Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 16, 2016

UK unemployment rate falls to 11-year low

UK unemployment fell to an 11-year low in the third quarter as the economy continued to show resilience in the face of the country's vote to leave the EU. Some further signs of a slowing in employment growth were evident in the three months to September, but more up to date surveys suggest that employers have since picked up their hiring again in October.

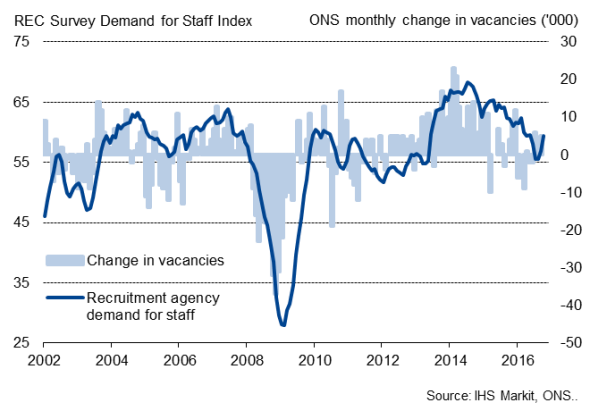

Recruitment activity

Employers nevertheless remain very cautious about committing to new hires amid worries about the economic outlook, suggesting jobs growth is likely to remain subdued while the uncertainty surrounding Brexit lingers.

Wage growth also remained disappointingly weak, contributing to intensifying gloom among households. Separate survey data showed pessimism about future personal finances hitting a three-year high due to worries about the extent that incomes are likely to be squeezed by higher inflation

Joblessness at 11-year low

The latest batch of data from the Office for National Statistics showed the unemployment rate dropping to an 11-year low of 4.8% in the three months to September.

Employment and unemployment

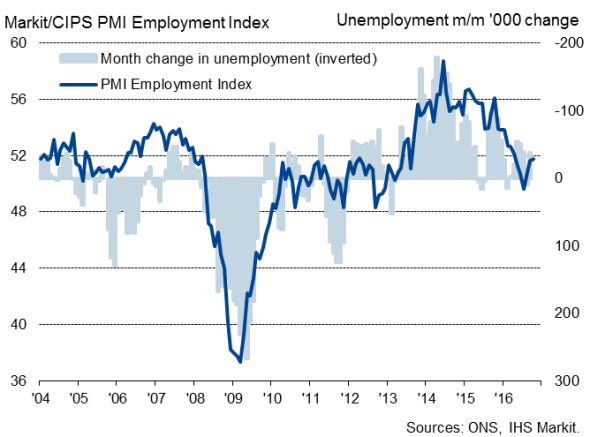

Employment continued to rise, but the rate of job creation showed signs of slowing. The number of people in work rose by 49,000 in the third quarter, but that was the smallest rise since the first three months of the year.

The slowdown in the employment trend matches business survey data which showed a similar pull-back in hiring in the aftermath of the Brexit vote. However, the same survey data have since shown employment growth to have picked up again in October, albeit remaining subdued compared to earlier in the year.

The latest PMI surveys covering services, manufacturing and construction collectively showed the largest rise in employment for six months in October. The REC recruitment industry survey meanwhile found the number of people placed in permanent jobs by agencies to have grown at the fastest rate for eight months.

Despite showing signs of improvement, the surveys also reveal that uncertainty about the future continues to restrain hiring. IHS Markit's survey of UK firms' expectations for the year ahead found employment intentions to have improved only by the smallest of margins in October compared to the near three-and-a-half year low seen back in June. A reluctance to take on extra staff was generally ascribed to worries about the potential impact of Brexit and rising costs resulting from the pound's depreciation.

The message from the surveys is therefore that, while we should expect employment to continue rising modestly in the near-term, firms' appetite to invest in new staff remains very fragile and will clearly be swayed by the path the government chooses to take in terms of a hard or soft Brexit.

Subdued wage growth

The latest official data also showed average weekly earnings continuing to rise at an annual rate of just 2.3% in the three months to September. Excluding bonuses, the rate of increase accelerated to a one-year high of 2.4%.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16112016-Economics-UK-unemployment-rate-falls-to-11-year-low.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16112016-Economics-UK-unemployment-rate-falls-to-11-year-low.html&text=UK+unemployment+rate+falls+to+11-year+low","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16112016-Economics-UK-unemployment-rate-falls-to-11-year-low.html","enabled":true},{"name":"email","url":"?subject=UK unemployment rate falls to 11-year low&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16112016-Economics-UK-unemployment-rate-falls-to-11-year-low.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+unemployment+rate+falls+to+11-year+low http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16112016-Economics-UK-unemployment-rate-falls-to-11-year-low.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}