Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 16, 2017

UK household squeeze intensifies as inflation rises to highest since 2013

UK inflation moved further above the Bank of England's 2.0% target in April, highlighting the growing squeeze on household budgets.

Inflation at 3" year high

Data from the Office for National Statistics showed consumer prices rising 2.7% on the year in April compared with 2.3% in March. This is the highest rate of inflation since September 2013 and looks almost certain to lead to an intensifying fall in real wages. Regular wage growth has slowed to just 2.2%.

The timing of Easter looks to have played an important role in pushing inflation higher in year-on-year terms, pushing air fares up in particular. Inflation may therefore dip again in May as the effect of higher Easter holiday prices drops out, but sterling's depreciation since the referendum last June is also clearly a significant factor, lifting prices for imports and likely to pile further upward pressure on consumer prices in coming months.

Future pressures easing

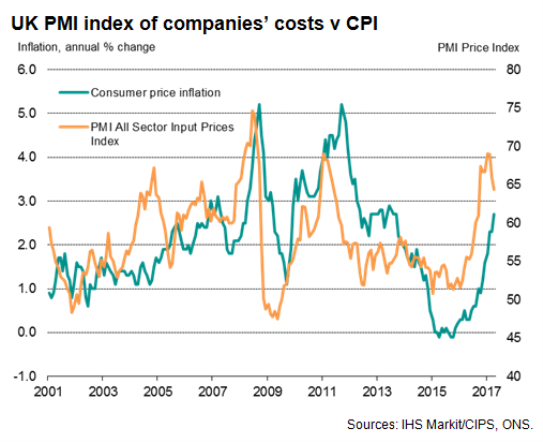

There are nevertheless signs that inflation could perhaps rise less than many had feared. Survey data are already showing companies' costs are rising at a slower rate than earlier in the year, and recent weeks have seen some easing in global commodity prices, notably oil. Brent crude prices are hovering at around $50 per barrel compared with about $58 at the start of the year. IHS Markit's Materials Price Index (MPI), which measures global commodity prices, dropped 2.1% last week and has now declined some 11.2% from its mid-February high. The PMI survey measure of UK companies' input costs showed the smallest rise in seven months in April. Sterling has also recovered some of its losses from the lows seen after the referendum.

Barring any further marked rise in oil prices or downward lurch in sterling, we are now expecting inflation to peak at around 3.0% later this year compared to an earlier expectation of 3.3%, and should come down steadily as we move into 2018.

The likelihood is therefore that the Bank of England will continue to look through the upturn in inflation in coming months.

Looking further out, the latest Bank of England Inflation Report lays out a scenario of interest rates rising towards more normal levels over the next three years if Brexit negotiations go smoothly, wage growth starts to accelerate and productivity improves; all of which may be seen as rather optimistic assumptions for a base case scenario.

In particular, there's growing evidence to suggest that weak wage growth is likely to persist and restrain so-called 'second round' inflationary pressures. Employers, citing the uncertainties of Brexit, are likely to take a tough line on pay negotiations, meaning higher prices won't necessarily feed through to higher pay. The risks seem tilted to the downside, with an intensifying real pay squeeze limiting consumer spending power and keeping a lid on longer-term inflationary pressures for some time to come.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16052017-Economics-UK-household-squeeze-intensifies-as-inflation-rises-to-highest-since-2013.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16052017-Economics-UK-household-squeeze-intensifies-as-inflation-rises-to-highest-since-2013.html&text=UK+household+squeeze+intensifies+as+inflation+rises+to+highest+since+2013","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16052017-Economics-UK-household-squeeze-intensifies-as-inflation-rises-to-highest-since-2013.html","enabled":true},{"name":"email","url":"?subject=UK household squeeze intensifies as inflation rises to highest since 2013&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16052017-Economics-UK-household-squeeze-intensifies-as-inflation-rises-to-highest-since-2013.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+household+squeeze+intensifies+as+inflation+rises+to+highest+since+2013 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16052017-Economics-UK-household-squeeze-intensifies-as-inflation-rises-to-highest-since-2013.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}