Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 16, 2015

Japan flash PMI signals steady manufacturing upturn at year end

Japanese manufacturers enjoyed a solid end to the year, with activity growing at a rate close to November's 20-month high. The Nikkei Manufacturing PMI registered 52.5, down from 52.6 in November but remained comfortably above the 50.0 'no change' level, according to the preliminary 'flash' reading.

The average PMI reading for the fourth quarter is the highest since the first quarter of 2014, suggesting the sector is making a positive contribution to economic growth and that the economy is on a firm recovery path.

The relatively upbeat fourth quarter survey data follow recent revisions to GDP data, which now show the economy having expanded in the third quarter rather than succumbing to recession, in line with the brighter picture emanating from the PMI surveys.

Especially encouraging was an improvement in the rate of job creation in December to the highest since April 2014, as factories sought to boost production capacity in line with stronger demand.

Overall order books rose at a robust pace as the year came to an end, buoyed by a further solid gain in new export orders. Having slipped into decline in September, in line with a worsening in the official measure of exports, the PMI survey's export orders index has since signalled healthy overseas sales growth throughout the fourth quarter, linked to both reviving demand in export markets and the weakened yen.

Prices charged meanwhile fell marginally as firms benefitted from reduced global commodity prices.

With the economy showing signs of ongoing recovery, the Bank of Japan is unlikely to perceive the need for additional monetary stimulus, though the lack of inflation will no doubt remain a major concern.

Here are five key charts from the December flash PMI survey:

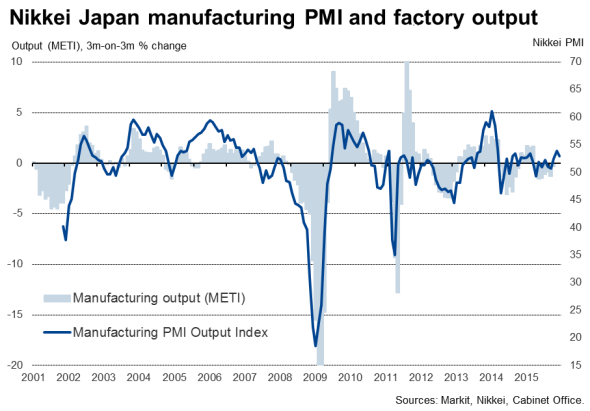

1. Solid factory output growth

The survey's Output Index dipped from November's 20-month high but remained in positive territory to indicate a revival of factory growth in the fourth quarter after the lull seen over the summer. The survey points to a 1% increase in the fourth quarter (the two series have a correlation of 81% with the PMI acting with a lead of one month).

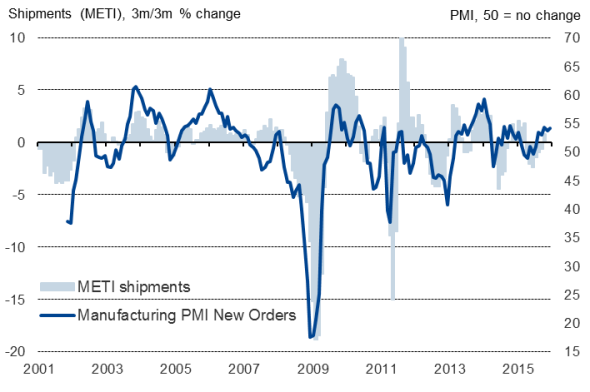

2. New orders drive production gain

The increase in production was driven by a solid increase in new orders. The survey's New Orders Index, which includes both domestic and export orders, showed the second-largest increase in demand seen over the past 14 months, beaten only narrowly by the upturn seen in October. The survey gauge corresponds approximately with a 1% rise in the official METI shipments series in the fourth quarter (the two series have a correlation of 73% with the PMI acting with a lead of one month).

3. Export orders rising strongly

The PMI New Export Orders Index slipped into contraction territory in September but has since returned to growth to suggest that the official data will likewise recover from recent weakness (the two series have a correlation of 72% with the PMI acting with a lead of two months). Although the rate of export growth is signalled to have eased slightly in December, the survey is pointing to a return to the strong c.8% annual rate of increase seen earlier in the year.

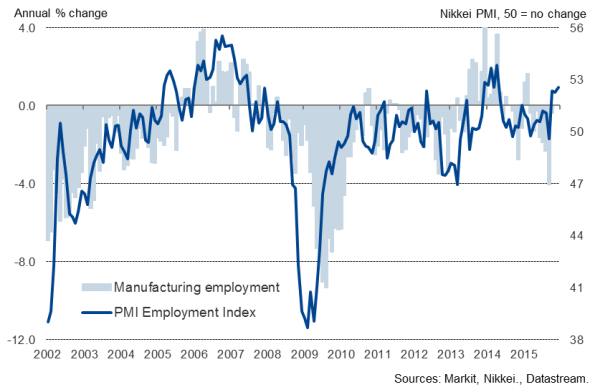

4. Job creation at 20-month high

The December survey showed factories taking on staff at the fastest rate since April of last year, pointing to a 1% annual rate of employment growth (the two series have a correlation of 72% with the PMI acting with a lead of six months). Solid hiring was sustained throughout the fourth quarter, recovering from the downturn seen at the end of the third quarter.

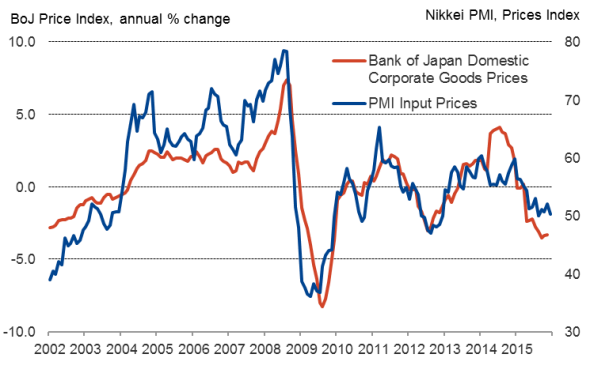

5. Input prices barely rise

Average input costs barely rose in December, the corresponding index registering its second-lowest reading seen over the past three years. Raised import prices resulting from the weaker exchange rate were largely offset by lower global commodity prices, notably for oil. Average selling prices meanwhile fell marginally amid widespread intense competition.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122015-Economics-Japan-flash-PMI-signals-steady-manufacturing-upturn-at-year-end.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122015-Economics-Japan-flash-PMI-signals-steady-manufacturing-upturn-at-year-end.html&text=Japan+flash+PMI+signals+steady+manufacturing+upturn+at+year+end","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122015-Economics-Japan-flash-PMI-signals-steady-manufacturing-upturn-at-year-end.html","enabled":true},{"name":"email","url":"?subject=Japan flash PMI signals steady manufacturing upturn at year end&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122015-Economics-Japan-flash-PMI-signals-steady-manufacturing-upturn-at-year-end.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan+flash+PMI+signals+steady+manufacturing+upturn+at+year+end http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122015-Economics-Japan-flash-PMI-signals-steady-manufacturing-upturn-at-year-end.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}