Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 16, 2015

Eurozone economy enjoys best quarter for 4 ' years

The eurozone economy enjoyed a comfortably solid end to 2015, though policymakers are likely to remain disappointed by the relatively modest pace of expansion and lack of inflationary pressures, given the stage of the recovery and the amount of stimulus already in place.

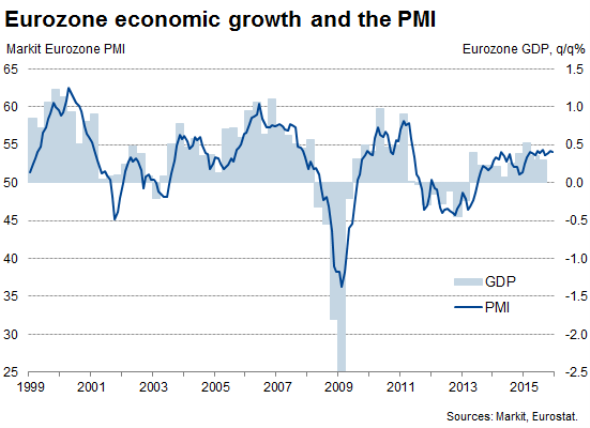

The Markit Eurozone PMI fell from 54.2 in November to 54.0 in December according to the preliminary 'flash' reading, but remained well above the 50.0 level. The expansion seen in December was sufficient to complete the strongest quarter of growth recorded by the survey for four-and-a-half years, albeit by a small margin.

Moreover, the survey is signalling a quarterly GDP rise of 0.4%, meaning the region grew 1.5% in 2015.

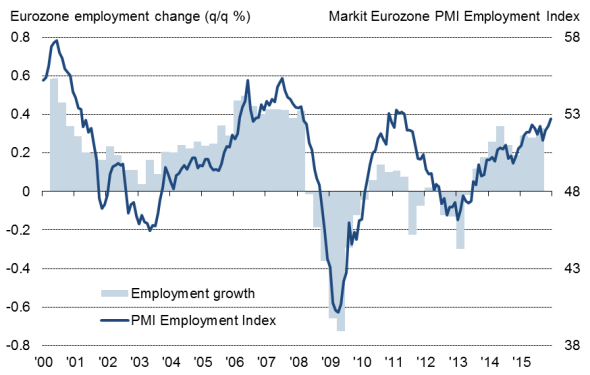

Most encouraging of all was an upturn in the rate of job creation to the highest since early-2011, which will hopefully pave the way for unemployment to start falling in earnest as we move into 2016.

The upturn in hiring also indicates that companies are optimistic about prospects for the year ahead and suggests that the pace of GDP growth could lift higher in coming months.

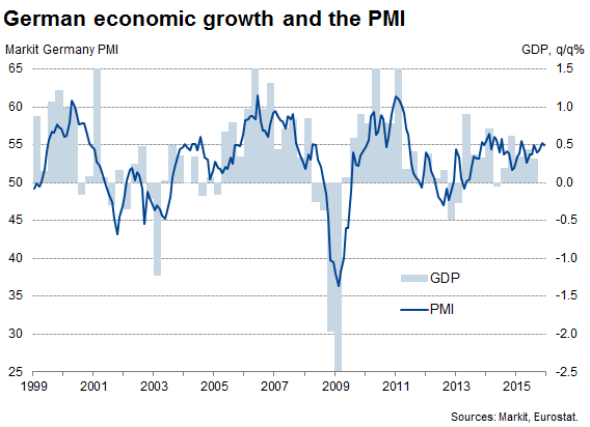

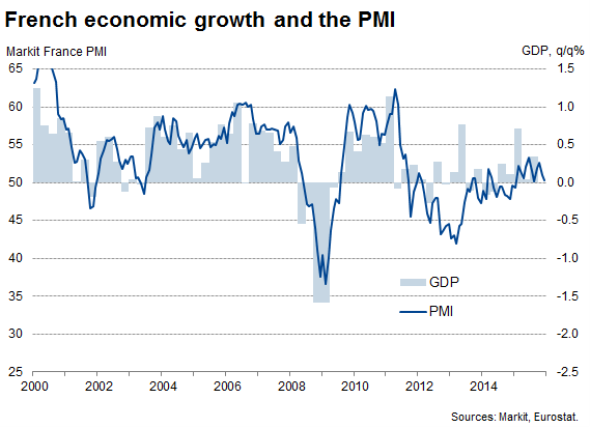

The survey data suggest GDP growth picked up in Germany during the fourth quarter, rising to 0.5% as strong domestic demand and rising exports drove a broad-based upturn in manufacturing and services. It's a different story in France, however, where the survey points to a mere 0.2% GDP rise at best in the fourth quarter, with a further slowing to near-stagnation in December boding ill for the coming year, especially in the stalling service sector.

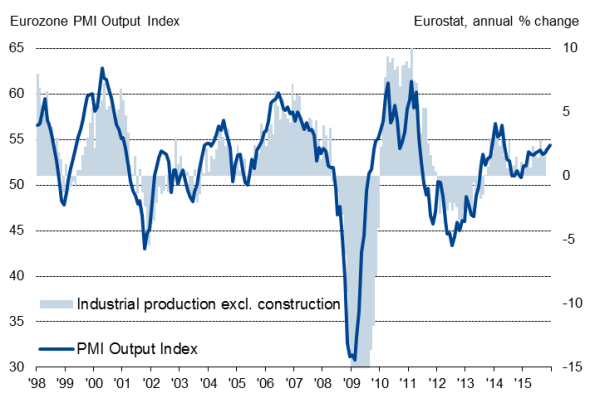

The sector data point to services leading the upturn but manufacturing is also increasingly supporting growth, with output rising at the fastest rate for 20 months and inflows of new orders hitting a 21-month high. These survey numbers are consistent with Eurozone manufacturing output growing at an annualised rate of 2.5%.

Employment

Sources: Markit, Eurostat (via Datastream)

Manufacturing output

Sources: Markit, Eurostat (via Datastream)

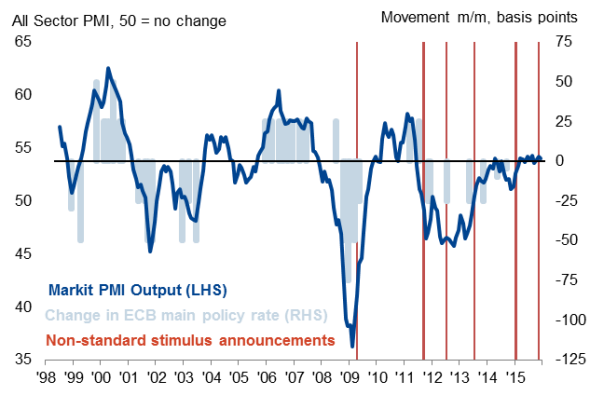

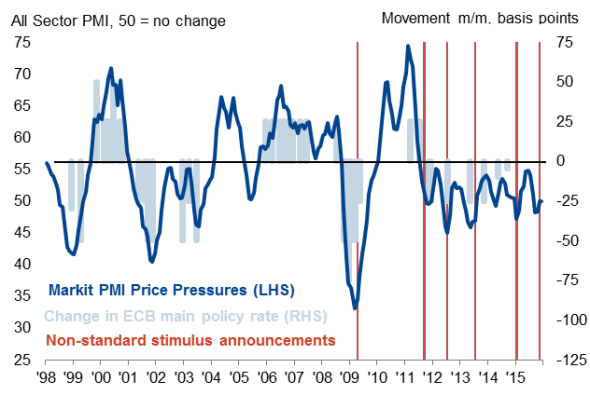

The charts below also show the ECB reaction to changing business activity and price trends. While the lack of price pressures clearly highlights why the ECB has felt the need to extend its QE programme, the recent strength of the PMI business activity readings are broadly consistent with a neutral ECB policy stance and go some way to perhaps explaining why the ECB held back from more aggressive stimulus at its December meeting.

ECB policy and PMI business activity

ECB policy and PMI price pressures

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122015-Economics-Eurozone-economy-enjoys-best-quarter-for-4-years.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122015-Economics-Eurozone-economy-enjoys-best-quarter-for-4-years.html&text=Eurozone+economy+enjoys+best+quarter+for+4+%27+years","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122015-Economics-Eurozone-economy-enjoys-best-quarter-for-4-years.html","enabled":true},{"name":"email","url":"?subject=Eurozone economy enjoys best quarter for 4 ' years&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122015-Economics-Eurozone-economy-enjoys-best-quarter-for-4-years.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+economy+enjoys+best+quarter+for+4+%27+years http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122015-Economics-Eurozone-economy-enjoys-best-quarter-for-4-years.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}