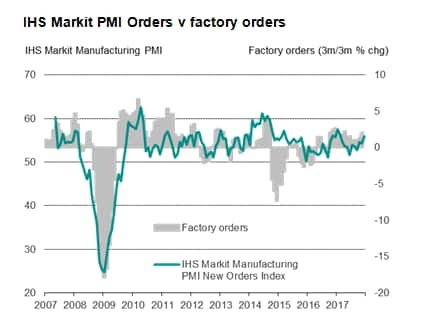

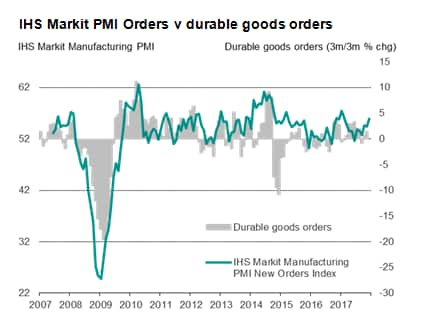

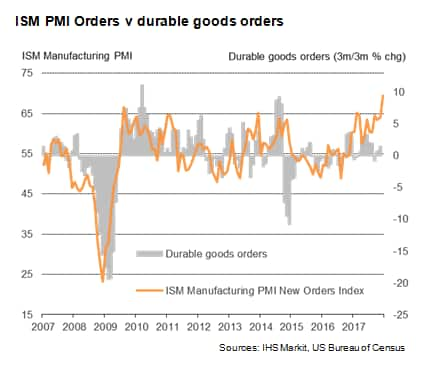

The PMI survey data can of course also be used to predict official factory orders and durable goods orders. The manufacturing PMI New Orders Index has exhibited a 76% correlation with both over the past ten years. The period 2014-2015 is notable in the disparities between the two series, with official data collapsing more than survey data. Excluding this period, the correlations rise to around 85%.

Factory orders

Durable goods orders

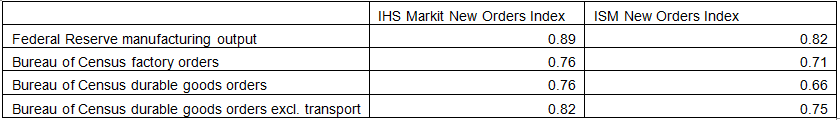

Survey v official data correlations

PMI monthly values compared with three-month change in official data, 2007-2017

Of note, the IHS Markit new orders data also enjoys a higher correlation with comparable official output, durable goods orders and factory orders than the ISM survey over the past ten years. Most striking has been the major divergence of the ISM data with official (and IHS Markit PMI) data through much of 2017, when the ISM numbers presented a far more buoyant picture of manufacturing than other sources. Note also that the volatile divergence between official orders data and survey data in 2014-2015 is also evident when compared with the ISM data

Chris Williamson, Chief Business Economist at IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17012018-US-PMI-factory-orders-manufacturing-output.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17012018-US-PMI-factory-orders-manufacturing-output.html&text=US+PMI+factory+orders+as+a+leading+indicator+of+manufacturing+output","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17012018-US-PMI-factory-orders-manufacturing-output.html","enabled":true},{"name":"email","url":"?subject=US PMI factory orders as a leading indicator of manufacturing output&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17012018-US-PMI-factory-orders-manufacturing-output.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+PMI+factory+orders+as+a+leading+indicator+of+manufacturing+output http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17012018-US-PMI-factory-orders-manufacturing-output.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}