Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 16, 2016

US manufacturing disappoints in October but surveys point to uplift

US factories stepped up production by less than markets had expected in October, but the shortfall's unlikely to dissuade the Fed from hiking interest rates at the FOMC's next meeting.

With equity markets having rallied after the election and the bond markets pricing in higher inflation, it seems it would need a major shock to the economy or financial markets to derail policymakers from tightening policy on the 14th December.

Sluggish upturn in manufacturing

Data from the Commerce Department showed industrial production unchanged in October, dragged down by a 2.6% drop in output from the utilities sector. Adding to the disappointment was a downward revision to industrial production in September, with a 0.1% increase turning into a 0.2% decline.

However, more importantly from the perspective of the health of the US goods-producing economy, the narrower measure of manufacturing output rose 0.2% for a second successive month.

Improving data

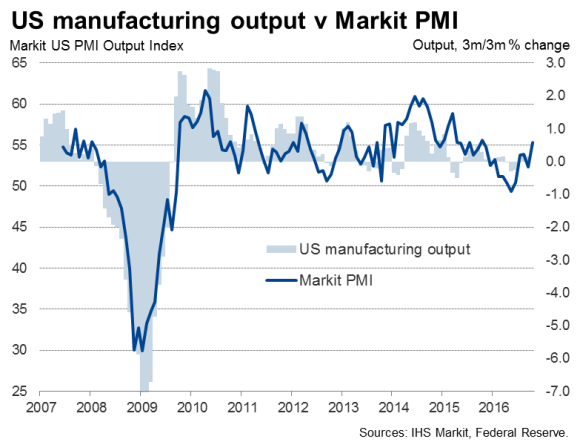

Surveys point to the production trend picking up as we move towards the end of the year. PMI data from IHS Markit showed manufacturers reporting the strongest upturn in new orders for a year in October, with sales boosted by rising domestic and export demand.

The surveys have also revealed service sector growth to have accelerated to the fastest since late last year, pointing to a broad-based strengthening of the economy.

The production data come on the heels of better than expected retail sales numbers, which showed shoppers starting the fourth quarter on a sound footing. Sales rose 0.8% in October, building on a 1.0% rise in September. Core sales, which tend to provide a useful guide to the underlying trend in consumer spending by excluding volatile expenditure on building materials, autos, gas stations and food services, also rose 0.8%, signalling the strongest monthly gain since April.

Rate hike odds shorten

The resilient economic growth at the start of the fourth quarter, a strengthening labour market and signs of inflation creeping higher mean the Fed looks almost certain to hike interest rates again on 14th December.

Inflation rose to a near two-year high of 1.5% in September and financial markets are pricing in further upward pressure on prices resulting from the stimulative policies likely to be introduced by president-elect Donald Trump.

IHS Markit expects the federal funds rate to gradually rise to reach 1.25% by the end of 2017 as the Fed cautiously tightens policy in response to a steady acceleration of economic growth and rising inflation.

However, it remains to be seen how businesses and consumers will react to the surprise election result. In this respect, the first post-election economic data become available next week, with the flash PMIs for manufacturing and services for November published on the 23rd and 25th respectively.

In the details of the Commerce Department report, motor vehicle production surged 0.9% and durable goods production recovered from declines in prior months to rebound by 0.4%. Production of non-durable goods was unchanged.

An upturn in production of business equipment was especially good news as it hints at increased business investment. Production of consumer goods disappointed, however, dropping slightly for a second month running.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16112016-Economics-US-manufacturing-disappoints-in-October-but-surveys-point-to-uplift.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16112016-Economics-US-manufacturing-disappoints-in-October-but-surveys-point-to-uplift.html&text=US+manufacturing+disappoints+in+October+but+surveys+point+to+uplift","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16112016-Economics-US-manufacturing-disappoints-in-October-but-surveys-point-to-uplift.html","enabled":true},{"name":"email","url":"?subject=US manufacturing disappoints in October but surveys point to uplift&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16112016-Economics-US-manufacturing-disappoints-in-October-but-surveys-point-to-uplift.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+manufacturing+disappoints+in+October+but+surveys+point+to+uplift http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16112016-Economics-US-manufacturing-disappoints-in-October-but-surveys-point-to-uplift.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}