Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 16, 2014

US factory output rebounds and jobless claims hit lowest for 14 years

A rebound in factory output and a steep drop in jobless claims to their lowest for 14 years provide some welcome upbeat news on the US economy, confirming recent buoyant survey data. The news keeps the Fed on course to raise interest rates in the first half of next year, barring any surprises in coming months.

Production leaps higher

Production rose 1.0% in September after a 0.2% decline in August, its biggest gain for almost two years, according to official data compiled by the Federal Reserve. Manufacturing output was up 0.5% after August's 0.5% drop.

The rise leaves industrial production 0.8% higher in the third quarter compared to the second quarter, adding to signs that the US economy continues to grow at a solid pace.

The upturn in production also pushed capacity utilisation up to 79.3%, its highest since June 2008. The Fed is keeping a close eye on how fast spare capacity is being used up, as this is a key gauge of future inflation trends.

Jobless claims lowest since 2000

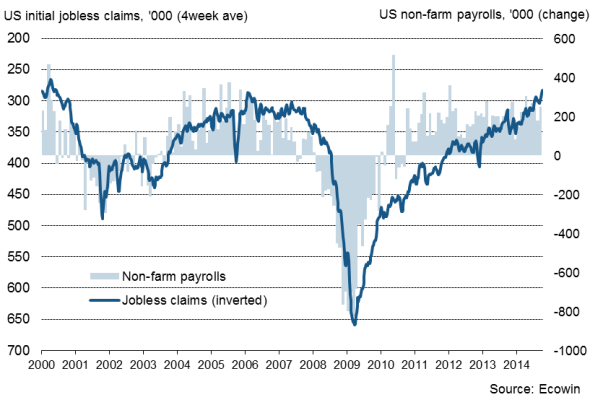

Separate data meanwhile showed new jobless claims slumping from 287,000 to 264,000 in the week ended 11 October, the lowest seen since April 2000. The four-week average also fell, down to its lowest since June 2000.

Fears of slowdown overplayed

The data should serve to allay fears that have grown in recent weeks about a renewed bout of weakness setting into the US economy. In reality, such fears look to be overplayed.

US labour market

In addition to the expansion seen in the industrial sector, employment continued to rise strongly in September, up 248,000 compared to August, and the recent drop in new jobless claims means payroll numbers look set to move sharply higher again in October. Unemployment should therefore decline further, the jobless rate having already slid to 5.9% in September, its lowest since 2008.

Retail sales are also still trending upwards. Despite a 0.3% drop in September, sales are up 1.0% in the third quarter compared to the second quarter. Consumer confidence is running at levels not seen since 2007, providing grounds to believe that spending should remain on an upward trend in coming months.

Business surveys have likewise pointed to continued strong expansion in September. Although Markit's two PMI surveys collectively indicated an easing in growth to a four-month low in September, rates of expansion remained buoyant in both manufacturing and services. Flash Manufacturing PMI data for October are published next week.

The surveys and official data available so far are therefore consistent with GDP rising at an annualised rate of at least 3% in the third quarter, a rate of growth which is probably sufficient to keep the Fed on track to raise interest rates in the first half of next year.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16102014-Economics-US-factory-output-rebounds-and-jobless-claims-hit-lowest-for-14-years.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16102014-Economics-US-factory-output-rebounds-and-jobless-claims-hit-lowest-for-14-years.html&text=US+factory+output+rebounds+and+jobless+claims+hit+lowest+for+14+years","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16102014-Economics-US-factory-output-rebounds-and-jobless-claims-hit-lowest-for-14-years.html","enabled":true},{"name":"email","url":"?subject=US factory output rebounds and jobless claims hit lowest for 14 years&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16102014-Economics-US-factory-output-rebounds-and-jobless-claims-hit-lowest-for-14-years.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+factory+output+rebounds+and+jobless+claims+hit+lowest+for+14+years http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16102014-Economics-US-factory-output-rebounds-and-jobless-claims-hit-lowest-for-14-years.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}