Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 16, 2017

Czech manufacturing sector sustains strong growth at the start of Q2

Czech manufacturers saw a steep improvement in operating conditions during April, as has been the case in each month of 2017 so far. The sustained upturn has been underpinned by marked increases in production, new work and employment, boding well for the official Q1 GDP release on 16th May.

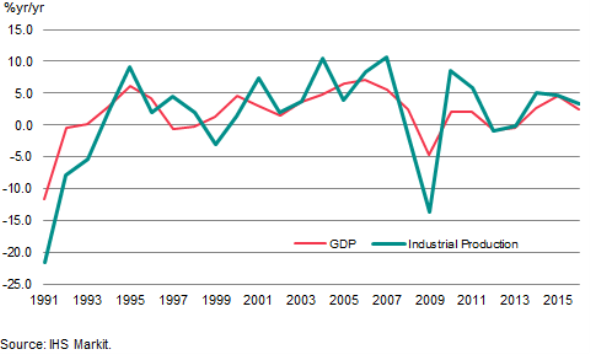

IHS Markit forecasts that quarter-on-quarter GDP will increase at an annualised rate of 2.5% in the first quarter, up from 1.9% in the fourth quarter of 2016. Overall, IHS Markit expects the economy to expand by 2.8% over 2017 as a whole. This is due to the manufacturing sector contributing substantially to overall growth. That said, several underlying uncertainties surrounding exchange rate movements, inflationary pressures and employment pose downside risks to the economy.

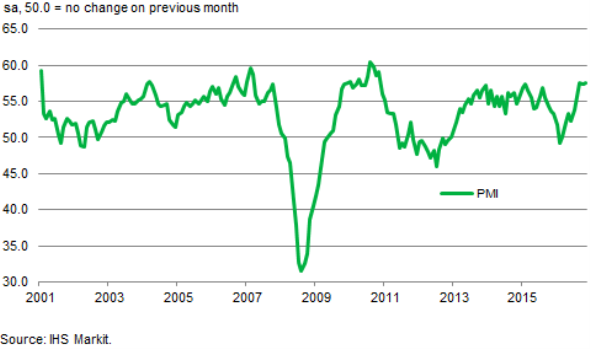

IHS Markit Czech Republic Manufacturing PMI

Solid manufacturing expansion sustained

The IHS Markit Czech Republic Manufacturing PMI registered 57.5 in April, unchanged on March’s reading but well above the 50.0 ‘no change’ level to therefore indicate a sharp improvement in overall operating conditions. The latest data are pointing to the strongest period of growth since early 2011.

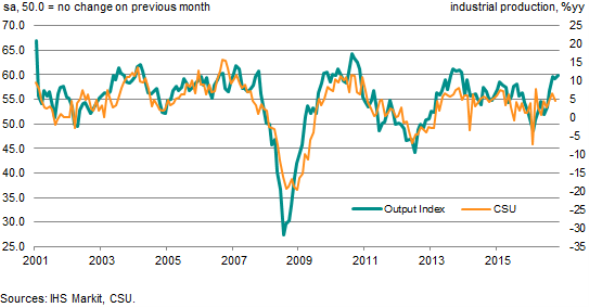

Official data regarding industrial production also signal strong growth in output. According to recent data from the Czech Statistics Office, industrial production rose by 4.4% year-on-year[1] in March, to round off the best quarter since the third quarter of 2015.

Output Index vs official industrial production

Monthly industrial production data are closely watched as they tend to exhibit a similar trend to GDP, which is only published quarterly. Because PMI data give an advanced signal of how the industrial sector is faring, the surveys can be used as a timely guide to GDP.

The latest PMI data indicated an acceleration in manufacturing production growth in April to its highest since May 2014. Expectations for output over the next 12 months meanwhile reached the second-highest since January 2016.

Industrial production and GDP

Inflationary pressures remain sharp

The upturn in growth has not come without problems, with costs rising and the exchange rate remaining a key source of uncertainty.

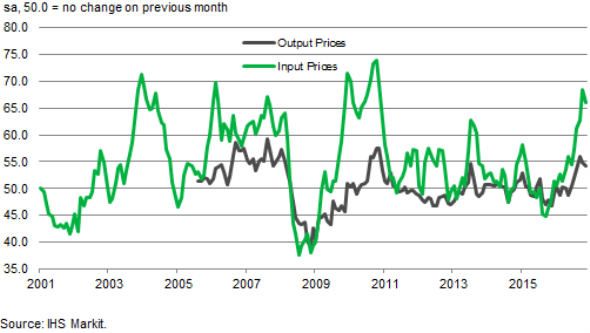

Increased cost burdens have blighted company balance sheets across the world since 2016, including those of Czech manufacturers. Anecdotal evidence from the PMI survey has linked higher input costs to the increased global prices of raw materials such as metals, chemicals and oil.

As firms aim to protect their profit margins, these increased world commodity prices have been partly passed on to clients in the form of higher selling prices.

However, April PMI data brought some tentative good news, signalled the first month of softening inflation after historically strong increases between November 2016 and March 2017.

Future price trends will depend to a large extent on the exchange rate, as this affects the cost of importing raw materials. After exiting the koruna cap in April there was great uncertainty as to how currency markets worldwide would react. The koruna, however, has remained relatively stable despite previous fears that this could lead to greater price volatility. The Czech National Bank (CNB) has retained its forecast for target inflation of 2.0% in 2017. That said, future movements of the koruna remain a downside risk to Czech manufacturers, as fluctuations could intensify cost pressures and impair international competitiveness.

Labour shortages pose risk to growth

Another problem is one of labour shortages. PMI data indicate that a lack of suitable staff is becoming an increasing concern for manufacturing companies in the Czech Republic. As output and new orders continue to rise sharply, and backlogs build further, efforts to boost capacity will be crucial in order to sustain the current run of growth. According to the seasonally adjusted PMI Employment Index produced by IHS Markit, the trend of job creation was extended to two years in April. However, after reaching a 19-month high in February, growth in staffing levels has softened since, with a number of firms reporting difficulty in finding suitable candidates. Furthermore, the latest increase in workforce numbers was the weakest in five months, despite an acceleration in output expansion.

Trends in the Input and Output Price Indexes

Implications for monetary policy

Monetary policy decisions made by the CNB in recent years have revolved around protecting the exchange rate cap. However, following the exit from this arrangement, and in the light of increased inflationary pressures, speculation about the next interest rate decision has intensified. The CNB anticipates an initial increase in the base rate in the third quarter of 2017, with prospects for a further rise in 2018. In contrast, IHS Markit forecasters do not predict a rate rise before 2018, largely predicated on inflationary pressures cooling as the year proceeds.

Going forward

Also eagerly anticipated is the release of the preliminary official estimate of first quarter GDP on the 16th May. PMI figures for May will subsequently be published at the start of June, which will give an indication of movements in production and GDP growth in the second quarter, as well as signals on inflation and employment. Based on the current data for 2017, the Czech manufacturing sector looks on track to achieve solid growth, supported by stronger optimism towards future output.

Forthcoming economic data releases:

- May 16th: Czech GDP Q1 (Preliminary)

- June 1st: IHS Markit Czech Republic Manufacturing PMI

- June 2nd: Czech GDP Q1 (Final)

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16052017-Economics-Czech-manufacturing-sector-sustains-strong-growth-at-the-start-of-Q2.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16052017-Economics-Czech-manufacturing-sector-sustains-strong-growth-at-the-start-of-Q2.html&text=Czech+manufacturing+sector+sustains+strong+growth+at+the+start+of+Q2","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16052017-Economics-Czech-manufacturing-sector-sustains-strong-growth-at-the-start-of-Q2.html","enabled":true},{"name":"email","url":"?subject=Czech manufacturing sector sustains strong growth at the start of Q2&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16052017-Economics-Czech-manufacturing-sector-sustains-strong-growth-at-the-start-of-Q2.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Czech+manufacturing+sector+sustains+strong+growth+at+the+start+of+Q2 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16052017-Economics-Czech-manufacturing-sector-sustains-strong-growth-at-the-start-of-Q2.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}